NVIDIA: Qualitative description

NVIDIA Corporation, headquartered in Santa Clara, California, is a leading technology company specializing in the design and manufacture of graphics processing units (GPUs), as well as system-on-a-chip units for mobile computing and automotive applications.

Founded in 1993, NVIDIA operates in various segments, including Gaming, Professional Visualization, Data Center, and Automotive.

Its mayor institutional investors, in order, are Vanguard Group Inc (203mln shares), Blackrock Inc (180mln shares) and FMR (129mln shares).

In the fiscal year 2022, NVIDIA reported a total revenue of $26.97B (Y/Y % 0,22%).

The company achieved an impressive EBITDA margin of 21.38%, showcasing efficient cost management and profitability.

The Gaming and Data Center segments were major contributors to revenue, with Gaming accounting for 49% and Data Center contributing 41%.

NVIDIA has established itself as a key player in the gaming and data center industries. The Gaming segment has experienced significant growth, driven by increasing demand for high-performance GPUs in the gaming market. The Data Center segment has also thrived, fueled by the growing adoption of artificial intelligence and machine learning applications.

NVIDIA’s stock ownership is diversified, with a significant portion held by institutional investors, including investment managers, pension funds, and other financial institutions.

NVIDIA: Quantitative description

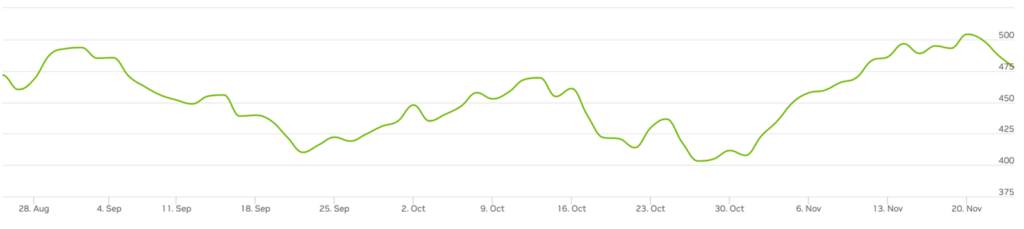

As of the latest available data, NVIDIA’s stock is trading at $477,76 (24/11/2023) per share, with a Market Cap of $1.245,1B, and a P/E ratio of $43,76 (24/11/2023) constantly increasing.

This P/E ratio suggests that the market perceives NVIDIA as a company with strong growth potential and earnings. Investors may interpret this valuation as an expression of confidence in the company’s prospects.

NVIDIA maintains a balanced capital structure with a low debt-to-equity ratio of 0.4956. This relatively prudent mix of debt and equity provides financial flexibility while minimizing the risk of financial distress.

The company also offers a dividend of $0,16 (by quarter) for its shareholders, with an average dividend yield equivalent of 0,09%.

The Return on Equity (ROE = Net profit / Income) for NVIDIA is at 19,76%, showcasing the company’s efficient use of investments to generate earnings. Such ratio has seen a noticeable improvement with respect to previous quarters, demonstrating an expansion of profitability for the corporation. This ratio has improved from previous quarters, indicating increased profitability.

Moreover, NVIDIA’s Return on Investments (ROI = Net income / Total Assets) is an impressive 13,73%, showing that revenues from made investments are larger than associated costs. This metric has been expanding following a positive trend in the past 3 Quarters, showing NVIDIA’s ability to generate profitable medium-term returns.

Finally, the Returns on Sales (ROA = Net profit / Total Assets) of NVIDIA is stated to be 10,60%, representing company’s profitability in relation to its total assets.

Stock Chart:

NVIDIA: The “Magnificent seven companies”

NVIDIA is considered as one of the “Magnificient Seven Companies”.

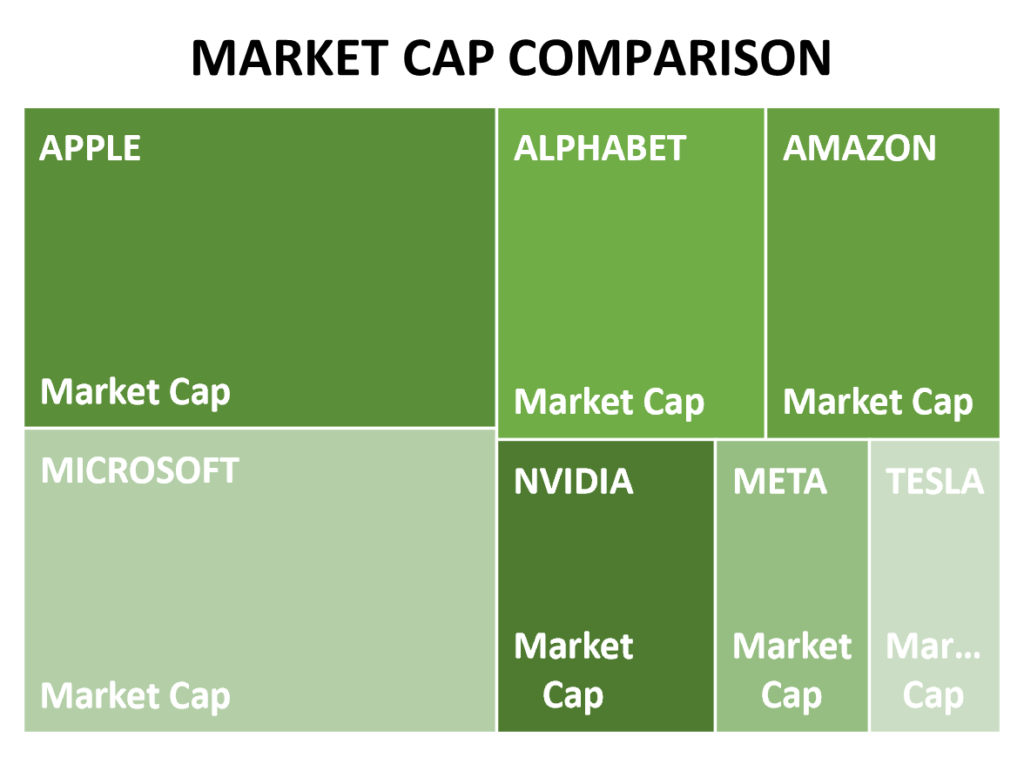

The so-called “Magnificent Seven” – Amazon, Apple, Google (Alphabet), Meta, Microsoft, Nvidia and Tesla – have driven most of the US market’s outperformance to other markets this year.

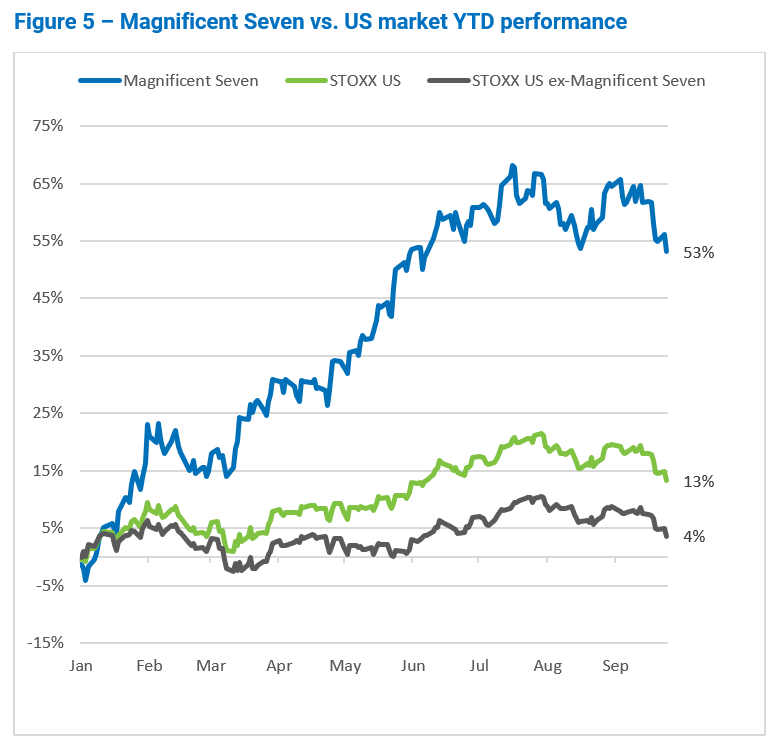

This graph, instead, illustrates the Magnificent Seven vs. the whole US Market YTD performance.

As it can be seen, their portfolio has had a YTD return of 53%.

Without these stocks, the US STOXX index’s year-to-date (YTD) return would have been about 4% (instead of 13%), underperforming both Europe and Asia/Pacific.

Talking about NVIDIA in particular, this company has had an astonishing YTD return of over 230%.

NVDA stock, in fact, has skyrocketed 237.3% in 2023, becoming the top performer in the S&P 500 this year.

Nvidia is at the forefront on the AI Boom: around 90% of the graphics processing units (GPUs) used in AI-accelerated data centers derive from Nvidia.

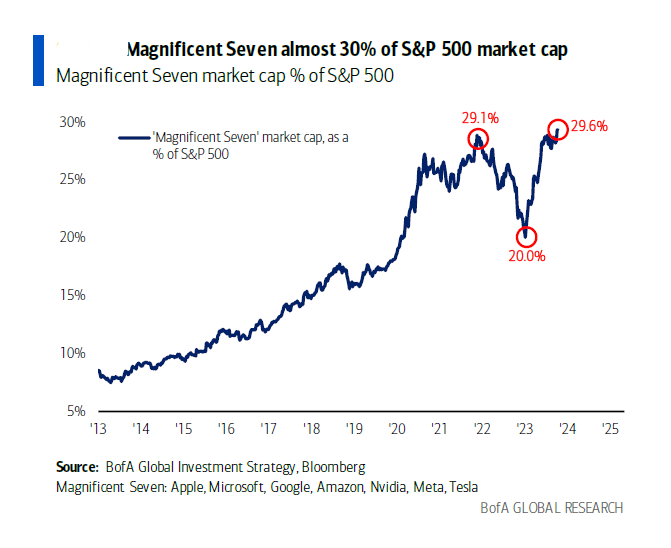

Differently, in this graph is shown that the Magnificent Seven now account for 29.6% of total S&P 500 MARKET CAP, the highest level on record.

Author: Corporate Finance Division