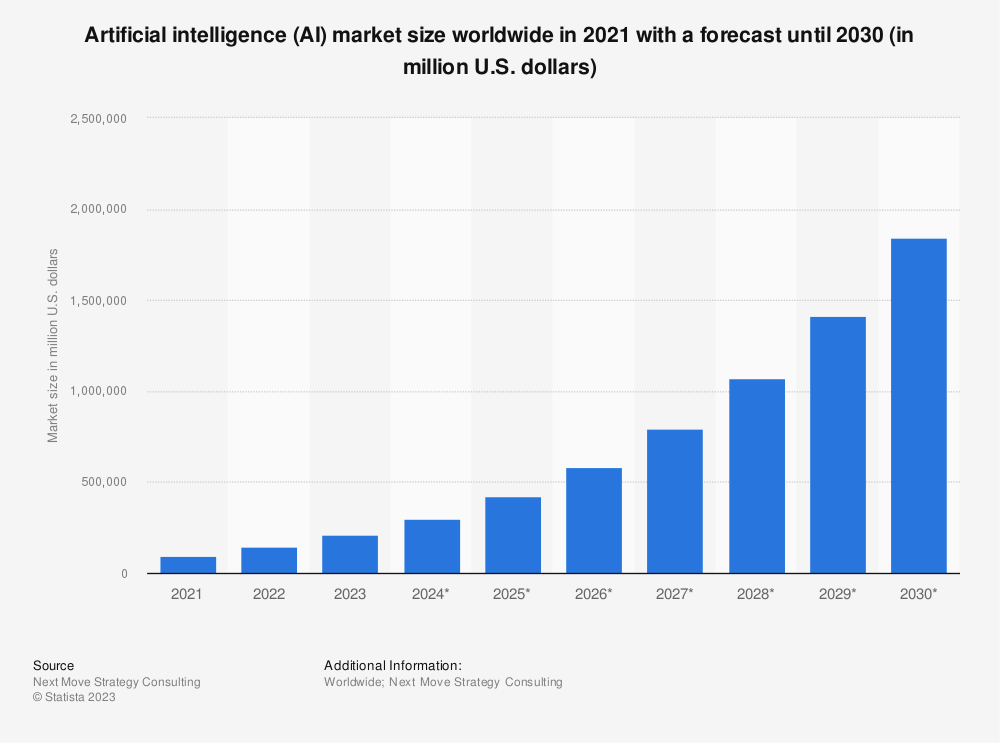

Humans have been fascinated by the possibility of creating machines capable of simulating the human brain. The term “artificial intelligence” was coined in 1955 by John McCarthy, who, along with other scientists, organised the ‘Dartmouth Summer Research Project on Artificial Intelligence’ in 1956. This event led to the creation of machine learning, deep learning, predictive analysis, and, more recently, prescriptive analysis. Furthermore, it gave rise to a completely new field of study, namely data science. Today, artificial intelligence forms the basis of all computer learning technologies and represents the future of all complex decision-making processes. Artificial intelligence is the ability of a machine to display human capabilities such as reasoning, learning, planning and creativity. It allows systems to understand their environment, relate to what they perceive, solve problems and act towards a specific goal. The computer receives data (either prepared or collected through sensors, like a camera), processes it and responds. AI operates in numerous sectors, which can also characterise the everyday life of any individual, including: online shopping and advertising, online searches, personal digital assistants, automatic translation, smart homes, cities and infrastructures, vehicles, cyber security and many other areas. In 2022, in Italy, the artificial intelligence market recorded a growth of 21.9%, reaching a value of 422 million euros, and statistics predict a total value of 700 million euros by 2025, with an average annual growth rate of 22%. This emerging sector is also showing strong growth at the global level, having reached a value of about 387 billion dollars. According to estimates, by 2029, it will surpass 1,000 billion dollars in revenues (a growth of more than 260% compared to 2022). Here is a graph showing the recently provided data on the current value of the global artificial intelligence market and an estimation. The graph shows the market value in billions of dollars for the years 2022, 2025 and 2029. As previously mentioned, there is a significant increase in market value over this period, reflecting the rapid growth and expansion of the AI sector globally.

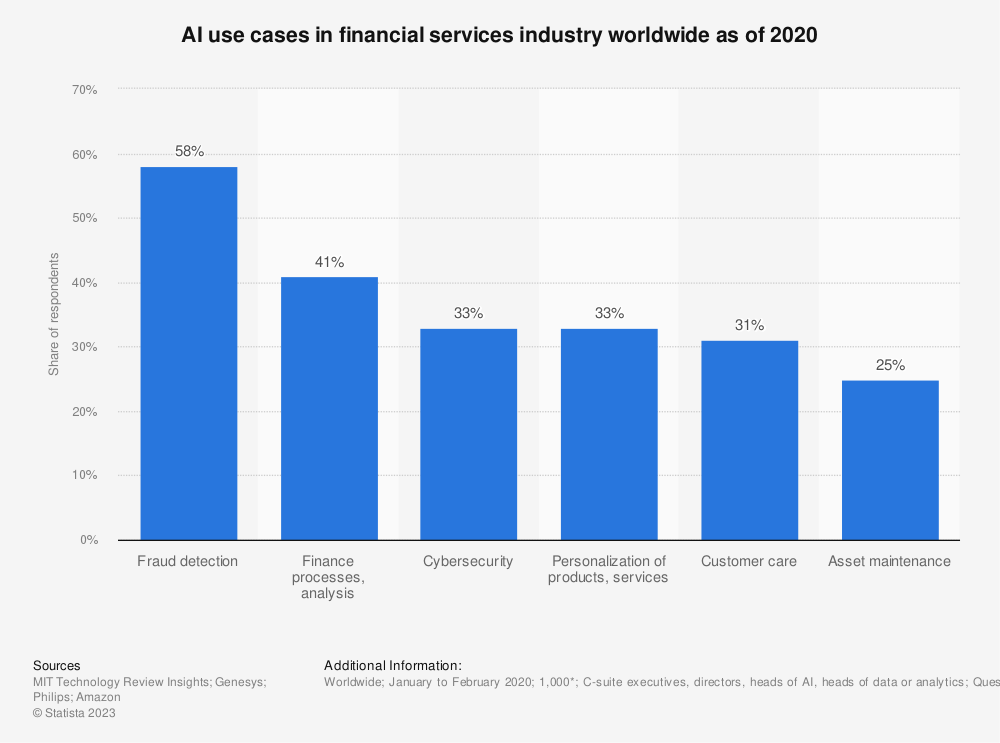

The United States of America holds a dominant position, representing 41.2% of the entire AI business. Following closely are China, Projected to achieve a turnover of 64.7 billion dollars by 2027, along with Canada and Japan. According to the Statista portal, in Europe revenues will increase to nearly 27 billion euros over the next three years. Among the emerging powers are the United Kingdom, Germany and France. Moreover, the latter is ready to invest 2.2 billion euros to help startups and companies focused on artificial intelligence grow and develop steadily and decisively. A particular type of artificial intelligence that is forcefully establishing itself in the market is conversational AI, which has numerous models and platforms developed to enable machines to understand and respond to natural language inputs. One notable example is Chat GPT (Generative Pretrained Transformer), a powerful and versatile natural language processing tool, which uses advanced machine learning algorithms to generate human-like responses within a conversation. This technology, developed by the non-profit organisation OpenAI, projects its organisational plan to research on artificial intelligence. With the potential to revolutionise interactions with machines, it holds promise for various applications across different domains. In addition, Chat GPT could also be used in other sectors, such as predicting the prices of commodities or currencies; in fact, there are many potential applications of AI in finance, and the future looks very promising. The financial community has welcomed the introduction of Chat GPT and other AI systems into the sector, but some concerns have been raised about the possible loss of jobs for human traders. Most industry experts believe that AI will not completely replace human traders, but rather assist them in carrying out their daily activities, and that AI could also help them identify new investment opportunities and reduce the risk of losses. Chat GPT could also help investors to understand better financial language and analyse market data more efficiently. This could lead to greater transparency in the financial sector and more informed investment decisions. Today over half of banks claim to have implemented this technology for management and revenue generation. Eminent institutions and companies, including BlackRock, Goldman Sachs, UBS, Morgan Stanley, Deutsche Bank, JPMorgan Chase & Co and the Big 4 are making significant investments in AI technologies every year to boost all their processes and to maintain their competitive advantage. A clear indication of the persistency of this trend comes from the statements that Daniel Pinto, President and Chief Operating Officer of JPMorgan Chase, made during an interview, in which he affirmed JPMorgan’s commitment to invest one billion dollars or more a year in AI. In the field of finance, artificial intelligence serves as a mighty instrument for deriving insights from data analytics, surveying performance, making predictions and forecasts, performing real-time calculations, improving customer service, and intelligently retrieving data. These enhanced technologies empower financial institutions to gain a deeper understanding of markets and customers, analyse and learn from digital interactions, and engage in a manner that simulates human intelligence and interaction on a large scale. Considering that AI applications spread across various fields in finance, it’s challenging to identify one “most important” area. One however stands out due to its improvement as a consequence of AI’s implementation: risk management and fraud detection. The integration of AI in risk management has become a significant advancement in the financial sector: Dr. Lewis Z. Liu, CEO and co-founder of Eigen Technologies (an AI software company that has developed a document processing platform), highlighted the potential of AI in preventing financial disasters by enabling a more informed and accurate decision-making process. Liu asserted that many financial organisations currently base crucial decisions on as little as 10% of the available data due to cost and accessibility constraints. However, with the integration of AI, risk management teams are taking advantage of the rapid analytics processing of extensive datasets, overcoming limitations associated with manual risk analysis. In the banking sector is observed a balance between traditional credit risk models, favored for interpretability and regulatory compliance, and machine learning models, known for optimising parameters and enhancing variable selection. Extending beyond risk management, AI is a formidable tool in fraud detection, particularly in financial services and insurance sectors. AI handles diverse data types and uses various techniques to distinguish between fraudulent and non-fraudulent transactions and to address fraudulent activities (like money laundering). According to Vrinda Khurjekar, senior director at Searce, the application of AI in monitoring large scale credit card and e-payment transactions enables financial institutions to detect changes in purchase behavior, streamline the process of dealing with deceitful activities and improve protection. The advent of AI has sparked a significant debate, particularly in the finance sector. While AI brings numerous benefits such as improved efficiency and accuracy, it also raises valid concerns about job displacement: a recent report from Goldman Sachs suggests that due to the potential impact of generative AI, which creates content based on user prompts, around 300 million jobs worldwide could be affected, with finance, media, and legal services being the most vulnerable sectors. The report also anticipates that in the U.S. and Europe, AI automation could potentially impact two-thirds of jobs to some extent. Furthermore, it suggests that AI could fully carry out approximately a quarter of all jobs. The World Economic Forum predicts three significant transformations in the finance sector due to AI: a reduction in jobs, the creation of new roles, and enhanced efficiency. Moreover, they estimate that, by 2027, AI will take over approximately 23% of jobs in China’s financial industry. Despite the situation seems severe, it is crucial to note that AI is not expected to entirely replace human workers. This is because the unique human qualities such as empathy, creativity, and strategic thinking are still irreplaceable in the financial industry. Instead, AI is intended to reshape job roles and automate repetitive tasks. Besides, because workers necessitate a new skill set to interface with AI, companies should focus on enhancing and retraining their employees to prepare them for the changing landscape of finance driven by AI.

Here is a graph that shows in which situations AI is used in the financial sector.

However, the future of work is not entirely bleak. The robot revolution will likely create about 97 million new jobs and will also create new positions within companies. Only 47% of managers fear a decrease in workforce and 85% of respondents say that all this will allow companies to earn and maintain a competitive advantage. In conclusion, artificial intelligence is already having an impact in the current world of work and, consequently, the key for organisations and individuals is to embrace this technological and social change and invest in updating and new skills to ensure they are prepared for the future of work; indeed, the human hand will always be necessary, as it is the only one capable of experiencing emotions, reasoning outside the box and having critical judgment in certain situations.

Authors: Leonardo Zaramella & Riccardo Cremonesi