Moody’s, Standard & Poor, and Fitch are credit ranking agencies that assesses the creditworthiness of various entities, including countries and banks.

The creditworthiness of an entity, whether this is a bank or a country, refers to its ability to meet financial obligations, particularly with reference to repayment of borrowed money. It can be simplified as an assessment of the l entity’s likelihood of returning the money it owes.

Agencies like Moody’s, Fitch and S&P assess creditworthiness. These evaluate a country’s economic and financial situation, including factors like its GDP, fiscal policies and political stability and mainly government debt. Their credit rating reflects the risk associated with lending money to a country. The higher the credit ranking, the lower the risk of default. This makes it more likely that the country will be able to repay its debts.

Banks, as financial institutions, also undergo credit assessments. Factors considered in this case may include liquidity, profitability, and the quality of its loan portfolio. A similar rationale to countries applies to banks: the higher the credit rating, the less risky for depositors and investors, suggesting the high reliability of a bank.

After the Moody’s valuation about Italy, the agency decided to reward Italian bank institutions.

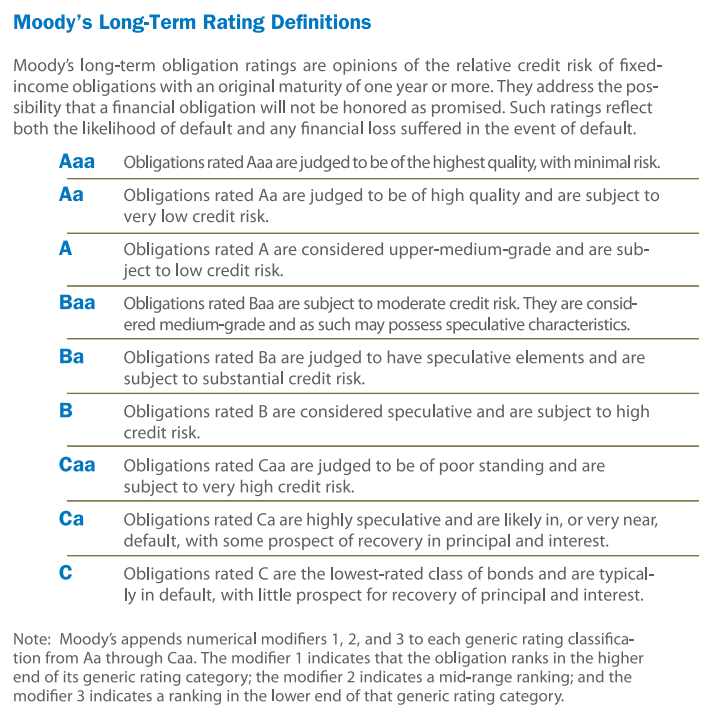

On November 17th 2023, Moody’s changed Italy’s outlook from “negative” to “stable” with no change on rating, which remains stable at Baa3, deciding to reward Italian Banks by cutting stabilization of the country’s economy, debt, and banking sector.

This showcases the high performance gained by Italian banks and the importance of M&A transactions after MPS, Monte dei Paschi di Siena, was privatized.

On November 20th 2023, Italian Mef (Ministero delle economie e Finanze) sold 25% of MPS whose consideration per share was 2.92€ for a total of EUR 920 million.

Among those who allegedly bought the stocks are Algebris, Kairos, and Fideuram, Intesa Sanpaolo’s savings giant.

What follows is the valuation of the most important Italian banks institutions:

- MPS:

Its rating gained a notch: specifically, the “Standalone Baseline Credit Assessment” increased from B1 to Ba3, “long-term deposit” rating also increased from Ba1 to Ba2 and “long-term senior unsecured debt” from Ba3 to B1 thanks to a better operational context.

- Unicredit:

UniCredit saw improvements in its overall rating. Importantly, its rating is higher than the sovereign Italian Rating (Baa3), which is a positive sign.

- Intesa Sanpaolo:

As for Intesa Sanpaolo, on the other hand, the U.S. agency confirmed the long-term senior preferred rating at Baa1, improving the outlook from negative to stable, suggesting confidence in the bank’s stability and performance.

Other Italian Banks ratings from Moody’s:

BPER confirmed at Ba1, Credit Agricole Italia confirmed at Ba1, BNL at Ba2, Mediobanca at Baa1, Credito Emiliano at Baa3, CA Auto bank at Ba2, Banca Sella at Ba2, Banca del Mezzogiorno – MCC at B1, Banca Ifis at Ba2, BFF Bank at Ba2, Cassa Centrale Raffeisen at Baa3 and Mediocredito Trentino Alto Adige at Ba2.In conclusion, Moody’s upgraded the ratings for 16 banks and two Italian government institutions, namely Cassa Depositi e Prestiti and Invitalia (to Baa3).

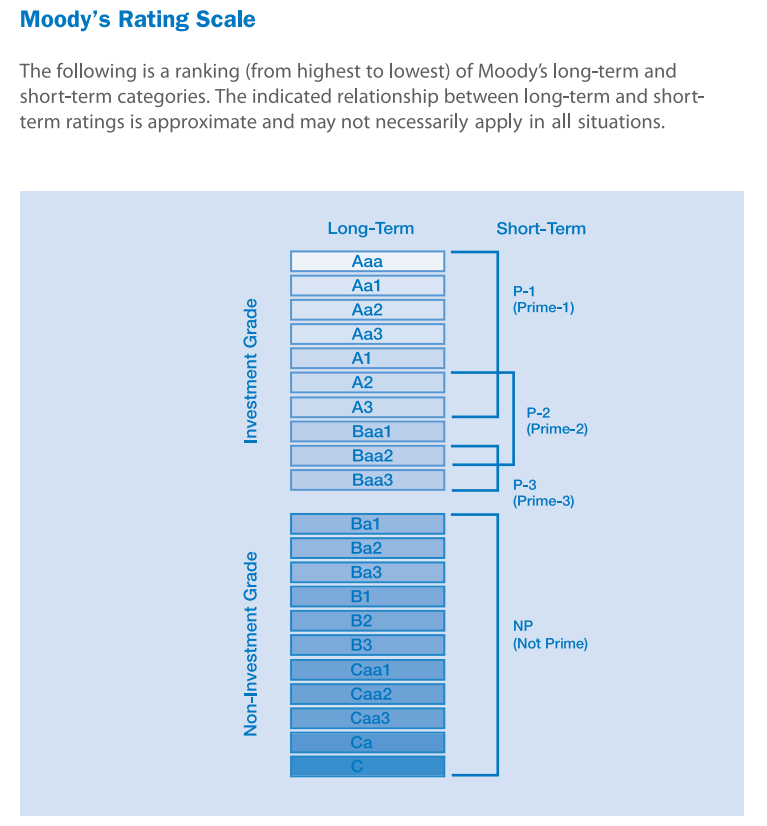

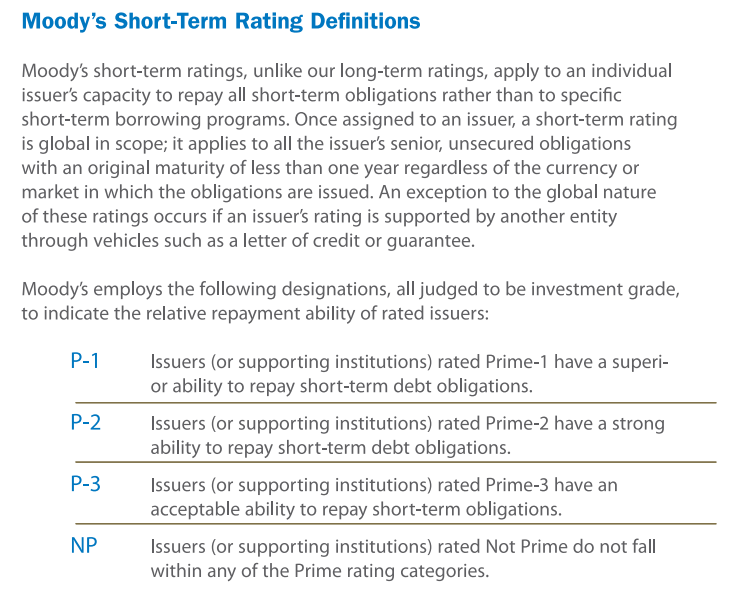

But how is Moody’s rating scale?

Author: Gianluigi Pezone