The commercial real estate market is regarded as a vital indicator for economic well-being, boosting the interconnection of factors including local economies, population growth, interest rates, and government regulations. Through this article, we will try to understand the complexities of the real estate industry, recalling the trends of the past year and looking forward to what is going to be its evolution.

The Current Global Real Estate Market

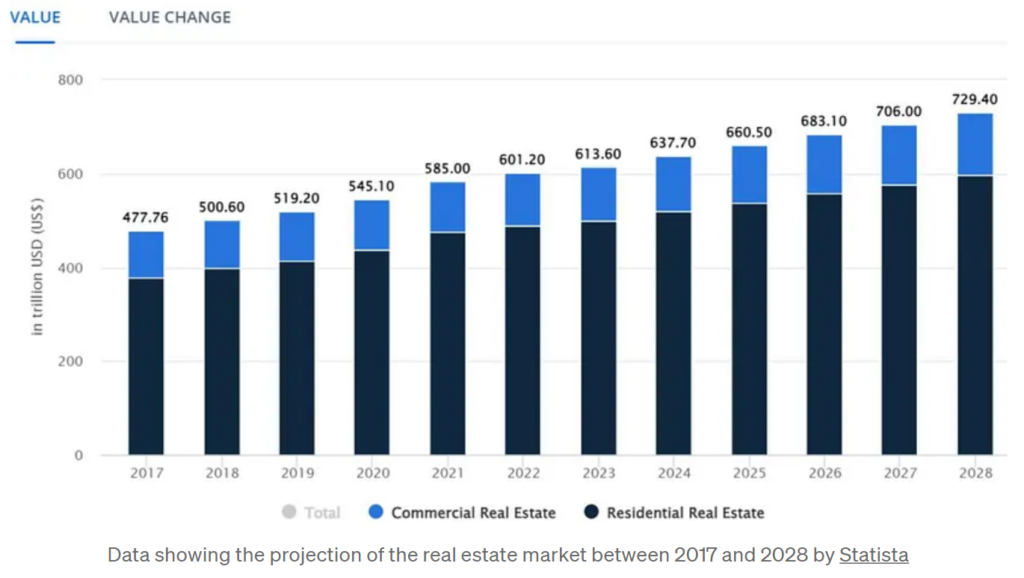

Today, the global real estate market is a massive phenomenon in world economy, destined to reach an astounding value of US$637.80 trillion by 2024, with residential real estate dominating at US$518.90 trillion. These figures, extracted from a STATISTA analysis on global real estate markets, underscore the strength of the market on a worldwide scale. The market is projected to grow at an annual rate of 3.41%, and it is expected to reach a historical US$729.40 trillion in value by 2028.

However, the commercial real estate sector will be affected by external influences. Recent market analysis reveals a mixed macroeconomic outlook (look at the macroeconomic expectations for 2024 article): While better, although weak, economic growth is forthcoming for 2024, the effect of higher interest rates and geopolitical uncertainties may pause downside risks. Despite that, falling interest rates are expected to act as a counterbalance, developing a gradual revival in capital markets.

Impact of Technology and Innovations: Transforming the Real Estate experience

In an era dominated by technological change, the real estate market has not been left untouched. Innovations such as virtual tours, online listings, and blockchain in property transactions have become fundamental constituent of the industry. Virtual tours, a standout feature, permit potential buyers to explore properties from their phone at home, revolutionizing the way real estate was experienced and transacted. Furthermore, online listings and blockchain add layers of efficiency, accuracy and transparency to property transactions, smoothing processes and inducing trust in participants.

The taking over of technology was further accelerated by the advent of COVID19, with virtual tours and online lease agreements becoming commonplace. This technological shift is not merely a trend but a transformative pressure that will persist in shaping not only the commercial real estate market, but also the other markets in the foreseeable future.

Changing Demographics and Housing Preferences

Modelling the current market segment and painting the portrait of the real estate customer, changing demographics plays a crucial force influencing housing preferences. The adoption of most companies of remote work, escalated by the pandemic, has led the way in a new era of flexibility in employment, making individuals and companies reconsider their spatial necessities.

Forbes expects that 2024 will be a better buying year for real estate experts and users. The housing market, after facing challenges in 2023 with ever increasing mortgage rates and elevated home prices, is anticipated to soften in certain areas. The impact of remote work on housing selection is evident, with a rush in demand for suburban properties as more people will go for remote work arrangements.

Challenges and Opportunities of the Market

Even if the real estate market presents immense opportunities, it is not lacking challenges. As previously described, 2024 will have weak economic growth that won’t result in enormous changes, however the expected policy changes will allow for a market revival and improved conditions for investors. Given that, investment activity is expected to rise in the second half of the year, boosted by clarity on new price levels and improved stock market conditions.

The office leasing sector, adapting to the paradigm switch in workplace strategies, anticipates slow progress in 2024. Quality differentials become more apparent, with rightsizing and quality enhancement arising as prominent trends. Co-working spaces, a reflection of the flexible work arrangements trend, will be on the rise, furnishing shared workspaces for individuals and companies.

Sustainability and ESG Considerations

Social, and Governance (ESG) considerations are now within the first points of real estate decision-making agenda. Sustainability has become a critical aspect for buyers and investors, driving the demand for energy-efficient properties with low carbon emissions and sustainable materials. The European Commission’s Energy Performance of Buildings Directive sets clear sustainability targets, influencing the renovation of existing housing stock to meet energy efficiency standards.

The living sector, facing structural undersupply, is expected to notice upward pressure on rents in 2024. The demand for housing, particularly in larger European cities, is skewed towards the rental market, driven by increased mortgage rates making renting more reasonable than homeownership.

The global real estate market stands at a turning point, facing new challenges and adapting to transformative trends. The impact of technology, changing demographics, and sustainability considerations are reshaping the landscape. While the macroeconomic outlook for 2024 may present obstacles, the market’s resilience and adaptability are visible in the forecasted gradual recovery in capital markets.

Piece: the Italian startup that will revolutionise the real estate market

Piece is an avant-garde platform that addresses the challenges of home ownership in the face of inflation and income stagnation, in particular for the younger generation. It was founded by Kentaro Sohara, a Japanese businessman who has stabilised his entrepreneurial home in Italy, Piece’s objective is to issue accessibility and transparency in real estate investments.

The current scenario in Italy introduces a notable difficulty for desiring homeowners, with housing obtainability at its lowest levels in the last 30 years. Kentaro Sohara recognises the increasing problem of constantly unaffordable housing and the difficulty for young individuals to take part in the real estate investment market. Internationally, real estate remains a lucrative asset, estimated at $280 billion, yet less than 5% of young individuals have access to it. Kentaro acknowledges the limitations of different solutions such as real estate crowdfunding, particularly for those with limited investment capacity.

Piece is thought as a fractional ownership platform, allowing people to acquire shares of a rented property and, in turn, get a percentage of the rental income. The platform, that is still in evolution, will provide users with the possibility to invest in properties with a starting price as low as €20. This low entry point makes it achievable for students or young workers with even a modest amount, even €100, to start looking at the real estate market.

The platform’s functionality is thought to be transparent and user-friendly. Users can pick out properties to invest in, each already operational with tenants paying monthly rent, guaranteeing a stable income for shareholders. Kentaro emphasizes that possessing a share indicates receiving a monthly dividend from the rent and a portion of the capital gain if the property is sold. Furthermore, Piece aims to educate users about property management by providing exhaustive information on rent value, platform commission, expenses, taxes, and insurance.

Piece not only centre’s its attention on property investment, but also establishes a secondary market for buying and selling ownership shares. The team places a strong emphasis on education, aiming to equip users with the necessary knowledge to eventually control their own properties and foster financial literacy among the younger demographic.

At the moment in the opening fundraising stage, Piece has captivated the awareness of attentive ambassadors and European investors. The funds raised will be used to acquire the first properties for users and launch a demo version of the platform. The team envisions a beta launch in the summer or fall, with schemes to seal the first equity round by the end of the year to strengthen the technical aspect of the team.

Looking ahead, Kentaro visualises the potential evolution of Piece, including smart contracts and inspecting blockchain technology to intensify security. Piece represents a promising solution, spanning between proptech and fintech, supplying a practical pathway for people to enter the real estate market and make enlightened investment decisions.

Author: Vittorio Matalone