Inflationary pressures easing faster in the Eurozone

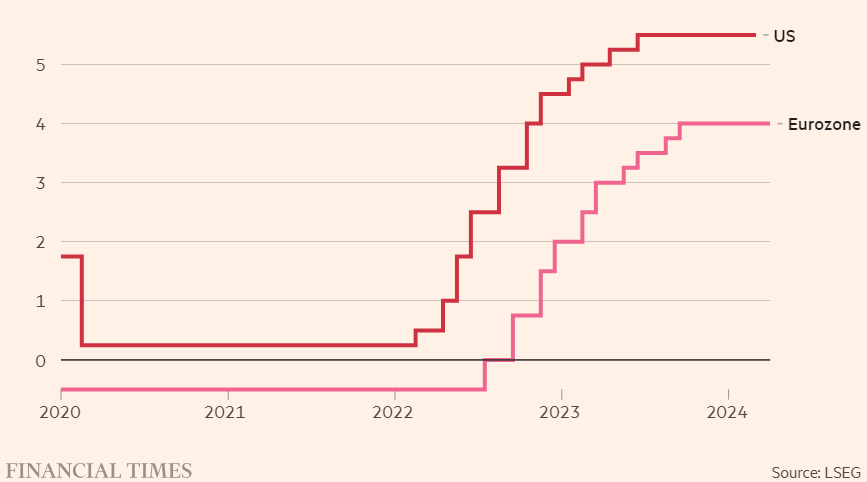

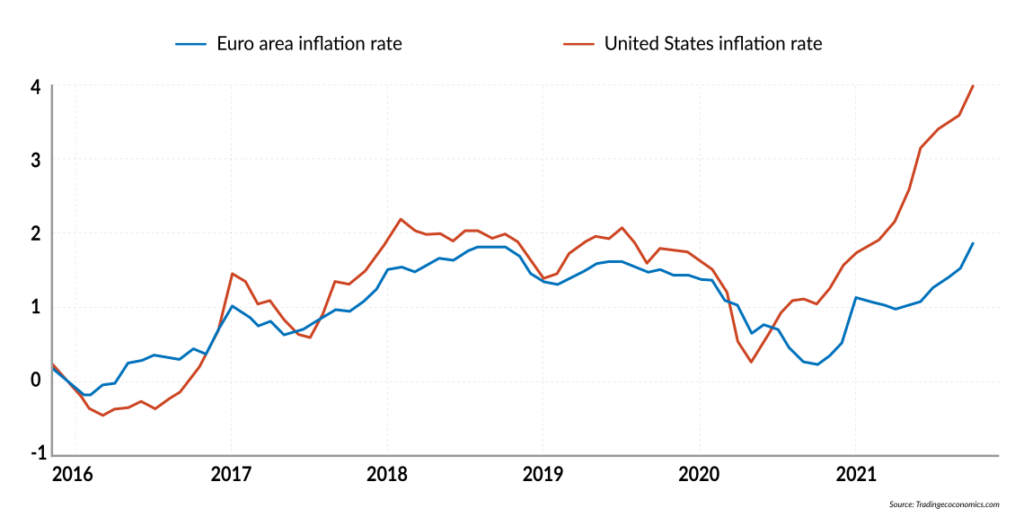

Inflation in the Eurozone is approaching the 2% target, reaching 2.4% in March, exceeding US forecasts. This has led investors to speculate that the ECB could cut interest rates before the FED does. Central bank policy rates are shown in figure 1. Conversely, US inflation surpassed forecasts, rising from 2.4% in January to 2.5% in February. As a result, investors are revising down their expectations for rates cuts by the FED as Jay Powell stated that high US inflation may keep the bank from cutting rates, as previously anticipated. Powell explained that the rates will be lowered only when the FED will have greater confidence that inflation is moving steadily towards the target. Meanwhile, the ECB has announced its intention to reduce interest rates in June.

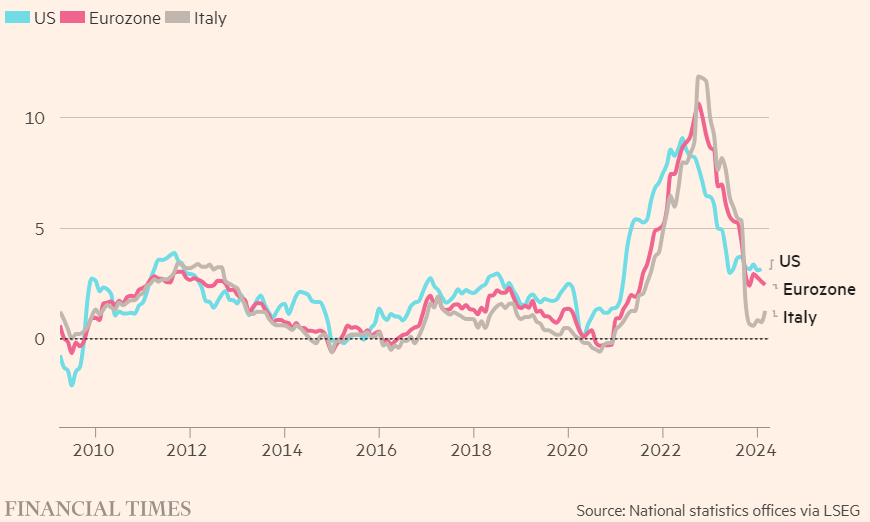

US inflationary pressures persists at elevated levels due to the 2023 economic growth, with GDP increasing by 2.5%. On the other hand, the Eurozone GDP grew only by 0.5% and in 2023 experienced stagnation, motivating the central bank to implement an expansionary monetary policy by loosening interest rates to boost economic activity. This is illustrated by the graph below, suggesting that in 2024 the US has a higher percentage change in consumer price index (CPI). This means that the cost of living is increasing faster in the US compared to the Eurozone.

U.S. is experiencing higher growth rates and inflation compared to the Eurozone due to two main causes, its faster population growth and US net exports of energy. Net exports increase, being a component of GDP, contribute positively to economic growth. In contrast, Europe cannot meet all its energy demand with its scarce domestic energy sources and therefore pays a high price for imports, reducing net exports and economic growth.

Furthermore, there are two main reasons why the ECB is proceeding cautiously and waiting until June. Firstly, cutting interest rates could increase service prices which constitute 45% of the CPI basket, posing at significant risk of domestic inflation. Secondly, ECB aims to prevent a divergence with the FED, which could lead to fluctuations in foreign exchange rates and bond markets, causing additional inflationary pressure.

Implications of policy rates cuts

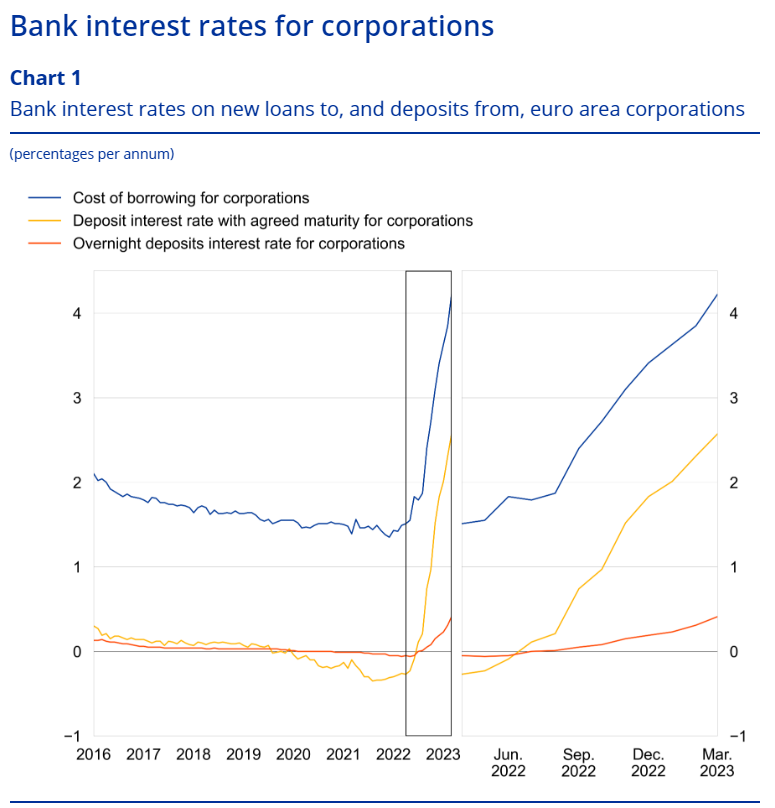

In the real estate market, cuts in interest rates stimulate the economy as render borrowings more affordable, thereby increasing consumer spending and investments, which in turn boosts the house market by indirectly impacting mortgage rates. Indeed, for home buyers, a reduction in the interest rate could lead to lower mortgage rates and increased purchasing power also for low-income earners, stimulating the real estate market. It is important to note that home prices are not only affected by rates but by a combination of factors. Hence it is hard to predict specifically housing market impacts.

The effects of central bank interest rates adjustments to keep a low and stable rate of inflation, have contrasting effects on private equity (PE) funds and firms, depending on whether the PE deals involve buyouts or exits. In leverage buyouts, PE firms finance their takeover costs through long-term debt from sources like pension funds or investment banks, involving periodic interest payments. Therefore, lower policy rates would decrease the cost of debt financing, making leverage more attractive due to the positive direct impact on the Internal Rate of Return (IRR) of investments. Interest rate cuts would increase asset prices due to increased demand, providing benefits to PE funds by positively impacting the IRR. Lower interest rates typically result in lower discount rates which would increase the present value of cashflows. PE firms use financial derivatives such as interest rates swaps to offset interest rates fluctuations.

The capital surplus available could cause increased competition among buyers, further increasing assets prices, challenging PE firms seeking to make acquisitions. From the seller’s side, an abundance of capital would be beneficial, and IPOs would increase as PE firms seeking to exit can obtain higher valuations and returns. However, interest rate changes have broader macroeconomic implications and the increase in investments and consumer spending would create inflationary pressure.

Author: Claudia Marsilia