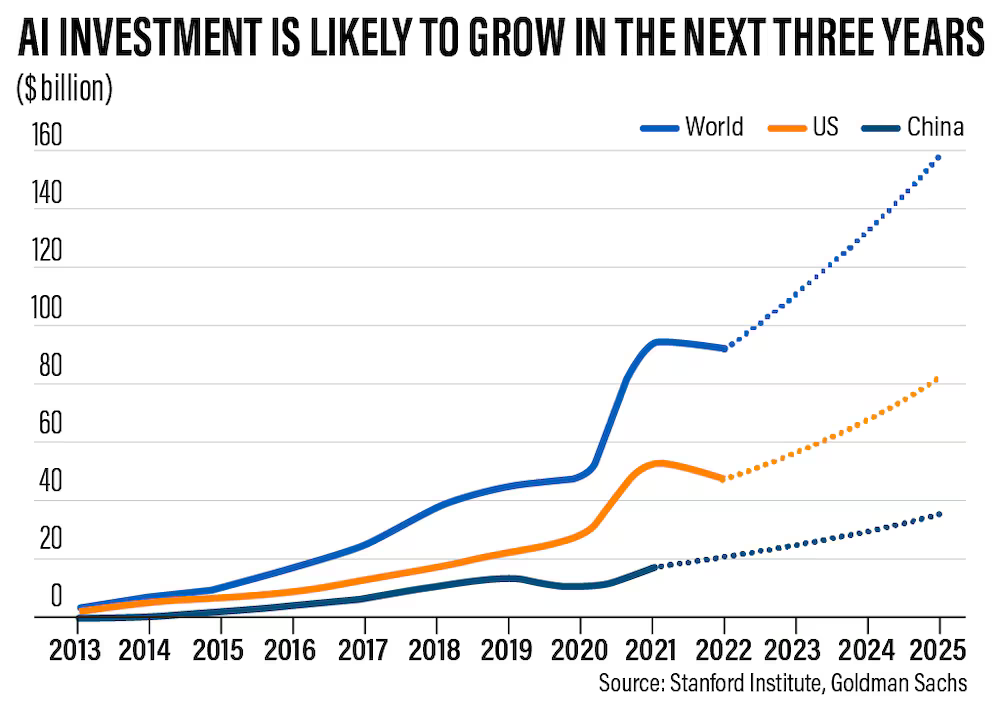

Ever since the discovery of OpenAI’s ChatGPT, the attention towards Artificial Intelligence has now touched an all time high. With a burgeoning market valued at an estimated USD$200bn, many companies are pivoting towards the sector.

Amongst the many firms investing in the market, the most important worth mentioning is Microsoft. Its strategic investments in AI have significantly enhanced its product offerings across its vast portfolio, further solidifying its position as a titan in the tech industry.

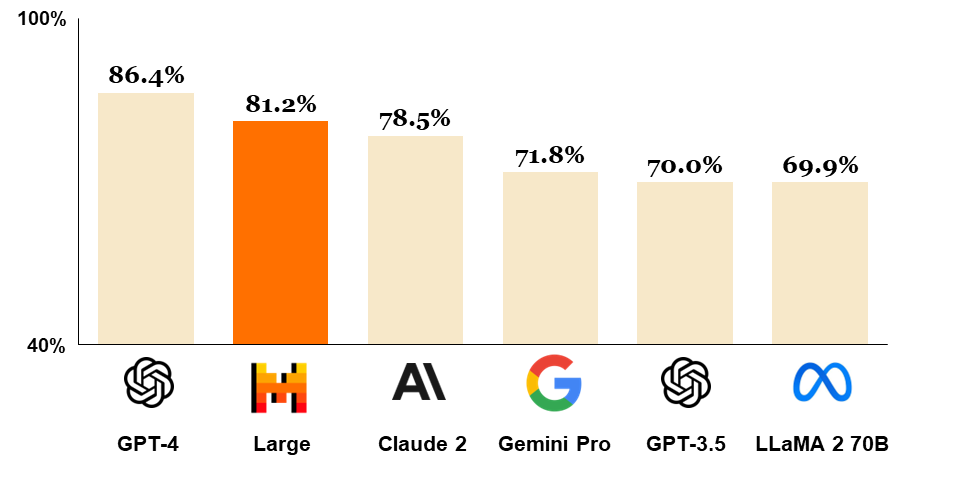

After the USD$13bn invested in OpenAI, Microsoft has struck a deal with French artificial intelligence start-up Mistral AI as it seeks to broaden its involvement in the fast-growing industry. Born in April 2023 from ex DeepMind Arthur Mensch and ex Meta Timothée Lacroix and Guillaume Lample, the Paris based company is currently building both private and Open Source LLM (Large Language Model) that are able to compete with the american colossus ChatGPT. After obtaining USD$113 million of funding in just 4 weeks since its release, Mistral AI raised the biggest seed round ever for a European startup, and is now valued at USD$2,1bn.

The Tech giant is set to invest in order to create a research and development collaboration and help the new-born startup spread their commercial language models. The new partnership will grant access to “Mistral Large” on the Microsoft platform Azure Cloud Computing.

Apart from Mistral in France, Microsoft has announced $5.6bn in new AI data center investments in the past two weeks in Germany and Spain, encouraging innovation and competition in AI. As a matter of fact, there seems to be a relevant number of AI startups rising in Europe, although they all have to submit to the tough regulations and invasive antitrust checkups.

Given the circumstances, Microsoft investments are still flowing, but recently pointing towards Japan as a new target. The Redmond based company announced it will invest USD$2.9bn over the next two years to increase its hyperscale cloud computing and AI infrastructure in Japan, while aiming at teaching AI programming skills to over 3 million people in Asia. Part of the deal also includes the creation of the first Microsoft Research Asia lab in Japan, where there will be conducted projects that “align with Japan’s socio-economic priorities” including how AI can impact well-being and robotics.

The investment, noticeably the largest one in its 46 years in the country, aims to support Japan’s key pillar to tackle deflation and stimulate the economy while striving to accelerate Japan’s digital transformation and adoption of AI. The announcement coincided with Japanese Prime Minister Fumio Kishida’s state visit to the United States, where he was joined by Microsoft Vice Chair and President Brad Smith.

Witnessing Microsoft’s global expansion, other Big Tech rivals are also investing heavily in building generative AI, meaning software that can produce text, images and code in seconds, which analysts believe will shake up industries across the world.

Amazon being first on the list as its USD$1bn Industrial Innovation Fund is to step up investments in companies that combine artificial intelligence and robotics, as the e-commerce giant seeks to drive efficiencies across its logistics network. Its venture capital arm has already made 12 investments since last year. Aside from that, Amazon has recently marked its largest venture deal by committing up to USD$4bn to generative AI start-up Anthropic. Anthropic is the developer behind the AI model Claude, which competes with GPT from Microsoft-OpenAI and Google’s Gemini. Along with Meta and Apple, they’re all racing to integrate generative AI into their vast portfolios of products and features to ensure they don’t fall behind in a market that’s predicted to top USD$1 trillion in revenue within a decade.

Finally, what we have been able to witness these past few months is just the beginning of something bigger: in recent earnings calls, tech executives reiterated their focus on generative AI, making it clear to investors that they have to spend money to make money, and invest as much as possible in those costly but worth ventures, whether it’s on internal development or through investing in startups.

Author: Liliana Prina