In the broad and intricate universe of bonds, junk bonds are one category among many.

Junk bonds, also referred to as high-yield bonds or speculative bonds, represent one of the numerous categories of corporate debt securities: these are typically issued by companies or firms burdened with heavy debt or those carrying a speculative level rating (which are usually in a start-up phase).

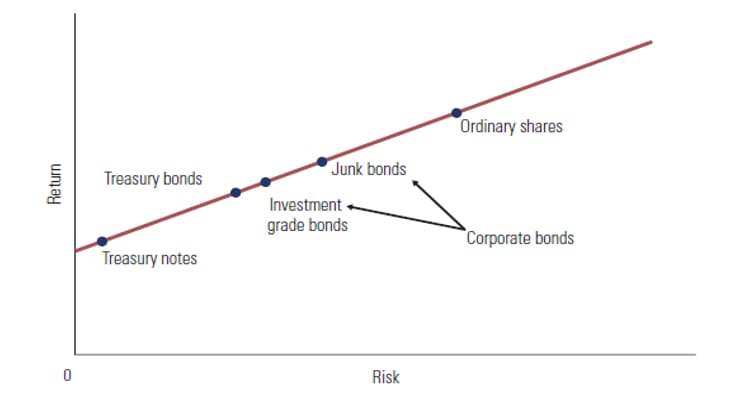

They offer higher interest rates compared to regular corporate bonds due to their increased risk and lower credit ratings.

It is important to remember that, just because a security offers higher returns, it does not necessarily mean it is superior to others: there is a common misconception that higher risk always yields higher returns.

The truth is, while there is indeed a positive correlation between risk and return, it is crucial to remember that higher risk does not guarantee higher returns, and taking on more risk could potentially lead to a more substantial loss of capital.

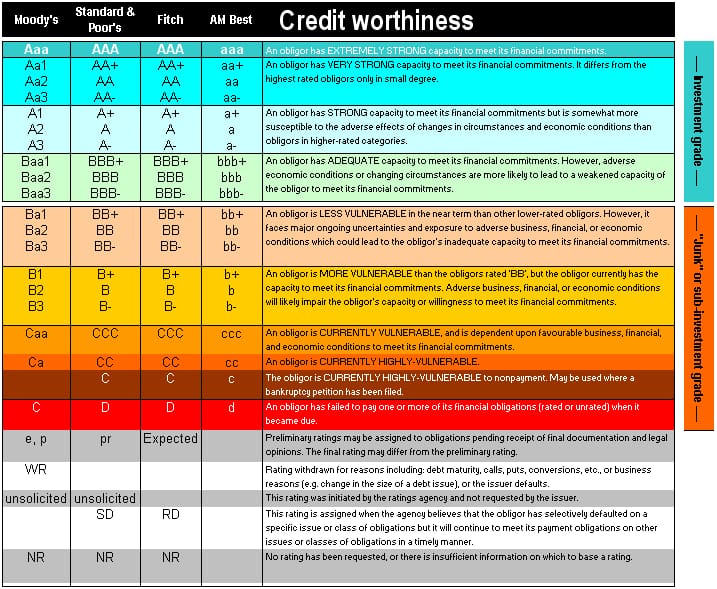

Rating agencies (also known as CRA, or credit rating agencies) are firms that evaluate the creditworthiness of various instruments (especially bonds), which is the ability of corporations and governments to meet the principal and interest payments on their debts. These companies usually assign to these bonds a rating inferior to Baa or BBB (these letter grades are used by Standard & Poor’s, Fitch, and Moody’s, which are the three leading agencies in the world).

A security is deemed to be non-investment grade if it has a rating below BB+ or Ba1: the lower the rating, the greater the risk that the issuer will default on the debt, which means that it will not be able to repay the debt.

To better understand why investors might choose high-yield bonds, despite the high risk involved, must be underlined the potential of this financial asset to generate a return.

About the matter, a chartered financial analyst named Robert Johnson has declared that “From 1983 through 2020, a diversified portfolio of junk bonds returned 8.8% compounded annually while a diversified portfolio of Treasury bonds returned 6.2% compounded annually.”

Thus, even if less reliable the capacity of this title to generate profit it’s undoubtedly relevant, also considering the possibility that the company paying its debt improves its rating causing an appreciation of the security.

Additionally, despite high-yield bonds are certainly riskier than investment-grade bonds, compared to individual stock may still be a better choice since in case of bankruptcy bondholders are paid back before stockholders.

However, Investors have several considerations to take into account when deciding to purchase junk bonds. For example, the default rates of these financial assets are way higher than the ones of investment-grade bonds, in 2020 the junk bonds’ default rate was 5,5% compared to 0,00% of more secure bonds.

Another downside concerns the liquidity of these assets. Often investors are usually skeptical about this kind of security, and it may be difficult to sell them quickly if liquidity is needed.

Furthermore, It can be inferred that In the same manner, a company can improve its rating by paying debts, the rating could fall even more diminishing the value of the security.

An example useful to illustrate the risks and rewards of high-yield bonds is Occidental Petroleum (Oxy), which in 2019 after acquiring Anadarko Petroleum was downgraded to junk bonds. In 2020 lots of new bonds were sold to help pay for Anadarko, adding tons more debt to Oxy’s balance sheet.

However, today’s elevated price of oil and an efficient debt management of the company, have brought the bonds to a reevaluation, and Fitch Ratings upgraded Occidental Petroleum back to investment-grade status (BBB-).

Consequently, these created a significant profit for the investors who trusted the security at the time, proving that with a favorable market and prudent behavior, high-yield bonds can effectively be profitable.

Author: Alessandro Verga & Leonardo Zaramella