Banco Bilbao Vizcaya Argentaria (BBVA) recently made a strategic move in the banking sector, unveiling its proposal to acquire all outstanding shares of Banco Sabadell.

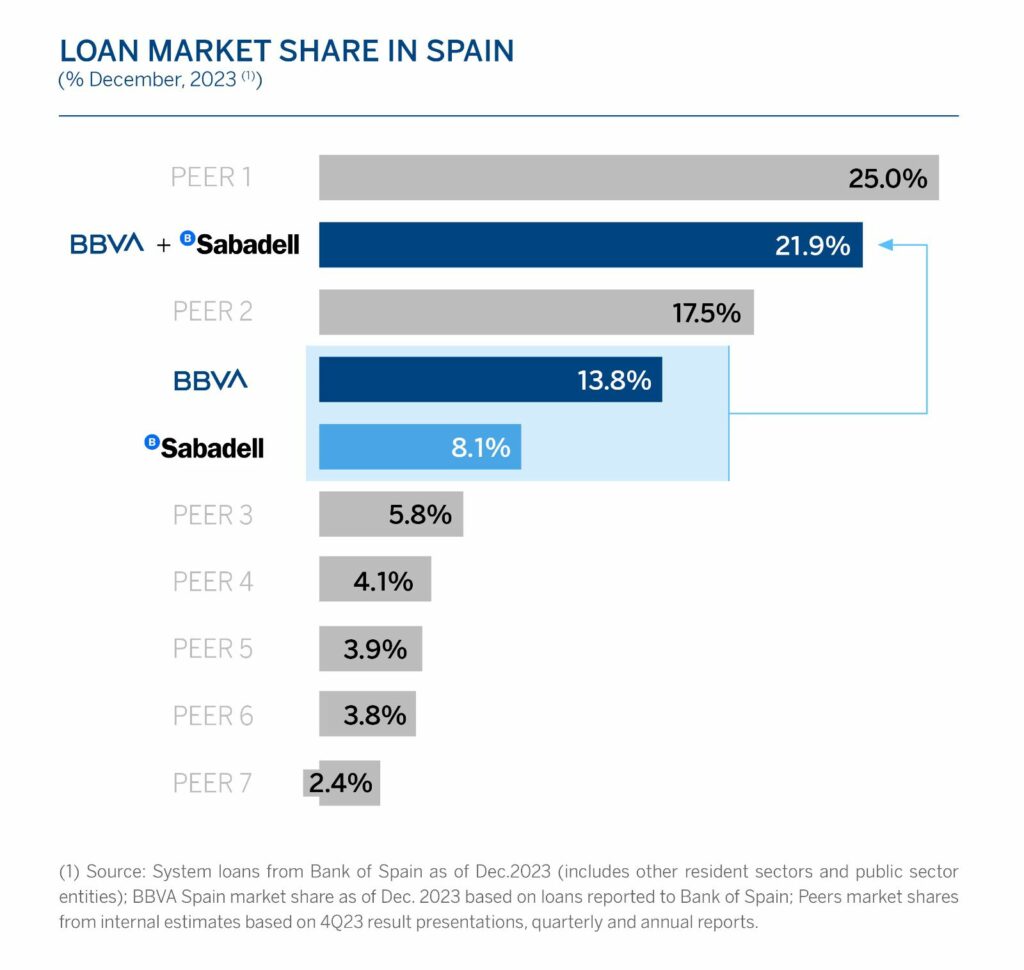

This proposition, presented at a premium of 30% over the closing price recorded on April 29th, amounts to a substantial figure of approximately $12 billion. The motive behind BBVA’s ambitious bid is clear: to solidify its position as a dominant force within the European banking landscape. By merging with Banco Sabadell, BBVA aims to create the second-largest bank group in Europe, boasting an anticipated market capitalization of €70 billion. This would place BBVA in close contention with industry heavyweight BNP Paribas, which currently leads with a market capitalization of €77 billion.

However, despite the allure of BBVA’s offer, Banco Sabadell has opted to reject the proposal, citing its confidence in its ability to generate value for shareholders independently. This decision has triggered a complex web of reactions and considerations within the Spanish financial ecosystem, further compounded by the public stance of the Spanish government against the proposed acquisition. The government’s vocal opposition underscores the potential ramifications that such a merger could have on various facets of the national economy, including employment and financial stability.

In the wake of Banco Sabadell’s rejection, speculation looms regarding BBVA’s next move. One potential strategy could involve BBVA presenting a counterproposal, perhaps with revised terms aimed at addressing concerns raised by Sabadell and regulatory authorities alike. Such a revised offer might include a blend of cash and stock components, designed to sweeten the deal for Sabadell’s shareholders while mitigating potential stock price volatility for BBVA. By providing a certain cash amount as part of the offer, BBVA could offer Sabadell’s shareholders a tangible incentive, irrespective of fluctuations in BBVA’s stock price.

This intricate dance of negotiations and strategic maneuvering highlights the complexities inherent in large-scale banking mergers, particularly within the regulatory framework of Spain. Under Spanish law, any acquisition in the banking sector must not only secure approval from antitrust authorities but also navigate potential intervention by the government. Given the government’s expressed concerns regarding the impact of the proposed acquisition on employment and the broader financial landscape, BBVA faces a significant challenge in securing the necessary regulatory green light.

Despite the regulatory hurdles and stakeholder resistance, BBVA’s leadership remains resolute in its pursuit of the proposed acquisition. The CEO Carlos Torres has expressed confidence in the value proposition presented by BBVA’s latest offer, emphasizing the potential benefits for shareholders and the broader economy. However, regional interests, such as those represented by the Catalonian nominating chair, advocate for the protection of local interests and employment opportunities, urging caution in proceeding with the merger.

The outcome of BBVA’s bid for Banco Sabadell holds significant implications not only for the two institutions involved but also for the broader landscape of European banking and regulatory dynamics.

Authors: Sabrina Ramdohur and Manuel Zanetti