In the life of a company, just as it occurs in a person’s life, there are significant instances that mark a deep shift from the previous life.

One amongst them is the IPO, which is an acronym that stands for Initial Public Offerings.

An IPO is a procedure through which a private company offers its shares among the public (the so-called creation of the free float) for the first time on a regulated market.

Upon making this shift, a company transitions from being privately held by a select group of owners and investors to being publicly owned. A company is regarded as private when its shares are held by a relatively limited number of shareholders. These shareholders often include initial investors such as the company’s founders, their family and friends, as well as professional investors like venture capitalists and angel investors.

The excitement and media attention surrounding an IPO frequently stimulate the interest of investors, attracting them to participate: this happens because there is evidence that, if you can secure a position on the ground floor of an IPO (meaning you receive an allocation in the IPO before the stock starts trading), you are likely to make a profit, because IPOs tend to be underpriced.

While it may appear as an easy way to make profits, there are several factors to take into account if you are considering participating in an IPO: the biggest challenge for the majority of investors is that securing a position in the IPO is quite challenging.

This is because most of the initial allocation is typically directed to institutional investors (which are companies that invest money on behalf of other people), while the allotment for retail investors is likely to be allocated to larger brokerage clients.

Fidelity, one of the largest asset management companies in the world, has described the allocation procedure for retail investors as follows: “Each customer who wants to participate in an IPO offering is evaluated and ranked based on his or her assets and the revenue they generate for the brokerage firm. Typically, customers with significant, long-term relationships with their brokerage firm will receive higher priority than those with smaller or new relationships”.

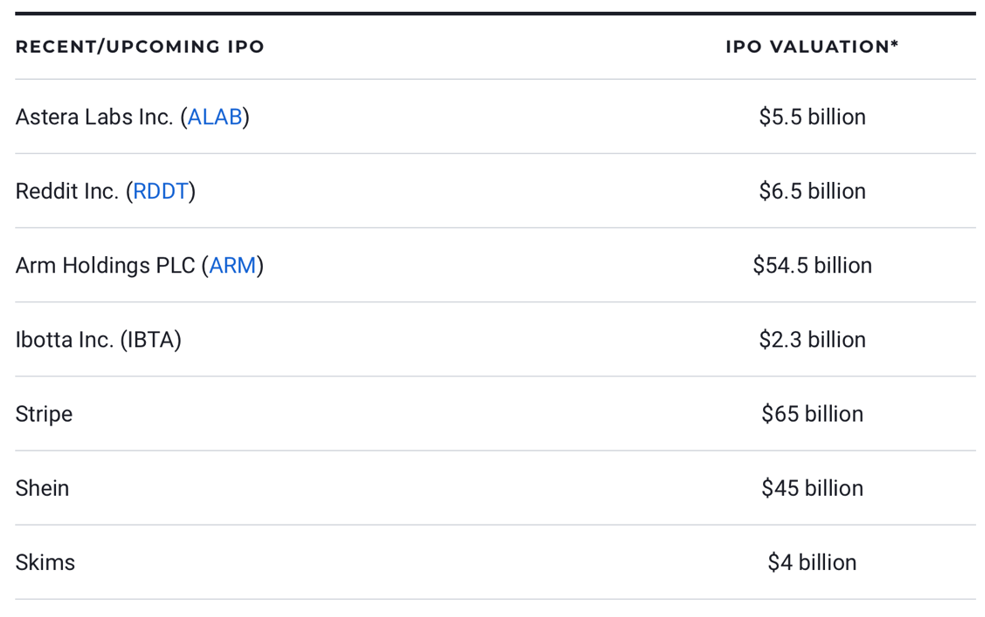

Furthermore, in many recent cases, IPOs are verifying a brief period of gains, followed by towering losses, which in many cases still need recovering. In 2024 numerous intriguing IPOs are upcoming in the market obtaining many relevant performances. Here’s a quick overview:

- Astera Labs Inc. (ALAB): Valued at $5.5 billion, Astera Labs specializes in AI and cloud connectivity. Its stock price rose by 46% on the first day of trading and is expected to continue climbing.

- Reddit Inc. (RDDT): With a valuation of $6.5 billion, it has faced challenges post-IPO, experiencing a 28% drop in stock price. Despite these losses, analysts remain optimistic due to Reddit’s AI potential.

- Arm Holdings PLC (ARM): Valued at $54.5 billion, Arm Holdings has demonstrated strong performance, benefiting from partnerships with Nvidia and Google.

- Ibotta Inc. (IBTA): Initially valued at $2.3 billion, Ibotta’s stock surged initially but then declined. The company’s shift to a B2B model and focus on AI remain central to its strategy.

- Stripe: Estimated to be valued at $65 billion, Stripe is a digital payments company highly anticipated for an upcoming IPO.

- Shein: The fast fashion giant, estimated at $45 billion, is facing legal challenges but is aiming for an IPO likely to be held in London.

- Skims: Estimated at $4 billion, Skims is a retail brand founded by Kim Kardashian. The company has shown strong sales growth and is planning an IPO.

In summary, Initial public offerings are a pivotal moment in the company’s journey, marking the transition from private to public ownership and allowing new investors to notice and interact with the company. This phase of the company’s life could be significantly profitable for early gains but came also with challenges related to securing allocation for retail investors due to strong competition. Despite, the huge possibilities that come from IPOS recent trends are showing how careful consideration and diligence are the keys to avoiding the substantial losses that some companies face after the initial gain.

Authors: Alessandro Verga & Leonardo Zaramella