Introduction

Tesla, Inc., founded in 2003 and headquartered in Austin, Texas, has been a pioneering force in the electric vehicle (EV) industry. Known for its innovative and high-performance electric cars, Tesla’s main product lineup includes the Model S, Model 3, Model X, Model Y, Cybertruck, and Tesla Semi. In addition to vehicles, Tesla also offers energy generation and storage products such as solar panels, Powerwall, Powerpack, and Megapack. Tesla is listed on the NASDAQ under the ticker TSLA and has a market capitalization of approximately $554.1 billion as of 2024.

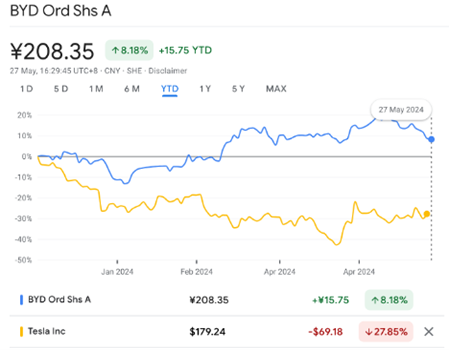

In the first quarter of 2024, Tesla reported revenue of $21.3 billion (9% year-over-year decline) and a net income of $1.1 billion. The company’s gross profit was $3.7 billion, and it held $26.9 billion in cash. Over the trailing twelve months ending March 31, 2024, Tesla achieved an EBITDA of $12.27 billion, translating to an EBITDA margin of 14.01%. With a daily trading volume of around 24 million shares, Tesla’s stock price as of May 27, 2024 stood at $179.34, reflecting a 28.33% decrease from the beginning of the year, as shown in Graph 1.

Tesla and Graham’s Stock Selection Criteria

Despite these impressive figures, which surely prove the company’s financial health, Tesla faces scrutiny under Benjamin Graham’s stock selection criteria, which emphasize value investing and differentiate underperforming companies from profitable ones.

a. Earnings-to-Price Yield

Tesla’s earnings-to-price yield currently falls short of Graham’s benchmark, which stipulates that the yield should be at least twice the US 10-year Treasury yield, approximately 4%. This implies a minimum yield of 8%, a threshold Tesla does not meet due to its lower profitability.

b. P/E Ratio

Graham’s criterion suggests that the price-to-earnings (P/E) ratio should be less than 40% of the highest P/E ratio over the past five years. Tesla’s P/E ratio has been highly variable and often exceeds this limit, making it less attractive by this measure.

c. Dividend Yield

Tesla does not pay dividends, thus failing to meet this criteria.

d. Stock Price below 2/3 of Tangible Book Value

Tesla’s stock price ($176) significantly exceeds its tangible book value, currently at $21 per share, not aligning with Graham’s valuation standards.

e. Stock price below 2/3 of Net Current Asset Value (NCVA)

Tesla stock price was $179.24 on May 24, 2024, while NCVA for last quarter was $6.5 billion, so this criterion is respected.

f. Total debt less than book value

As of March 2024, total debt amounted $9.91 billion.

Total assets $109.22 B, total liabilities $44.04B giving a book value of equity equal to $65.18B which is lower than total debt, so this parameter is also satisfied.

g. Current ratio greater than 2

Tesla has a current ratio of 1.72, so this parameter is not satisfied in this analysis however it still indicates good short-term financial strength.

h. Total debt less than 2 times Net Current Asset Value

Total debt is $9.91 billion which is less than $13 billion (2 times NCAV).

i. Earnings growth of prior 10 years at least at a 7% annual compound rate

Tesla’s 10-year compound annual growth rate is 46.51%.

Insight in EV industry

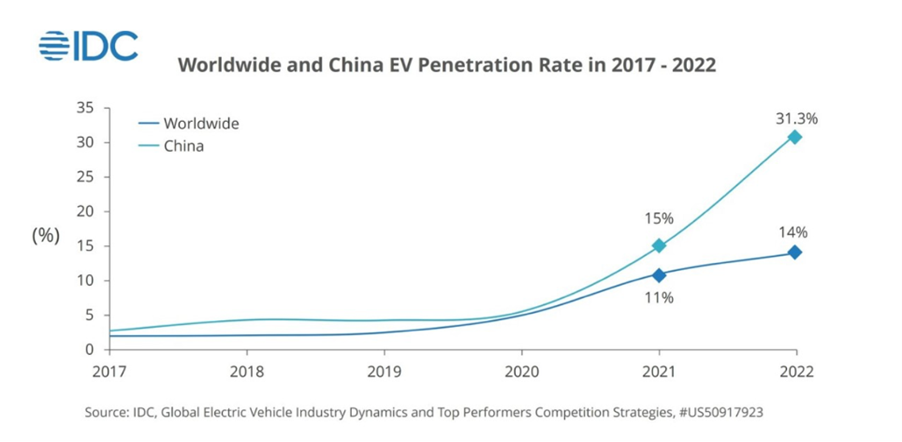

By EV we mean the Electric Vehicle industry which is currently going through an increasing trend. In this industry there’s a trade-off between sustainability and financial optimality for consumers. More and more car producing companies are shifting towards electric or hybrid cars and that’s because demand is increasing dramatically with respect to the past years. The leading country is China with a market share of 30%, followed by Europe with 23% and the US with 7.7%. EV market in 2022 had a penetration rate of 14% with 10 million units produces; as we can see in Graph 2, China had the largest penetration rate, taking a great distance from the overall worldwide industries. As demand increases firms need to be more and more competitive, it should be noted that companies that have the stronger position qualify themselves as technology companies rather than automotive as the size is noticeably bigger. However, there are some factors that prevent these companies from responding effectively to the demand.

Tesla in a competitive landscape

Tesla faces significant competition in the electric vehicle (EV) market from key Chinese players like BYD and Xiaomi. Both companies have made remarkable strides, positioning themselves as formidable challengers to Tesla’s dominance.

BYD, founded in 1995, has become the world’s largest EV manufacturer by volume, benefiting greatly from strong domestic demand in China, the largest EV market globally. This demand is supported by the Chinese government’s push for greener transportation solutions. Additionally, BYD offers a range of competitively priced electric vehicles, making them accessible to a broader consumer base. This ability to produce EVs at lower costs compared to Tesla enables BYD to attract price-sensitive customers. Furthermore, substantial government subsidies and incentives in China reduce costs and boost sales for BYD. These supports include financial incentives for consumers to purchase electric vehicles and funding for infrastructure development like charging stations. BYD’s control over the production of batteries and other components helps manage costs and ensure supply chain stability. This vertical integration allows BYD to streamline operations and reduce dependency on external suppliers, which has been a significant advantage over Tesla, which often faces supply chain disruptions.

Graph 3, shows how BYD’s competitive advantage is substantially outperforming Tesla, with a rise in stock prices of 8.18% YTD against Tesla’s concerning decrease of 28%.

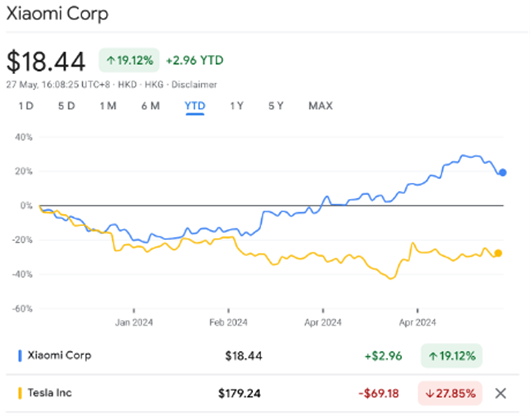

Xiaomi, established in 2010, is primarily recognized for its smartphones, mobile apps, laptops, and other consumer electronics. However, the company has recently ventured into the EV market, leveraging its strong brand presenceand technological expertise. Xiaomi can leverage its existing customer base to promote its new EV offerings, providing a built-in market advantage that Tesla does not have in the consumer electronics space. Furthermore, Xiaomi’s robust financial position allows for significant investment in research and development (R&D) and manufacturing capabilities. This financial strength supports rapid innovation and scaling, enabling Xiaomi to quickly respond to market demands and technological advancements. Xiaomi’s ability to offer high-quality products at competitive prices, combined with their direct-to-consumer sales model, reduces overhead costs and enhances customer engagement. This model contrasts with Tesla’s higher price points and reliance on a less diversified product range. Illustration in Graph 4 shows Xiaomi’s increase in stock prices of 19.12% from the beginning of the year, in comparison with Tesla’s.

Tesla recent issues

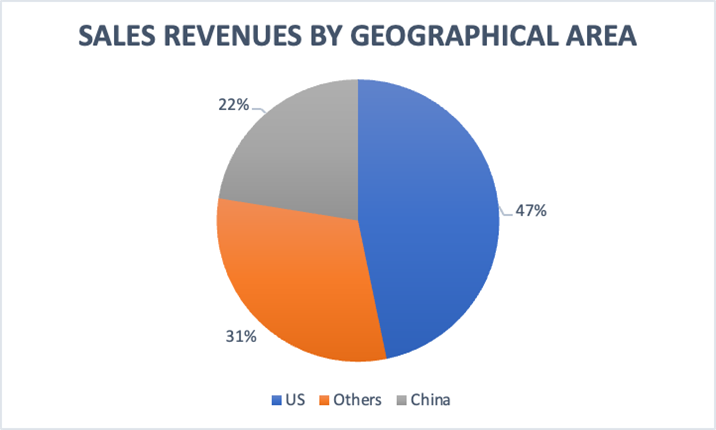

For a long time, it seemed that Tesla was on the roll in every field and on every product, they were producing, indeed we can look at the sales in the different geographical areas. In FY 2023 sales revenues in the United States amounted to 41,834,628; in China to 20,110,401; and others to 27,553,423. It is noticeable that the biggest portion of sales revenues happen in the US and from China Tesla had a great share of revenues.

However recently there’s been a decrease in car sales by 36% (YoY). In Q1 2023 deliveries were up to 422,875 with respect to a production of 440,808; in Q1 2024 deliveries were 386,810 with respect to a production of 433,371. We can see a net decrease in sales from year-to-year. And increase competition with Chinese brands that are challenging the Texas based company. As an obvious consequence we have witnessed a decrease in sales and profits, as well as a decrease in share price by more than a quarter. Many suggest that the reason of Tesla’s, although subtle, downfall is due to the lack of innovation, to the fact that EV are not anymore, a new, exciting product as they were when Tesla entered in the market. Other firms are exploiting their competitive advantage, for instance BYD is offering a similar product but at a lower price.

Another issue Tesla is facing is in the branch of brand reputation with leasing companies. In Europe, these contracts represent half of their sales; those companies claim Tesla ignored problems such as complaints, repair services and ordering problems. In addition to this, it seems like fewer and fewer people are willing to rent Tesla’s cars and so to leasing companies this has huge costs due to them purchasing cars but not have any return. Tesla’s solution seems to be discounts to those companies.

Possible Solutions for Tesla

To address its challenges and enhance competitiveness, Tesla should focus on three critical strategies:

I) Introducing more affordable models will make Tesla’s vehicles accessible to a broader market. This strategy helps Tesla compete effectively with BYD, known for its competitively priced electric vehicles. By lowering production costs through economies of scale and more efficient manufacturing processes, Tesla can offer lower-priced models without significantly impacting profit margins.

II) Strengthening supply chain resilience is crucial. Tesla should diversify its suppliers and increase in-house production of key components to reduce dependency on external sources and mitigate supply chain disruptions. This approach mirrors BYD’s vertical integration, which provides them with a significant competitive advantage by ensuring stable production and cost control.

III) Improving customer service and after-sales support is essential. Investing in expanding and enhancing service centers globally will reduce wait times for repairs and maintenance, thereby improving overall customer satisfaction. Additionally, expanding Tesla’s AI arsenal to customer support systems could provide quicker and more efficient service responses, addressing major pain points for Tesla owners.

By focusing on affordability, supply chain resilience, and customer service, Tesla can better navigate its current challenges and strengthen its position in the competitive EV market.

Authors: Giorgia Mentasti & Silvia De Santis