INTRODUCTION

Private equity investments are characterized by illiquid assets. To realize their returns, Limited Partners (LPs) and General Partners (GPs) must employ an exit strategy. This article provides a detailed analysis of the primary exit routes adopted by private equity firms.

“To make more on their investments Venture capitalist 1 need to turn illiquid stakes in private companies into realized return” Gompers and Lerner 2001

A defining feature of PE finance is the investment horizon. Limited Partners (LPs) typically commit their capital to a PE fund for a period of 10 years, with potential extensions of 1 to 3 years. This predetermined time frame forces PE firms to focus on realizing investments within the set period. This ensures that LPs receive their invested capital and a return on their investment.

Private equity firms can employ five main strategies for disinvestment, which include: trade sales, secondary buyout, initial public offer (IPOs), buy back and write-offs. Full and partial exits are possible for all the above routes.

Some authors deem recapitalization as a form of partial exit, on the other hand others do not consider it as an exit in a narrow sense, as it doesn’t change the capital structure of the company, however we will consider it as a partial exit route.

In addition to these traditional routes, the global financial crisis of 2008 marked the beginning of a sustained and growing trend in secondary market activity for Limited Partner (LP) investments. This development allowed an alternative mechanism for exiting LP’s holdings, bypassing traditional exit processes.

TRADE SALES 2 AND SECONDARY SALE

Trade sales are associated with the sale of a portfolio company to a strategic acquirer such as a competitor of the firm or an industry peer.

This exit route tends to be a full exit, meaning that the equity is sold integrally. Partial trade exits are rare, because of the boon linked to the acquisition of the whole company, which enables the company to implement synergies.

By operating in the same industry, acquirers are best positioned to estimate the fair value, compared to all the other purchasers. Due to the possibility of a strategic fit regarding strategic synergies, acquirers usually pay a premium.

Additionally, there are also other drivers that lead to acquiring the targeted company such as transition synergies and “make or buy” decisions. Transition synergies represent acquisition of human capital, intellectual properties and the acquisition of the target firm’s customer base. While “make-or-buy” decisions involve choosing between developing technology internally or outsourcing it.

A target company’s awareness of potential synergies significantly impacts their bargaining power during negotiations. This allows them to set a higher offer price. Conversely, the acquiring company is willing to pay a premium due to the strategic advantages they expect to gain from the merger. This negotiation dynamic makes the trade sales, the most common and preferred exit route by PE firms.

However, closing a deal can be challenging due to management’s potential unwillingness, as they may fear being replaced. Additionally, the inherent nature of the acquisition process can lead to the risk of confidential company information being disclosed.

While within Secondary sales transactions, PE firms sell their ownership stake in the target company, but the existing management team remains in place. While this avoids disruption for the target company, it also presents a challenge. The separation of ownership and management can hinder the integration of the target’s assets into the PE firm’s portfolio, thereby reducing the potential for transaction synergies. As a result, secondary sales often lead to lower prices and return for LPs. This is why secondary sales are a relatively rare exit strategy compared to trade sales.

SECONDARY BUYOUT

Secondary buyouts, also known as sponsor-to-sponsor transactions, involve private equity firms selling their ownership stake in a portfolio company to another financial institution. Studies suggest a correlation between the rise in secondary buyouts and the increasing volume of assets held by PE firms. This can be seen in situations where PE firms, instead of pursuing new deals, focus on managing existing investments. This trend might be a symptom of excess capital within the industry, leading firms to seek liquidity by selling to other financial institutions.

Secondary buyouts can carry a stigma, they are often viewed as a failed attempt to resort to a more traditional exit strategy like an initial public offering (IPO) or acquisition by a strategic buyer.

IPO

An IPO (Initial public offer) is a process in which a company sells its shares to public investors. Within this process, the company sells only a portion of its equity. To attract public investors, the company must list its shares on the stock market.

During specific periods, this route is one of the most commonly used exit strategies in the private equity industry because it can lead to high returns on investment due to bullish market conditions. Timing is a crucial aspect for IPOs since public offerings follow a highly cyclical trend. There are periods in which IPOs are frequently used by companies to raise capital, while during times of stress, it’s a less convenient route due to the risk of not receiving the expected capital. The general economic perspective, together with bullish or bear market, are factors affecting the exit route choice.

IPO processes are notoriously expensive, requiring companies to cover filing fees and meet listing requirements for stock market exchanges.

One of the leading disadvantages of IPOs are transaction costs, which can be differentiated in 4 main categories: underpricing, underwriting fee, over allotment costs, and other expenses (legal and administrative fees).

Additionally, It is estimated that 7% of the returns from IPOs are allocated to underwriter fees, not including other direct costs such as legal fees.

Therefore, a company must carefully factor in costs associated with different types of exit strategies, to make sure to choose the route that maximizes returns.

In addition to this there is the risk of not meeting all necessary requirements, and the compliance obligations often create the impression that IPOs are not particularly advantageous.

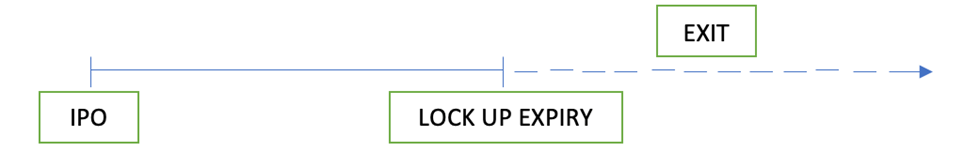

During an IPO, PE funds usually do not fully exit. A full exit can be seen as a lack of confidence in the company’s future potential, which could discourage new investors. The terms of an IPO require that the PE fund comply with the lock-up agreement. This agreement restricts the PE firm from selling shares for a period ranging from 6 to 12 months after the IPO’s conclusion. Due to this aspect, IPOs are not considered a complete exit, as the funds do not sell all their shares but rather prepare and facilitate a future exit.

The decision on assessing the best exit strategy for higher returns is heavily influenced by the duration a company remains within the PE firm’s portfolio. Companies held for longer periods are more likely to be exited through an IPO. As we said, selling to a strategic buyer is the most common exit route, difficulty in finding a suitable buyer can push PE firms towards an IPO. In such cases, pursuing an IPO becomes a more viable alternative to explore.

RECAPITALIZATION

Recapitalization is a particular form of exit, where capital is refunded through the payment of an extraordinary dividend. It represents a partial exit, and it is distinctive because at the beginning of the PE investment investors have the possibility to receive a specific class of shares designated for an extraordinary dividend payment.

Within the recapitalization mechanism the company raises capital in order to pay a special dividend. To achieve this, they can choose between borrowing money from the bank or issuing bonds. Once the necessary funds are raised, they pay a special dividend. This method is also known as Leverage Recapitalization and it’s a transaction commonly used in the Leverage Buyout process.

Generally, for employing this method the company must have a stable and sufficient cash flow since they need to repay back the issued debt.

A key advantage of this method is that the PE firm retains a stake in the target company, which provides the opportunity to receive tax benefits while receiving payment. However, they must be cautious, as excessive leveraging can result in a company becoming over leveraged, which can lead to financial distress and increased agency costs.

BUY-BACK

A buy-back occurs when a portfolio company reacquires its shares from the original owner, which could be the founder, management team, or another investor who previously sold them to the PE firm. This exit strategy is typically used by companies facing financial difficulties, often referred to as “distressed companies.”

To facilitate a buy-back, the portfolio company often needs to secure external financing, which can lead to a significant increase in its debt burden.

Buy-backs are more commonly employed for companies in earlier investment stages, where valuations are typically lower. This makes the buy-back financially more feasible.

WRITING OFF A FAILED INVESTMENT

Private equity (PE) firms don’t always achieve their expected outcomes from deals. When target companies fail to meet predetermined performance goals, PE firms may walk away and incur a “write-off.” This write-off reflects a loss in the value of the investment and is typically associated with the company’s underperformance. In such cases, the PE firm might liquidate the company, selling its individual assets. It’s important to underline that distressed companies, which are companies experiencing financial difficulty, can be an exception to the general rule that the sum of a company’s assets is less than its total worth. In some cases, the combined value of a distressed company’s assets may exceed the company’s overall valuation.

Authors: Gian Carlo Sari & Giuseppe Caccamo

- This article adopts the definition of venture capital as a subset of private equity. The key distinction between the two lies in the target companies they invest in. Venture capital is dedicated to financing young, emerging companies, often referred to as startups. ↩︎

- Trade sales are also known as M&A exit. It’s worth noticing that M&A exits take into account also for secondary buyouts. ↩︎