Evergrande is a Chinese real estate company. It has become well known around the world for the huge level of debt (more than 260 billion dollars). Such a high debt could lead to a global financial crisis. This enormous debt comes from a dangerous scheme that Evergrande used to take advantage of the exponentially growing real estate market in China.

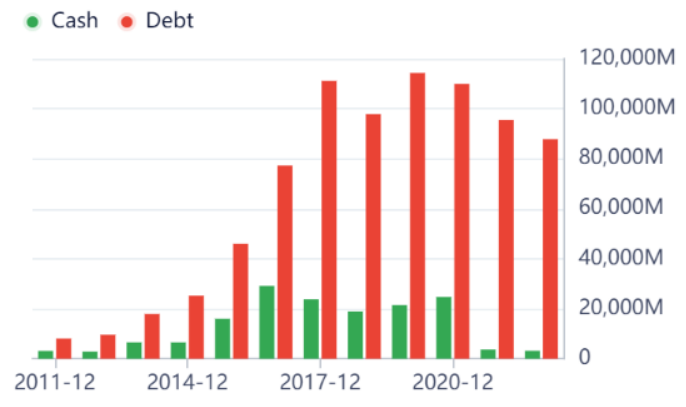

Basically, in that context Evergrande had to issue bonds in order to keep up with the real estate boom but, clearly, this caused a massive increase in the debt levels as it’s shown in the following graph.

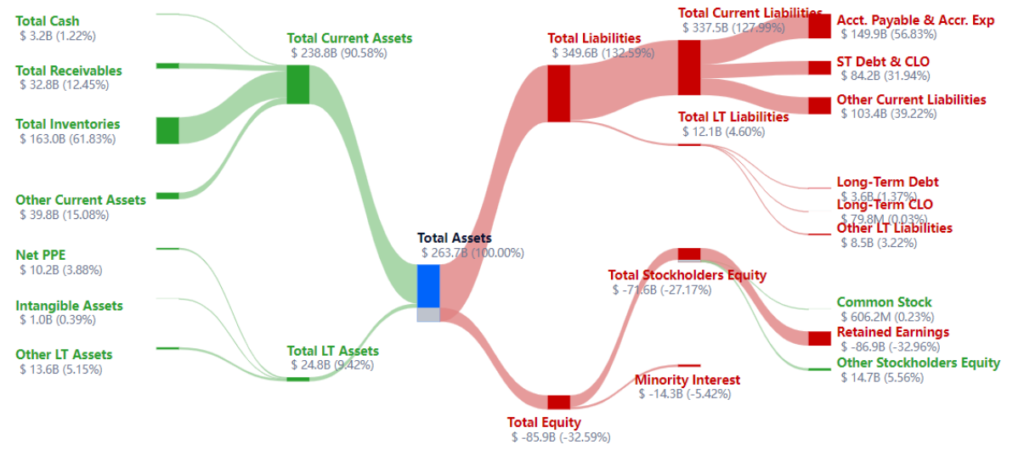

In 2020 the real estate bubble burst and by 2021 Evergrande was in default. Every attempt to save Evergrande was unsuccessful and on the 29th of January 2024, a Hong Kong Court ordered the liquidation. Evergrande liabilities reach 2390 billion yuan (333 billion dollars) and outweigh the 1740 billion yuan of assets by far. This clear disparity between assets and liabilities shows how deep the debt situation was for Evergrande in the last years, as the representation below highlights.

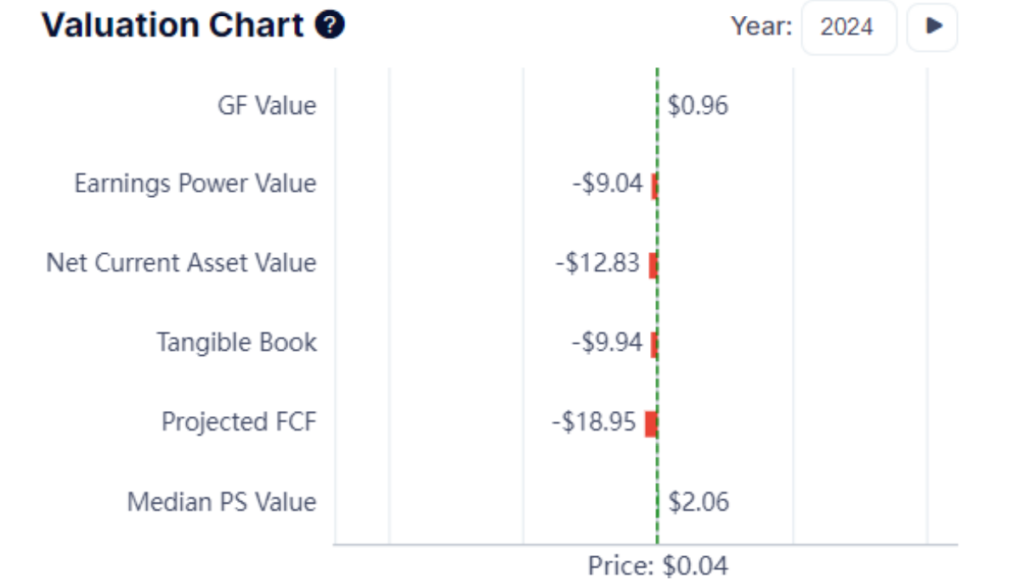

Trading of Evergrande shares on the Hong Kong Stock Exchange was halted on January 29 following a 21% decline. This caused the market value to drop drastically to only HK$2.15 billion, a significant decrease from its peak of HK$414 billion in 2017.

Numerous companies within the real estate industry have already announced bankruptcy in the past few years. Over twelve Chinese manufacturers are currently in the process of going out of business. Some middle-sized companies, like Logan Group Co. and Kaisa Group Holdings Ltd., are included among them.

However the Chinese government didn’t plan any bailout, that’s because Xi wants economic growth to come from sustainable areas such as manufacturing and services, rather than relying on endless amounts of concrete and steel. The government has also shown little interest in actually bailing out foreigners who invested in a high-yield bond market.

It is crucial nowadays to consider markets all around the globe highly interconnected. The creation of financial bubbles, like the one in 2008 or even the real estate bubble in the 80’s in Japan, represents an enormous problem for the economic system as a whole and for its stability in particular.

Authors: Sofia Olivia Pedemonte & Marco Epis