STOCK ANALYSIS: NU HOLDINGS (NU)

NUBANK’S RISE TO SOUTH AMERICAN UBIQUITY

Overview

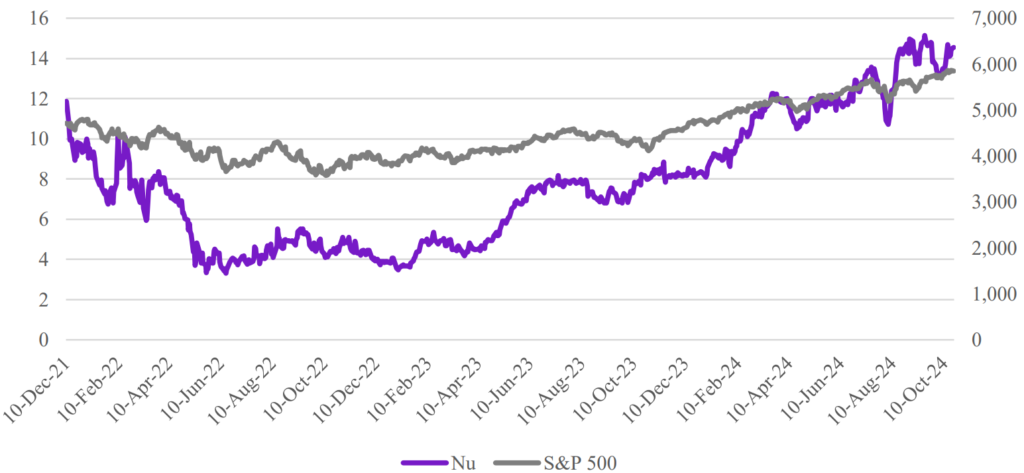

Nu Holdings Ltd. (NYSE:NU) is a Brazilian holding company which provides digital banking services in South America founded in 2013 and headquartered in São Paolo, Brazil. It has found great success by exploiting this untapped market, as South American countries have gradually begun to digitalize (1), and people yearn for a more simple and straightforward process that grants them access to financing. Its product offering is diverse, providing personal loans, credit cards, and insurance policies, with it eyeing a move to diversify its revenue sources by entering new industries. It launched its IPO on December 9th, 2021, on the New York Stock Exchange (NYSE), at a price of $9 per share, raising additional capital of $2.6 billion, with an implied valuation of $41.4 billion (2). Its current market cap stands at around $69.07 billion, with its share price up 72.63% YTD, and a $0.31 LTM EPS. Currently, the firm employs 7,686 people, with revenue per employee reaching $1.180M, showcasing its strong worker productivity.

Its founder, current CEO and Chairman, David Velez Osorno, born in Medellín, Colombia, is a very well-respected figure in the finance world. He obtained both a bachelor’s degree and MBA at Stanford university and worked at some of the most highly esteemed places, most notably Goldman Sachs and Morgan Stanley as an Investment Banking Analyst (FIG Industry Group), moving on to Sequoia Capital as a partner, with a focus on South America. These work experiences have most certainly been integral to him launching a financial services company and navigating through its early stages of growth (Sequoia is still the top shareholder with 11.74% of shares outstanding) (3).

(1) Teresa Rivas, “Berkshire Hathaway and Cathie Wood Own Nu Holdings Stock. Why You Should, Too.”, Barrons, 2024

(2) Felipe Marques, Katie Roof, and Vinicius Andrade, “Brazil’s Nubank Jumps in Debut After IPO Raises $2.6 Billion”, Bloomberg UK, 2021

(3) Bloomberg Terminal, Nu US Equity, Security Ownership

Geography and Products

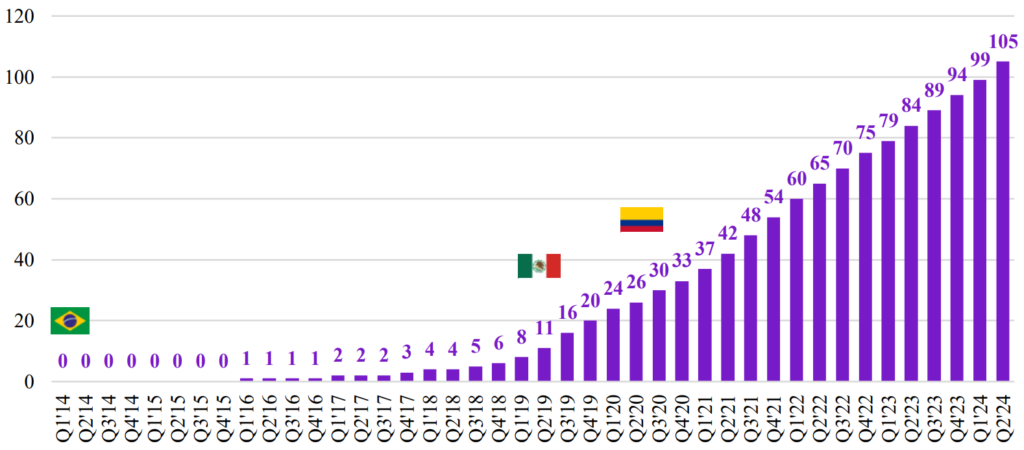

As of Q2 2024, the company reported adding 5.2 million new customers, with 20.8 million year over year (YoY). Its current customer base is made up of 104.5 million users, making it one of the largest and fastest growing digital banking services platforms in the world. Along with this, it is currently the fourth largest financial institution in Latin America in terms of total customers, and has also become the biggest credit provider, in terms of volume, in Brazil.

Its customer base is divided into 3 countries. Nu Holdings first launched its services in Brazil, then Mexico in 2019, and lastly Colombia in 2020, the largest countries in Central and South America. Brazil’s customer base currently represents 56% of the country’s adult population, at 95.5 million users, up 20% YoY and 2% from the previous quarter (Q1 2024). It also added approximately 1.2 million new users in Mexico this quarter, reaching 7.8 million in the Central American country. The fintech company believes this strong growth is motivated by increasing its deposit yields in the country, which has boosted momentum. The Colombian market also comes with good news, surpassing the 1 million user mark and currently hovering at around 1.3 million total (4).

Nu has also been exploring other markets as a way to diversify revenue. One such would be expanding into the mobile telephone business by striking a partnership with Claro, a telecommunications operator in Brazil. This project is in development stages with customers testing the service already. Additionally, NuViagens is already operational, which allows Nu users to purchase airline tickets and book hotel reservations directly from the app (5).

(4) “Earnings Release Q2’24”, investidores.nu, 2024

(5) John Coffey and Ramsey El-Assal, “3Q24 Fintech Preview for LatAm/Global Payment Processing”, Barclays, 2024

Income

Nu Holdings has been growing on all fronts. Lending ramped up, which expanded 92% YoY FX Neutral (FXN) to $4.6 billion, along with credit card receivables, which increased 39% YoY FXN to $14.3 billion, both sources acting as main drivers of overall growth.

Nu Holdings is expanding in all its products with strong numbers YoY, most notably Digital Accounts (30% reaching 77.5 million users), Consumer Credit Cards (13%, 41.8 million), Investments (78%, 18.5 million), Unsecured Lending (30%, 8.7 million), and Insurance Policies (73%, 1.9 million).

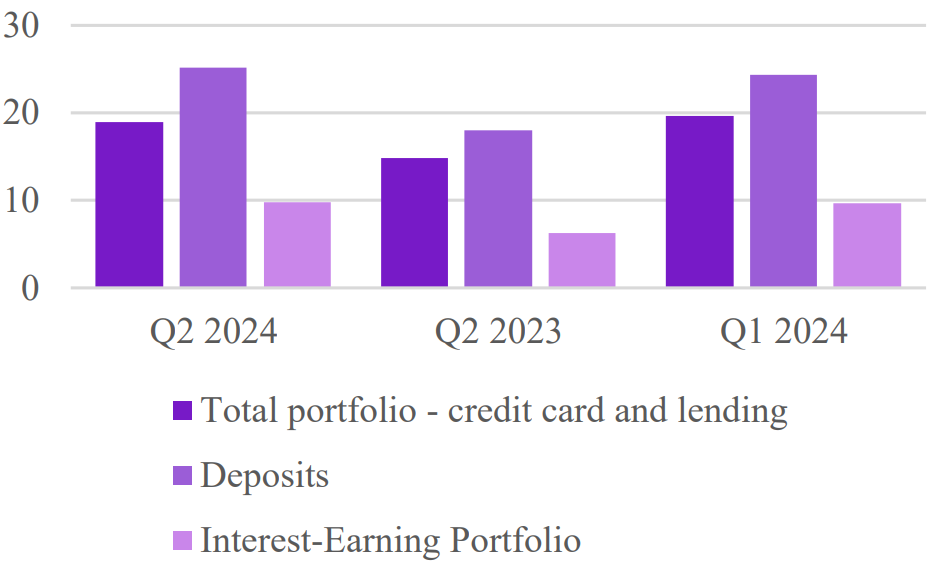

Net Interest Income (NII) grew 77% YoY in constant currency, hitting a new record of $1.7 billion in Q2 2024. This growth was fueled by the continued expansion of Nu’s credit card and lending portfolios, which collectively pushed both NII and the net interest margin (NIM) to record highs. In Q2 2024, Nu achieved a NIM of 19.8%, up 30 basis points quarter-over-quarter (QoQ) and 150 basis points YoY (6).

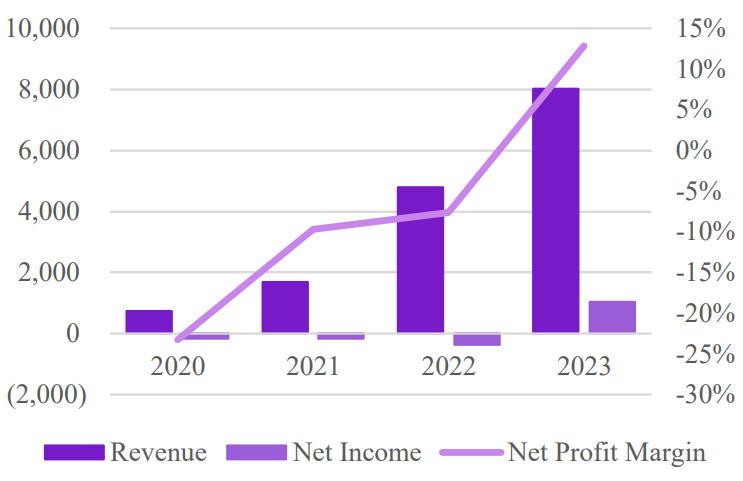

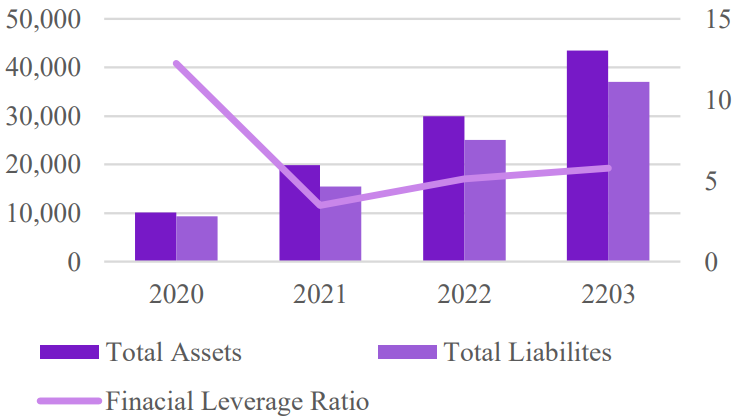

With these expanding operations, Nu has been able to hit profitability in 2023 for the first time. As seen in Figure 3, Revenue and Net Income have been following a growing trend, with Net Profit Margin reaching 12.84%, likely set to increase in the future. Looking at Figure 4, The fintech company has also been enlarging its balance sheet, taking on more liabilities and assets. Its Financial Leverage Ratio (Total Debt/ Total Equity) is starting to stabilize at 5-6, a common ratio for highly leveraged companies, such as banks. Overall, no figures seem to be a cause for concern, which is key for Nu Holdings to strengthen its credibility.

(6) “Earnings Release Q2’24”, investidores.nu, 2024

Expenses

Deposits increased 64% YoY, reaching $25.2 billion by the end of Q2 2024, as shown in Figure 5. The cost of deposit, however, has gone from 84% to 87% QoQ (with it being 80% for the 3 quarters before that), of the blended interbank rates of the three countries they operate in. This is justified by the growth in high yield deposits in Mexico.

Interest and Other Financial Expenses also rose, due to several factors: (i) higher interest expenses on retail deposits, driven by the growth in Nu’s retail deposit balance; (ii) increased interest expenses on financial bills, stemming from the issuance of financial letters and repurchase agreements; and (iii) rising interest and related expenses associated with new borrowings and financings, particularly linked to the expansion of operations in Mexico and Colombia. As previously mentioned, in Mexico, Nu would offer rates for its savings deposits higher than that of the overnight rate, which was intended to attract more users. The result was positive as $3.3 billion of deposits were poured in. With this, it has started to gradually trim the rate as the deposits can now fund Nu’s balances.

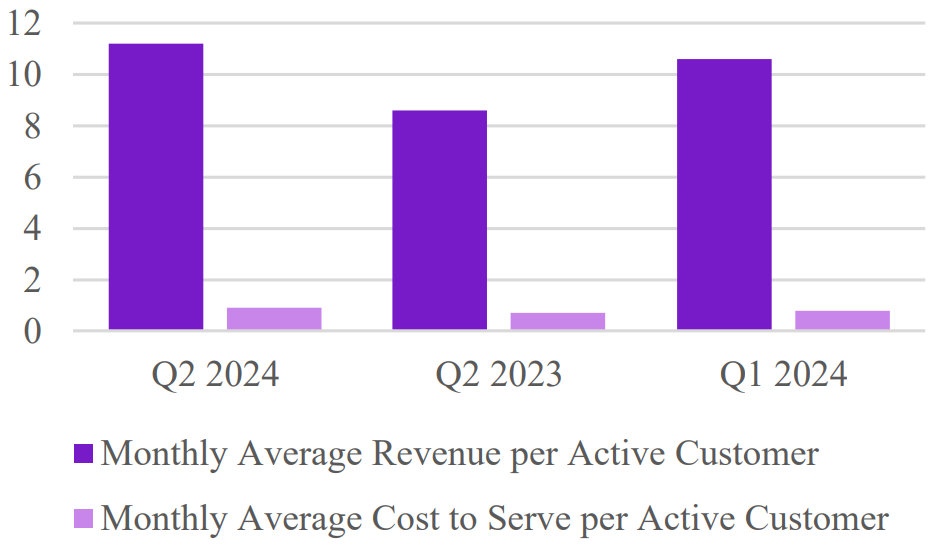

In spite of this, according to Figure 6, the South American company’s customer margins are very healthy. Additionally, Credit Loss Allowance Expenses continued to rise, largely due to the growth of the credit portfolio, as Nu front-loads provisions based on expected lifetime losses in line with the IFRS 9 methodology, similar to previous quarters.

Although a rocky rise in 15-90 NPLs from 2020, reaching a high of 5%, it has now lowered to 4.5% this quarter. 90+ NPLs, however, have not seen a decrease since 2020, with the latest quarter posting 7% compared to 6.3% from the quarter before. This jump is justified by the 15-90 NPL 90 bps increase, from the preceding quarter (7).

(7) “Earnings Release Q2’24”, investidores.nu, 2024

Relative Positioning

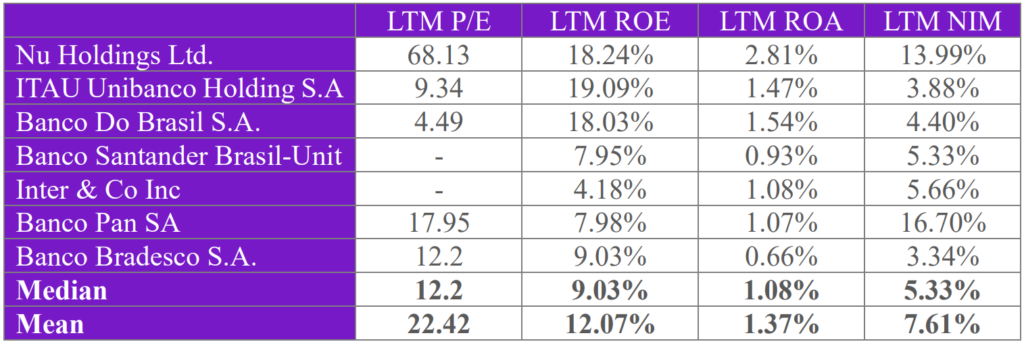

In its operating geography, Nu doesn’t have any similar competitors to lock horns with, but is rather mainly going up against established banking institutions, some of which are digitalizing their services. This can make it more challenging to perform an accurate comparable analysis, but regardless, there is still important information that we can unpack.

Nu currently fairs well against its competitors in terms of the listed KPIs (8). On all 4 ratios, the

company is comfortably superior to the median, average, and is leading on almost all fronts. The only concerning figure here is the very high P/E ratio, which makes the stock more expensive relative to earnings, compared to the others listed. This ratio is set to decrease dramatically on the next earnings call, set for November 13th, as its EPS will most certainly increase.

Nu has firmly established itself as one of the best-capitalized entities in the region. With a capital

requirement of $1.8 billion and an excess capital of $1.5 billion, its Capital Adequacy Ratios (CARs) consistently surpass regulatory minimums across all its operating countries, even before considering the additional $2.4 billion in excess liquidity held by Nu Holdings (9).

Nu is strategically positioned to unlock the full operational potential of its platform as it grows its customer base, introduces new features, and moves toward profitability in its emerging markets of Mexico and Colombia, which are currently in the investment phase.

(8) Bloomberg Terminal, Nu US Equity, Relative Valuation

(9) “Earnings Release Q2’24”, investidores.nu, 2024

SWOT Analysis

Strengths

- Experienced leader that knows his market in and out. Expert on the industry, the geography, and on launching a product;

- Biggest Shareholder is Sequoia Capital Partners, which can give the company a significant helping hand in terms of advice on growth and contacts;

- Dominant force in Brazil and expanding to other untapped South American countries as they gradually digitalize;

- App and services interface are user friendly.

Weaknesses

- Applied but haven’t yet received a banking license in Mexico, which limits the products and benefits they can offer in the area (10);

- Fully digital, which could temporarily halt customers from using the app when servers go down. This has happened once already, with the problem being fixed overnight but Nu’s stock still dipping the day after (11);

- Lack of a strong balance sheet compared to its big bank competitors.

Opportunities

- Fintech company that has growth margins similar to that of a tech company;

- Looking to expand product offering outside of the financial services, e.g. telecom, traveling;

- Beneficial collaborations with other companies for different services, e.g. Pix for instant payments,

Claro for telecom infrastructure and data services.

Threats

- Unstable jurisdictions have the possibility of being the root cause of many problems. Expanding Nu’s services to new areas in proximity would aggravate this issue;

- Changing regulatory landscape, which also correlates with unstable jurisdictions;

- Strong relative currency fluctuations are a regular characteristic of the areas in which Nu operates and can be a byproduct of the first threat mentioned;

- Vulnerable to cyber attacks.

(10) John Coffey and Ramsey El-Assal, “3Q24 Fintech Preview for LatAm/Global Payment Processing”, Barclays, 2024

(11) John Coffey and Ramsey El-Assal, “3Q24 Fintech Preview for LatAm/Global Payment Processing”, Barclays, 2024

DCF Model

A Discounted Cash Flow model was built in order to factor in our assumptions and find a price range for Nu’s share. We hold an optimistic view on the company and believe that it will meet and perhaps slightly surpass the upcoming forecasted earnings. Its South American customer base will likely keep growing in the future and we hope to see it expand to other countries, such as Argentina, Peru, and Venezuela. In addition, if Nu were to eventually break into new product markets, it would help grow and stabilize their revenues in times of economic downturns, especially with the retail telephone industry. This would also help counteract losses caused by a rise in NPLs, a concern that will hopefully be mitigated in the future. With the company still being in the growth stage, we believe Capex will continue growing, with D&A and Capex starting to converge in the 2030s.

With all this in mind, we would give Nu Holdings Ltd. A price range of $15.76-$17.59 per share.

Author: Gustave Lecomte