Introduction to IPOs

IPO stands for Initial Public Offering meaning that shares of a private company are made available to the public for the first time through a stock issuance. In order to have an IPO the company has to satisfy some requirements by the Securities and Exchange Commissions (SEC).

Going public represents a big opportunity for companies as they might be able to raise a lot of equity capital from public investors. Other than the capital perks which might allow the company to grow and expand, listed companies increase transparency and might help obtain better terms when trying to borrow funds.

Historically, the first modern IPO is considered to be when the Dutch East India Company offered his shares to the public in 1602. Since the 2008 crisis there’s been a decrease in IPOs but recently it seems that the market has experienced a turn for the better, in 2024 Borsa Italiana had 18 IPOs.

The IPO process consists of two parts, the fist is the pre-marketing phase of the offerings, when the company will advertise its intentions by underwriting private bids or make a public statement, furthermore the firm is involved in every aspect of the IPO due diligence, documents preparation, filing and marketing. The second step is the IPO itself.

Going public has advantages and disadvantages: one advantage is the possibility to access capital from a big pool of investors. A disadvantage is the expensiveness of IPO and the costs of maintaining a public company.

Hyundai Motor Co.

History of Hyundai Motor Co.

Hyundai Motor Co. is a multinational company founded 1967 in South Korea. Hyundai means “modernity” in Korean and their mission statement is constant improvement and put people at the centre. They want to improve people’s lives and guarantee a future of progress and sustainability. Their first car was the Hyundai Pony Coupé launched in 1975. The growth was exponential until the 2000s when Hyundai became a global brand. Since 2010 their focus is on sustainability: they aim to be carbon neutral in 2045 and all cars sold in Europe to be fully electric within 2035.

Position in vehicle market

In 2023, Hyundai kept a market share of 3.1% on the italian market, with 48.890 vehicles sold. They are leaders in the EV market: more than 1 Hyundai out of 4 is full or plug-in hybrid. Their electrified volume is 28% against the 18% of the market. According to “Best Global Brands 2024” by Interbrand, Hyundai reached $23 Billion in the chart, positioning 30th. As today, Hyundai offers 22 vehicles model spacing from city cars to Station Wagon to SUVs. Their concern in satisfying every kind of demand is reflected in their products offer. Hyundai’s biggest competitors in the EV and hybrid market are Toyota and Honda which compete in terms of quality, fuel efficiency and price.

Profitability indicators

Hyundai Motor Co. is listed in various stock exchange, in the Korea Exchange (KRX) the company is listed with the code 005380: as of October 18th the closing price was KRW 234.500, with a change of -0.42%.

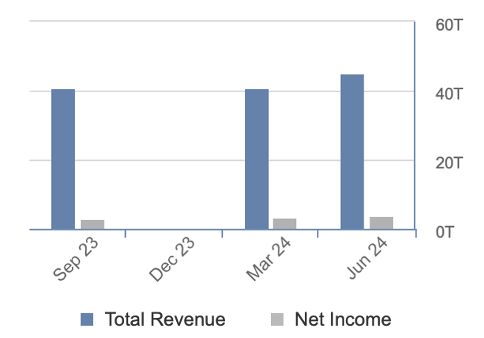

Hyundai Motor Company reported earnings results for the second quarter ended June 30, 2024. In the second quarter, the company reported sales of KRW 37,916,000 million compared to KRW 36,485,000 million a year ago. Net income was KRW 3,970,000 million compared to KRW 3,235,000 million a year ago.

Regarding income statement:

Using TTM measures (Trailing Twelve Months):

- Gross Margin: 20.78%

- Operating Margin: 8.95%

- Net Profit Margin: 7.49%

- ROI: 4.97%

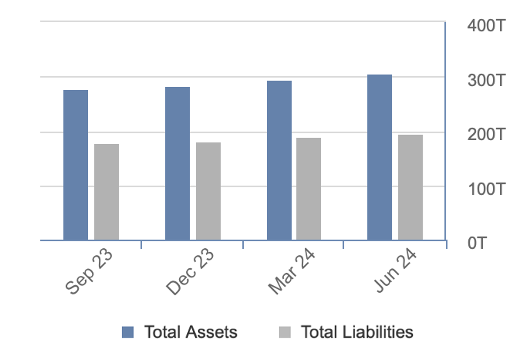

Regarding balance sheet:

Using MRQ measures (Most Recent Quarter):

- Quick Ratio: 0.47

- Current Ratio: 0.82

- Total Debt to Equity: 139.92%

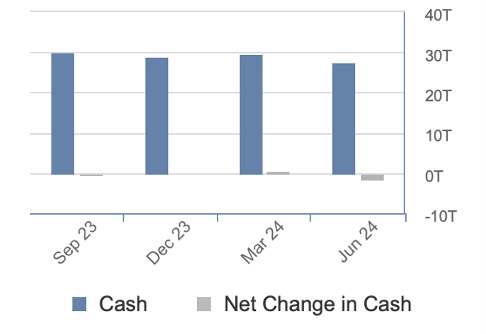

Regarding cashflow statement:

Using TTM:

- Cashflow/Share: -5,064.3

- Revenue/Share: 745,666.68

- Operating Cash Flow: 2.97%

Establishment of Hyundai in India and impact on Indian market

Hyundai Motor Co. is maitaining full ownership of a subsidiary in India called Hyundai Motor India Limited (HMIL).

It was established in 1996 and the plant in Chennai is equipped for producing a full range of vehicles and it forms a great part of Hyundai’s export hub to Africa, the Middle East and countries like Bangladesh and Nepal.

The IPO planned might be able to raise over ₹26,000. This comes at a time when the company has cemented itself as the second largest carmaker in India after Maruti Suzuki with a market share of 15% in FY23.

Due to the rising competition with national brands such as Tata Motors and Mahindra&Mahindra, HMIL needs to strengthen their operations performances, brand equity, financial performances and competitiveness: the IPO might be the response to the need of firming up its position as one of the most admired and successful automotive firms in India.

Hyundai Motor India’s IPO opened on Tuesday, October 15th, and closed on Thursday, October 17th. The company debuted on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on October 22nd.

The IPO involved the sale of 142 million shares, offered within a price band of $22.35 to $23.50 per share (₹1,878 -₹1,975), thus projecting total proceeds to amount to 3.3 billion USD. Crucially, this was an Offer for Sale (OFS), meaning that Hyundai Motor India did not issue new shares to raise capital, but rather to allow the parent company to monetize part of its existing holding. Hyundai Motor Company, after selling 17.5% of its stake in the Indian subsidiary, ended up retaining 82.5% ownership post-IPO.

The price band brings the company’s market capitalization to an approximate of 19 billion USD, with a total of 812 million shares outstanding. This valuation places Hyundai as a significant player in India’s automotive landscape, second only to Maruti Suzuki, which dominates the market.

Regarding the offering subscription, it was overall success, with total offer subscribed 2.37 times. This means that for every share available, investors placed bids for more than double the quantity, totaling around 7.9 billion USD in demand against an offer of 3.3 billion USD. However, the enthusiasm was not equally distributed across all categories of investors.

Qualified Institutional Buyers (QIBs) were the most aggressive participants, subscribing to 6.97 times the shares allocated to them, with major players like Fidelity Funds and BlackRock leading the bidding process. This heavy demand from institutional investors remarks their confidence in Hyundai’s long-term prospects in India, particularly as the company pushes to increase production capacity and to further invest into the electric vehicle (EV) segment.

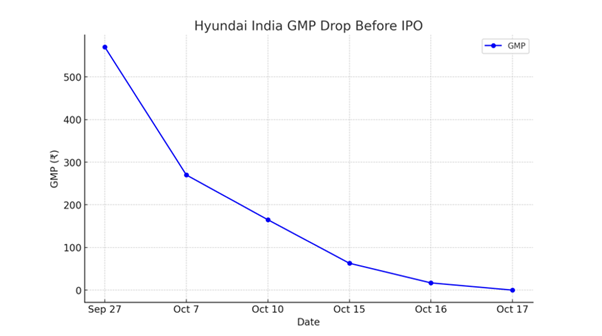

In contrast, Non-Institutional Investors (NIIs), like high-net-worth individuals, demonstrated significantly less interest, subscribing to only 60% of their allotted shares. Nonetheless, Retail Investors (RIIs) are the ones who caught the public’s eye the most with their dull response, subscribing to only 44% of their allotment. The reason behind this weak enthusiasm is to be found in Hyundai Motor Indias’s recent performance in the grey market, which is an unregulated marketplace where stocks are sold before being listed.

In fact, the company’s Grey Market Premium (GMP), which is the difference between the IPO issue price and the price at which IPO shares are traded in the grey market, dropped from $7 per share to just $0.20 in the days leading up to the IPO. The GMP is often used by investors as an indicator of how a stock might perform post-listing, and its sharp decline forecasted a subdued participation from non-institutional investors due to low expectations on short-term gain.

AI generated – The graph shows the drop in Hyundai India’s grey market premium (GMP) leading up to its IPO, with a sharp decline from ₹570 on September 27 to below ₹0 by October 17, highlighting key figures such as the decline to ₹63 on October 15 (opening day of the IPO). Source: Fortune India | Investor Gain

A strong support came from anchor investors, namely those who are invited to participate in an initial public offering (IPO) before it opens to the general public. Their participation was crucial to instill confidence in the market and to set the stage for IPO’s overall success.

Anchor investors, including institutional giants such as JP Morgan and HDFC Mutual Fund, the leading mutual fund investment company in India, had already secured 42.42 million shares before the IPO opened, amounting to a total investment of 1 billion USD.

Hyundai Motor India debuted on stock exchanges on October 2nd and its performance fell short of initial hopes: share price indeed declined around 7% on the first day after a bland debut on its primary stock exchange (the NSE). The stock opened at the discounted price of ₹1,934 ($23.25) , representing a discount of approximately 1.3% from the IPO price of ₹1,960 ($23.50). The closing price for the day of October 22nd was ₹1,820.40 ($21.88) – a 7.1% drop from the IPO price. As of October 28th, Hyundai Motor India reflects a 2% decline from its previous closing at ₹1,843, and 6.51% decline since its debut.

Hyundai Motor India Ltd (HYUNDAI.NSE) stock price performance over the last 5 days. Source: Google Finance.

The reasons are again very clear: the offer appears more appealing to investors with long-term plans, while those looking for a short-term gain are hesitant and waiting for the perfect time to buy.

“For allotted investors, we continue to recommend ‘Hold for Long-Term’ rating despite knowing the short-term volatility in the sector demand and supply scenario. For fresh new investors wishing to buy post listing, we advise to wait and watch for the price to settle and revisit the space with a better discounted opportunity, the best range of a Hyundai can be a 10-15% discount to its issue price. For the long term Hyundai’s growth story remains intact in line with India’s growth story”

Prashanth Tapse, Senior VP (Research), Mehta Equities

All in all, Hyundai’s IPO was a clear success in terms of total demand, and the enthusiasm driven by institutional investors shows confidence in the company’s long-term strategic play.

Hyundai is already responsible for 14.6% of the total sales in the domestic passenger vehicle segments, but QIBs’ oversubscription reflects the possibility of an even stronger future positioning, taking into consideration that the company is only second to Maruti Suzuki. As a matter of fact, Hyundai’s plans to expand even further its EV portfolio come with perfect timing as the Indian government is pushing to increased adoption of electric vehicles.

Authors: Giorgia Mentasti and Silvia De Santis