Secondary Buyouts

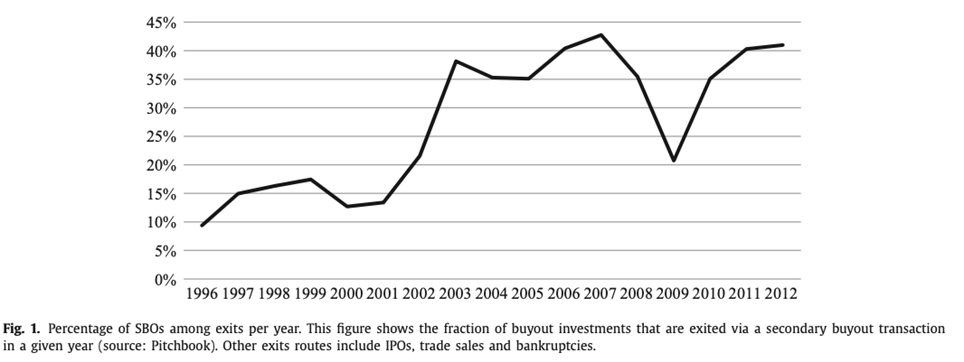

It is worth analyzing one of the most common and controversial way in which a PE firm is able to exit from an investment that has been made during the life cycle of one of its Private Equity fund. Secondary buyout, also known as SBO, is a strategy that is increasingly used starting from 1996; in this particular exit strategy the PE firm sells a portfolio company to another PE firm. According to On Secondary Buyout 1, SBO exit strategy sharply increased starting from roughly 9% in 1996 to more than 40% in 2012.

To present and explain why this type of exit is frequently seen as a possible manifestation of agency conflicts and opportunistic behaviors between GPs (General Partners) and LPs (Limited Partners), we can start from two situations that the Private Equity market is facing in 2024; the first one is related to the Investment Stage ( 2nd Stage) and the second one to the Exit stage (4th Stage). In 2023, as reported by Statista.com, the record value of Dry Powder of PE companies is equal to $3.9TN, higher than the $3.5TN registered in 2022.

The concern regarding the 4th Stage has been highlighted by Financial Times in its article “ Dealmaking slowndown leaves private equity with record unsold assets”, in the current scenario is very difficult to find a whatever kind of buyer side that is able to lighten the $3TN unsold companies held in PE firm’s portfolio (Numbers revealed by Bain&Co’s annual private equity report).

Given these circumstances, a situation arises that appears to be a “perfect marriage” between a PE firm struggling to disinvest and another PE firm urgently seeking a target company. This scenario becomes even more concerning when considering late SBOs, which occur late in the buying fund’s investment period. Such transactions are often driven by the buying fund’s desire to ensure management fees on the largest share of raised capital. This brings us to a critical question: Is this “perfect marriage” in the best interest of the PE firms only, or does it also benefit the investors?

If the business of PE is to transform companies and make them run efficiently, How can a Private equity firm add value to a company that has already been restructured by another Private equity Firm? This skepticism was also addressed by The Economists in 2010 claiming: “ Once a business has been spruced up by one owner, there should be less value to be created by the next”. A possible argumentation against this skepticism is that not all the PE firms have the same characteristic recalling the concept of COMPLEMENTARY SKILLS. As illustrated by Francois Degeorge, Jens Martin and Ludovic Phalippou in “On secondary buyout academic”, there could be situations in which a PE firm is able to add value to the job made by another private equity firm, highlighting the three main complementary features that this type of firm may have:

- Some firms focus on increasing margin, while other firms concentrate in boosting revenues.

- Firms where the general partner is an ex-consultant tend to increase the internal value, whereas those led by former banker outperform in M&A transactions (Acharya, V., Gottschalg, o., Hahn, M., Kehoe,C., 2010. Corporate governance and value creation: evidence from private equity.)

- Regional PE firm has more skills and competences in boosting the home market of the company, whereas Global PE firm are better equipped to help companies expand and succeed on a multinational level.

These different characteristics demonstrate that the skepticism and all the theories against the Secondary Buyout (SBO) exit route are probably too pessimistic and naïve. This raises significant questions about identifying the characteristics an SBO must possess to add value for both General Partners (GPs) and Limited Partners (LPs).

1 Degeorge, F., Martin, J., & Phalippou, L. (2016). On secondary buyouts. Journal of Financial Economics, 120(1), 124–145.

Author: Nicolò Pesaturo