Analysis of the Global Automotive Industry and Market

INTRODUCTION

The global automotive industry is undergoing significant transformations driven by technological advancements, shifting consumer preferences, and evolving regulatory landscapes. In 2024, the sector faces both challenges and opportunities as it navigates these changes.

INDUSTRY OVERVIEW

Global vehicle sales are projected to reach approximately 94.7 million units in 2024, marking a 3.3% growth compared to the previous year. This growth is influenced by factors such as interest rates and economic conditions. The transition towards electric vehicles (EVs) continues to accelerate, with manufacturers investing heavily in electrification and digitalisation to meet consumer demand and regulatory requirements.

CURRENT STATE OF THE GLOBAL AUTOMOTIVE INDUSTRY

Regional Highlights:

- China: maintains its position as the world’s largest automotive market, contributing over 30% of global vehicle sales.

- Europe: focused on EV adoption, driven by stricter emissions regulations.

- USA: a slower transition to EVs compared to Europe and China but still showing growth in hybrid and electric models.

Electrification:

- EV sales surged to 14 million units globally in 2023, representing 18% of total vehicle sales. By 2030, EVs are expected to account for nearly 50% of new car sales

- Battery technology innovations, like solid-state batteries, promise to enhance vehicle range and reduce charging times

Revenue Forecast:

Global automotive revenue is estimated to grow at a CAGR of 4.3%, reaching approximately $4 trillion by 2030.

Key Trends in the Industry:

- Electrification: The transition to electric vehicles (EVs) continues to accelerate. Battery electric vehicles (BEVs) are anticipated to account for 48% of total car sales by 2030. However, challenges such as limited range and charging infrastructure persist.

- Autonomous Driving: Advancements in autonomous vehicle technologies are reshaping mobility. Companies are investing in self-driving capabilities, aiming to enhance safety and efficiency.

- Connectivity: Vehicles are increasingly becoming connected platforms, offering enhanced user experiences and data-driven services. The integration of 5G technology is expected to boost the share of connected cars.

- Shared Mobility: Urbanization and changing consumer behaviors are driving the growth of shared mobility solutions, including car-sharing and ride-hailing services. This trend is influencing traditional car ownership models.

Emerging Opportunities in the Automotive Sector:

The evolving landscape presents investment opportunities, particularly in companies at the forefront of innovation. Chinese automotive firms have gained prominence due to their advancements in electric mobility and technology integration.

Opportunities in the Chinese Automotive Market:

China has solidified its position as the world’s largest automotive market, both in production and sales. Chinese automakers are expanding their global footprint through strategic investments and partnerships. Notable developments include:

- Xiaomi’s Entry into EVs: In 2024, Xiaomi launched its first electric vehicle, the SU7 sedan, aiming to become one of the top five automakers globally. The company has established a state-of-the-art factory in Beijing, capable of producing an SU7 every 76 seconds at full capacity.

- International Collaborations: Chinese firms are engaging in joint ventures with global manufacturers. For instance, Volkswagen invested $700 million in XPeng to co-develop EV models for the Chinese market, with plans to launch in 2026.

These initiatives highlight China’s commitment to innovation and its potential as a lucrative market for investment in the automotive sector.

EMERGING MARKETS

- India: EV market set to grow at a CAGR of 49% by 2030, with a strong push for twowheel EVs.

- Southeast Asia: Nations like Thailand and Indonesia are becoming key hubs for EV manufacturing.

- Africa: Early-stage automotive market with increasing investment from China and Europe.

KEY RISKS AND CHALLENGES

- Economic Uncertainty: Inflation and fluctuating raw material costs impact vehicle pricing.

- Supply Chain Bottlenecks: Persistent semiconductor shortages and dependency on key materials.

- Regulatory Compliance: Stricter emissions standards increase production costs.

KEY PLAYERS AND FINANCIAL OVERVIEW:

- Tesla Inc. (TSLA): A pioneer in the EV market, Tesla’s stock is currently trading at $355.23 USD. The company reported a net profit of €2.2 billion in the third quarter of 2024, a 17% increase compared to the same period the previous year. Analysts predict that Tesla will deliver approximately 1.79 million vehicles in 2024, slightly below the company’s target of 2 million units.

- General Motors Company (GM): GM’s stock is trading at $53.25 USD. The company is undergoing restructuring efforts in China due to intense competition, leading to over $5 billion in impairment charges and write-downs. Despite these challenges, GM has provided optimistic forecasts for 2024, indicating strong consumer demand and stable pricing.

- Ford Motor Co. (F): Ford’s stock is currently at $10.65 USD. The company is investing in EV development and has experienced challenges in the Chinese market. Ford has also provided positive forecasts for 2024, citing sustained consumer demand and better-than-expected pricing.

- BYD Company: As a leading Chinese EV manufacturer, BYD reported a 42.04% increase in revenue in 2023, reaching approximately ¥602.3 billion RMB. The company is expanding its global presence and has become a significant competitor in the EV market. BYD aims to surpass 4 million sales in 2024.

- NIO Inc. (NIO): A Chinese EV startup, NIO’s stock is trading at $4.54 USD. The company focuses on premium electric vehicles and is expanding its market reach. NIO delivered 20,575 vehicles in November 2024, a slight decline compared to October.

- Li Auto Inc. (LI): Specializing in electric SUVs, Li Auto’s stock stands at $22.375 USD. The company is investing in new model development and technological innovation. Li Auto delivered 48,740 vehicles in November 2024, a slight decline compared to October.

- XPeng Inc. (XPEV): XPeng focuses on smart EVs, with its stock at $12.7 USD. The company is enhancing its autonomous driving capabilities and expanding its product lineup. XPeng achieved a record with 30,895 deliveries in November 2024.

CHALLENGES AND STRATEGIC RESPONSES:

The Chinese automotive market is highly competitive, with domestic companies like BYD experiencing significant growth, while foreign automakers such as GM and Tesla face challenges. GM has incurred substantial charges due to market difficulties in China, and Tesla’s sales have declined amid rising competition from local manufacturers.

In response, traditional automakers are forming strategic partnerships with Chinese companies to leverage EV technologies and platforms. For instance, Volkswagen’s investment in XPeng aims to develop new electric models for the Chinese market.

FOCUS ON STELLANTIS

Stellantis N.V., a prominent player in the global automotive market, is navigating a period of transition. In December 2024, CEO Carlos Tavares resigned amid differing views with major shareholders and challenges in the North American market. John Elkann is leading an interim executive committee while the search for a new CEO is underway, with an appointment expected by mid-2025.

Stellantis is also addressing issues related to inventory management and pricing strategies, particularly in the U.S. market, to enhance competitiveness and profitability.

DATA AND PROJECTIONS

Global EV Sales (2018-2030):

EV sales are forecasted to grow exponentially:

- 2023: 14 million units 2025: 30 million units

- 2030: 50 million units

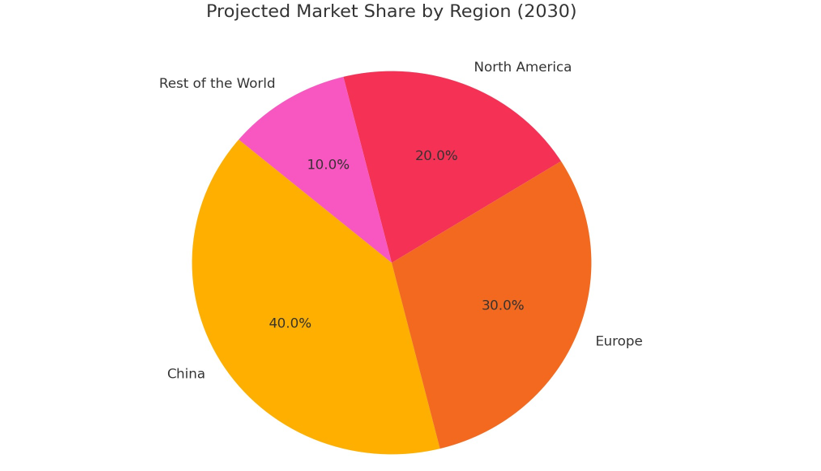

Market Share by Region (2030):

• China: 40%

• Europe: 30%

• North America: 20%

• Rest of the World: 10%

Investment Trends:

- Venture capital funding in EV startups reached $8 billion in 2023, highlighting investor confidence.

CONCLUSION

The automotive industry in 2024 is characterised by rapid technological advancements and shifting market dynamics. Companies that embrace innovation, foster strategic partnerships, and adapt to evolving consumer preferences are well-positioned to capitalise on emerging opportunities. Monitoring developments in key markets, such as China and Europe, is crucial for stakeholders aiming to navigate this complex landscape effectively.

Author: Matteo Gatti