NextEra Energy (NEE) - Investment Report

OVERVIEW

NextEra Energy, Inc. (NYSE: NEE) is an American energy company and a global leader in renewable energy production, founded in 1925 as Florida Power & Light (FPL) and headquartered in Juno Beach, Florida. Initially serving as a traditional electric utility for Florida, the company has evolved into the world’s largest producer of wind and solar energy by leveraging advancements in clean energy technologies and strategically responding to the global energy transition. Its operations are divided into two primary subsidiaries: Florida Power & Light (FPL), which serves over 11 million residents in Florida, and NextEra Energy Resources (NEER), focused on developing renewable energy solutions across North America.

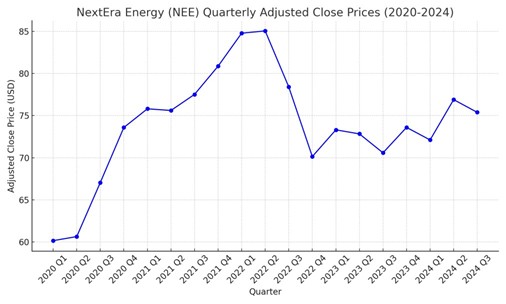

NextEra Energy has demonstrated robust growth by capitalizing on the increasing demand for clean energy and grid modernization. The company’s diversified portfolio includes wind farms, solar arrays, and battery storage facilities, enabling it to provide reliable and sustainable power while reducing carbon emissions. In 2009, the company rebranded from FPL Group to NextEra Energy, Inc., marking its commitment to clean energy leadership. Since then, its market capitalization has surged, currently standing at approximately $145 billion, with its share price delivering steady long-term returns.

The firm’s leadership, under CEO John Ketchum, has been instrumental in driving innovation and sustainable growth. Ketchum, with a proven track record in energy and infrastructure investment, has overseen large-scale projects that have positioned NextEra Energy as a pioneer in renewable energy. The company employs over 15,000 people, maintaining operational excellence and strong productivity.

NextEra Energy’s forward-looking approach, backed by multi-billion-dollar investments in wind, solar, and energy storage, has allowed it to solidify its market position while fostering environmental stewardship. With a strong pipeline of renewable projects and continued expansion into emerging energy technologies, NextEra remains at the forefront of the clean energy revolution, aligning profitability with sustainability.

GEOGRAPHY AND PRODUCTS

NextEra Energy operates as a diversified clean energy leader with a significant presence across North America, particularly in the United States. The company’s operations are primarily divided into two core subsidiaries:

1.Florida Power & Light (FPL):

FPL is the largest electric utility in Florida, serving over 11 million residents. FPL is responsible for delivering low-cost, reliable electricity across the state and remains a cornerstone of NextEra’s operations.

2.NextEra Energy Resources (NEER):

NEER leads the development of clean energy infrastructure, with a focus on wind, solar, and advanced battery storage. It has built renewable energy projects across key regions in the U.S., Canada, and Mexico, establishing itself as the world’s largest generator of wind and solar energy.

The company’s expansion strategy focuses on renewable energy adoption across diverse regions, particularly in areas with supportive regulatory policies and strong energy demand. NextEra Energy’s clean energy projects are strategically located in high-wind regions like Texas, solar-rich states like California and Florida, and emerging energy markets such as Mexico.

NextEra Energy continues to explore emerging opportunities in energy grid modernization and battery storage systems to further strengthen its product offerings. In recent years, the company has also expanded its reach into Hawaii through large-scale renewable energy projects, aligning with the state’s clean energy goals.

INCOME

NextEra Energy has experienced substantial growth across its key revenue and profit drivers, underpinned by its leading role in renewable energy, infrastructure modernization, and expanding customer base.

REVENUE EXPANSION

NextEra Energy’s total revenues have been on a consistent upward trend, driven by growth in its two primary subsidiaries:

- Florida Power & Light (FPL): Continued customer base expansion and grid modernization.

- NextEra Energy Resources (NEER): Accelerated deployment of clean energy assets, including wind, solar, and advanced battery storage projects.

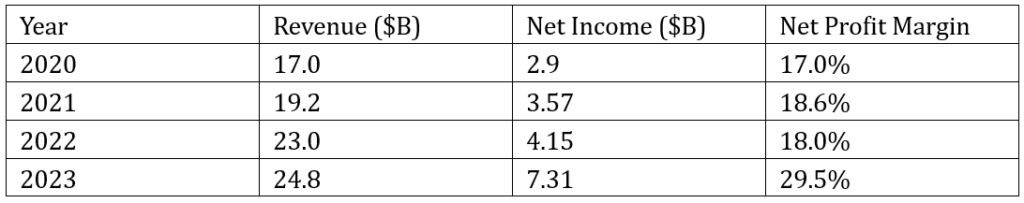

2020: Revenue totaled $17.1 billion, reflecting stability during global economic disruptions.

2021: Revenue grew 22.5% YoY to $21.0 billion, driven by strong renewable energy capacity growth. 2022: Total revenues surged to $28.1 billion (+33.8% YoY), supported by large-scale solar and wind projects across North America.

2023: Revenue reached $26.2 billion, maintaining robust performance despite economic headwinds.

GROWTH ACROSS SEGMENTS

FPL:

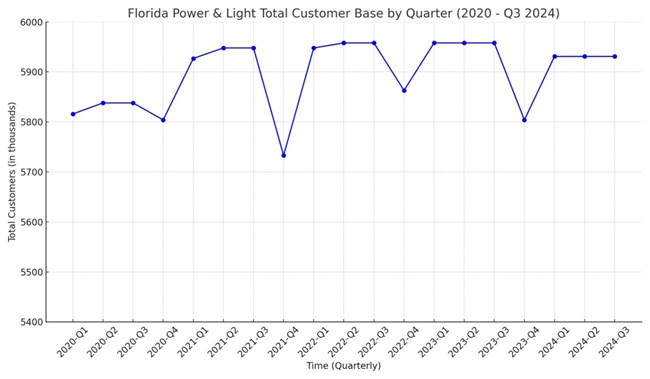

- FPL remains a cornerstone of NextEra’s operations, serving 5.9 million customers and generating 70% of the company’s operating earnings in 2023.

- The utility’s investments in grid resilience and clean energy have led to significant cost savings, ensuring reliable and low-cost electricity for over 12 million residents in Florida.

NextEra Energy Resources (NEER):

- NEER has built more than 33,276 MW of renewable energy capacity, making it the largest producer of wind and solar power globally.

- Revenue from renewable energy projects increased substantially, fueled by long-term contracts and energy trading gains.

NET INCOME AND MARGINS

Net Income Growth:

- Net income increased from $2.9 billion in 2020 to $6.95 billion in 2023, reflecting 24% compound annual growth.

- This strong performance is attributed to higher operating efficiencies, cost control measures, and scaling of profitable renewable energy projects.

Net Profit Margin:

- NextEra achieved a net profit margin of 5% in 2023, highlighting its ability to generate highmargin returns while pursuing aggressive clean energy expansion.

FINANCIAL HEALTH AND LEVERAGE

NextEra has strategically balanced its capital structure, enabling it to fund large-scale projects while maintaining solid financial health. The company’s Debt-to-Equity Ratio stabilized at 1.39x, a reasonable figure for a capital-intensive industry.

EXPENSES

Operating expenses at NextEra Energy increased 7.5% year-over-year (YoY), reaching $17.8 billion by the end of Q3 2023, driven by rising costs associated with capital-intensive projects, inflationary pressures, and investments in clean energy infrastructure. The increase in costs is attributed to the following factors:

1. Higher Interest Expenses

- Rising interest expenses stemmed from new debt issuances to fund renewable energy expansions, grid modernization, and large-scale solar and wind projects.

- While financing rates have increased due to a higher interest rate environment, NextEra Energy continues to lock in long-term, lower-rate debt instruments to mitigate cost pressures.

2. Increased Operating and Maintenance (O&M) Costs

- Operating costs rose 2% YoY, primarily driven by the development and deployment of battery storage systems, which are critical for integrating renewable energy into the grid.

- Expenses also grew due to ongoing maintenance and upgrades to Florida Power & Light’s (FPL) infrastructure, ensuring grid resilience and reliable service for 11 million residents.

3. Capital Expenditures (CapEx)

- NextEra’s CapEx reached $18.1 billion for the trailing twelve months, reflecting significant investments in:

- Expanding wind and solar generation capacity under NextEra Energy Resources (NEER).

- Modernizing FPL’s transmission and distribution networks.

- Deploying advanced grid-scale battery storage solutions to meet growing electricity demand and stabilize supply.

4. Fuel and Purchase Power Costs

- Fuel costs increased 1% YoY, primarily due to volatility in natural gas prices and higher demand during peak periods.

- Despite this, NextEra has successfully offset fuel cost impacts through its increased reliance on solar and wind energy, which accounted for a growing share of its energy mix.

RELATIVE POSITIONING

1. Market Leadership and Competitive Edge

NextEra Energy (NEE) stands out as the world’s largest producer of renewable energy from wind and solar sources, surpassing its competitors in clean energy production capacity. With a renewable generation portfolio exceeding 33,276 MW, NextEra has scaled its operations faster than peers like Duke Energy (DUK), Southern Company (SO), and American Electric Power (AEP).

2. Renewable Energy Focus

While most competitors maintain diversified portfolios with traditional energy sources, NextEra Energy Resources (NEER) prioritizes clean energy innovation:

- Wind and Solar: Leading large-scale deployment across the U.S. and Canada.

- Battery Storage: Investing heavily in grid-scale storage solutions, providing a competitive advantage as energy markets shift toward sustainability.

3. Financial Performance

Compared to key competitors in the regulated utility sector:

- NextEra Energy: Market cap of $147.9 billion with a trailing PE ratio of 21.34.

- Duke Energy: Market cap of $83.1 billion.

- Southern Company: Market cap of $90.8 billion.

4. Geographic Reach and Scale

NextEra’s operations through Florida Power & Light (FPL) position it as the dominant regulated utility provider in Florida, serving 5.9 million accounts and over 12 million residents. Comparatively, utilities like Southern Company operate within smaller regional markets.

5. Long-Term Growth Strategy

While competitors like Dominion Energy and Duke Energy focus on gradual clean energy transitions, NextEra Energy has maintained an aggressive investment strategy to expand renewable capacity, modernize grid infrastructure, and secure long-term contracts.

SWOT ANALYSIS

Strengths:

- Market leader in clean energy solutions.

- Strong financial performance with consistent revenue and profit growth.

- Strategic investments in renewable energy projects. – Expanding customer base.

Weaknesses:

- High capital expenditure requirements.

- Exposure to regulatory and policy risks.

Opportunities:

- Increasing demand for renewable energy globally.

- Expansion into new markets and advanced technologies.

- Partnerships with governments and private sectors for clean energy initiatives.

Threats:

- Rising interest rates could impact financing for new projects.

- Intense competition from other renewable energy providers.

- Economic downturns affecting electricity demand.

CONCLUSION

NextEra Energy represents a compelling investment opportunity in the clean energy sector. Its market leadership, financial strength, and focus on renewables position it to benefit from global trends favoring clean energy. The company’s ability to deliver consistent growth while expanding its customer base makes it an attractive choice for long-term investors.

Authors: Diego Andretta