An Overview of Boeing:

The Boeing Company is a U.S. based global aerospace company which develops, manufactures and services commercial airplanes, defense products and space systems.

Its customers operate in more than 150 countries. Nowadays, there are more than 10,000 Boeing commercial jetliners in service, as the division of Boeing Commercial Airlines aims at providing airplanes with superior design, efficiency and value. Competition is very intense in the airplanes industry, but we will focus on Boeing’s main and most famous competitor, Airbus, as well as giving an insight into the company’s main KPIs.

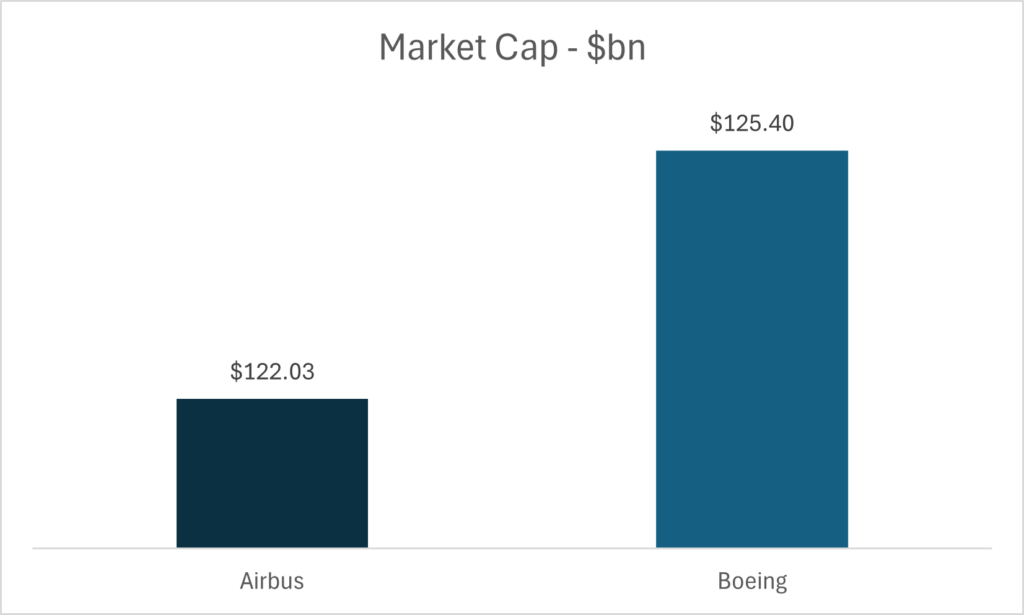

Boeing, quoted as BA in NYSE, closed with a price per share of $202.96 as of March 7th 2024. Currently, Boeing has a market cap of $122.03 Billion with a change of -22.62% with respect to 2023. Boeing’s EBITDA for 2023 was $1.088 billion Boeing’s 2023 annual EPS was $ -3.67.

KPIs:

The Quick Ratio (or Acid Test) measures the ability of a company to meet its short-term obligations by converting quick assets (current assets minus inventory) into cash. This ratio measures the financial strength of a business and it’s useful for customers.

Boeing’s quick ratio for 2023 had been 0.31, a relatively low number as companies usually aim for a ratio greater than one. An example that explains this value is the inability of Boeing to deliver airplanes in time to Ryanair, which will have available only 40 airplanes out of the 50 promised by the U.S. company. Indeed, the CEO of the Irish flight company claims that they are discussing compensation for this delay, which will definitely impact Boeing’s financial performance even more.

The Accounts Payable Turnover measures whether a company pays its suppliers on time and how fast, which is crucial for creditors. Boeing’s measure was 6.32, higher than the other companies in the same industry, this is a positive sign as it means it pays its suppliers on time. This indicator is fundamental for the sustainability of Boeing’s supply chain as it is extremely complex and large.

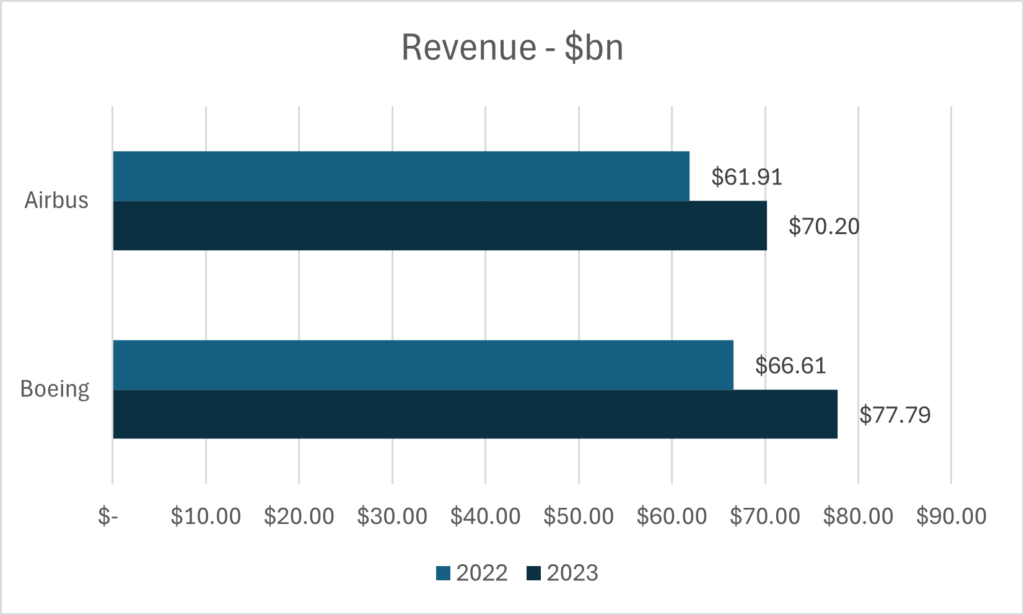

Sales Growth Rate shows the change in net sales from the previous period. This rate increased by 16.79% from 2022 to 2023 for Boeing since its revenue grew up to $77.794B with respect to $66.608B of the previous year. This rate has been continuously increasing over the past few years. When you look at Airbus, they bring in a lower income, around $67.587B, and their sales growth rate isn’t as impressive as Boeing’s, only showing a 12.45% increase.

Gross profit margin measures the profitability and efficiency of a company’s core business. Boeing’s Gross profit margin in 2023 was 12.25%. Meaning that for 1$ sold, Boeing gains 0.1225 $ of gross profit.

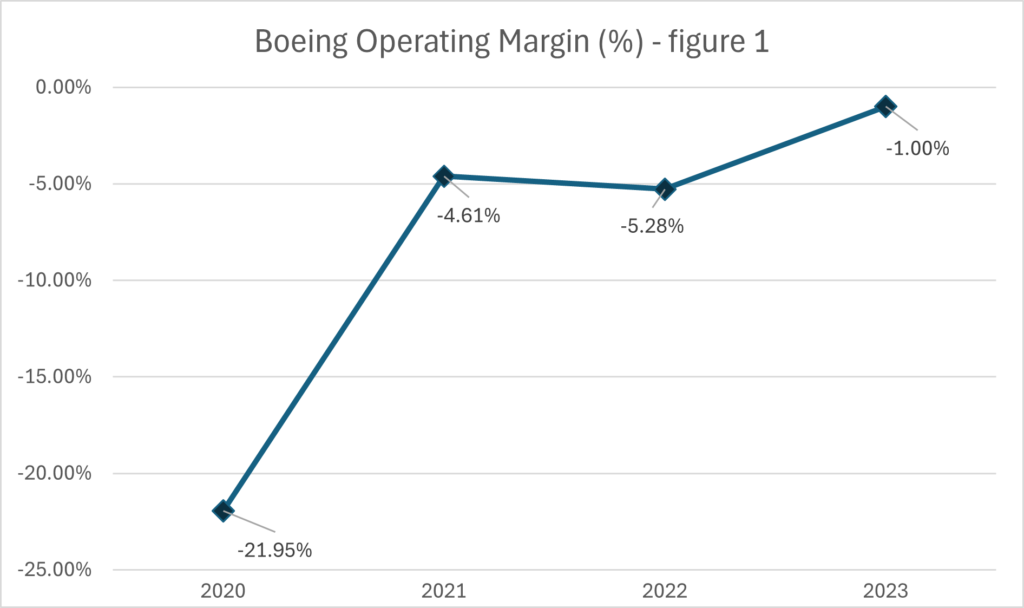

Boeing operating margin stands at -1% for 2023. Showing that after deducting COGS and operating expenses the company loses 1% of 1 $ of revenue. A negative operating margin implies that the company is unable to turn revenue into profit. We can presume that these negative results are a consequence of the global flight ban of Boeing’s 737 MAX 9 in 2019. As shown by figure 1, the operating margin has been increasing over the years, however we believe that this increasing trend will have a pause in 2024 due to the door opening accident of January 5, 2024, on a Boeing 737 MAX, this prompted federal authorities to step up security regarding the company’s maintenance process, which will definitely increase costs.

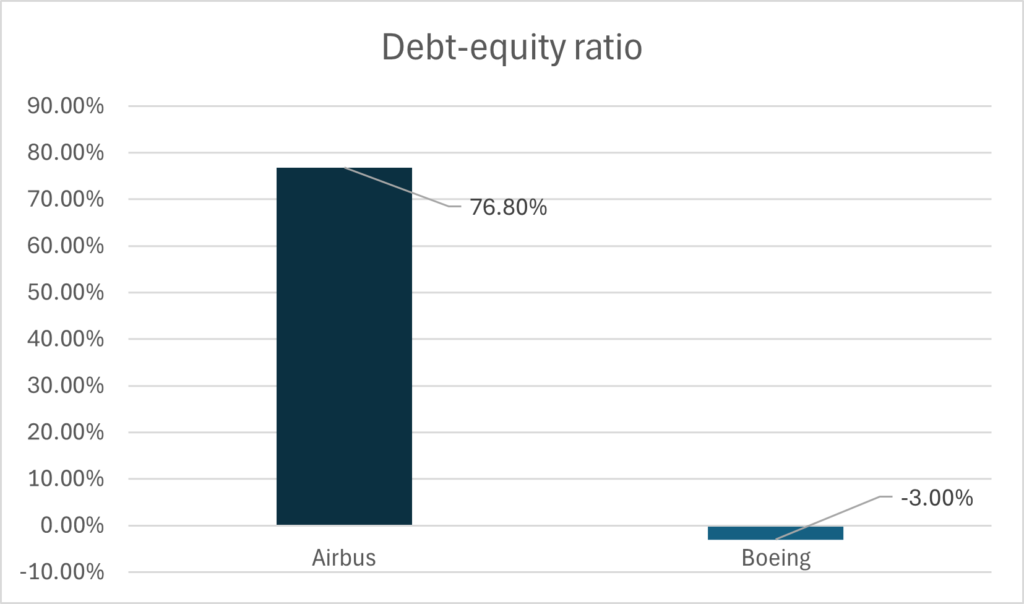

Debt-to-equity ratio reflects how the company’s assets have been financed, either through debt or equity. Boeing’s debt-equity ratio stands at -3%, the negative value indicates a deficit accumulation over the years. This means that the company’s book value is currently negative, and it relies heavily on debt financing. In comparison, its main competitor, Airbus, has a debt-equity ratio of 76.8%.

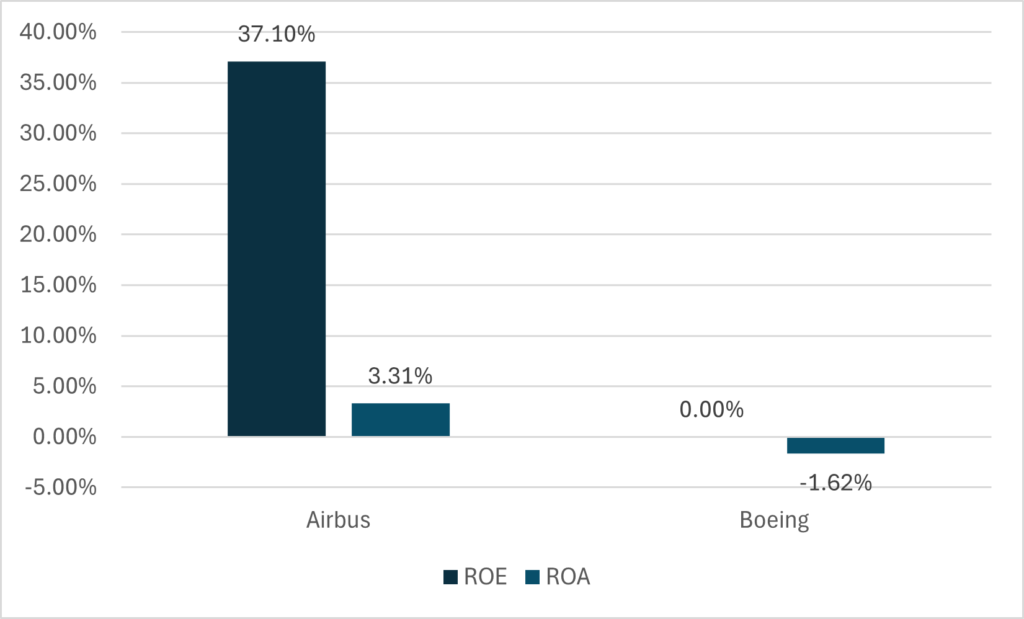

Return on asset (ROA) shows how well operation management uses its assets, both current and noncurrent, to generate profits. Return on Equity (ROE) explains how efficient a company is at generating income from its equity financing. On the one hand, Boeing’s ROA for 2023 was -1.6% and a ROE of 0%1. Such a low value is a bad indicator as it means the company is not able to use its assets efficiently, furthermore, the negative value implies that costs outweigh revenues. On the other hand, Airbus ROA was 3.31% for FY 2023 and a ROE of 37.10%, this proving that Airbus managed to be profitable in relation to its assets. These metrics underline the importance of dealing effectively with costs and risks, instead of just generating revenue.

- Boeing has reported negative net profit and equity figures. Considering this, we are choosing not to indicate a specific ROE (Return on Equity) value, as using this metric in such circumstances could potentially lead to misleading interpretations. ↩︎

Conclusion:

Recently, Boeing has gathered negative attention in the news, which has adversely affected investor’s opinions. The significant issues that they are facing in reputation and financial damage, are due to the events regarding the security of their airplanes (2019 – 737 MAX 9 and 2024 door opened mid-flight).

In this analysis we highlighted negative margins regarding the financial position of the company, which will persist in the short term but if they will be able to address the security issues and taper the costs, we believe that positive margins for the company will arise, given the stringent regulations within the aviation sector, we remain optimistic that in the long term Boeing will effectively address these security concerns and make it through these challenges successfully.

Moreover, Boeing has a massive backlog worth $ 520 billion, which includes over 5,600 commercial airplanes. This indicates that there is a huge demand, and to produce them it will take at least 10 years. Therefore, our focus isn’t on sales but rather on Boeing’s ability to manage costs, be efficient in production and deliver airplanes on time. We think Boeing’s clients won’t cancel their orders because nobody wants to lose their position in the buy list.

Authors: Giorgia Mentasti & Gian Carlo Sari