Introduction

Kering is a global Luxury group that manages the development of a series of renowned Houses in Fashion, Leather Goods and Jewellery: Gucci, Saint Laurent, Bottega Veneta, Balenciaga, Alexander McQueen.

Acquisition

On April 4th, the French luxury group Kering bought a prestigious retail block in Monte Napoleone’s street (Milan). The sale of the 18th century building amounted to 1.3 billion euros and belonged to Blackstone since 2021.

Indeed, Keering declared that they remained focused on proactively managing its real estate portfolio with the short to medium term objective of retaining a stake in its prime assets alongside co-investors in dedicated vehicles. This investment is part of Kering’s selective real estate strategy, aimed at securing key highly desirable locations for its Houses.

This is Italy’s biggest property deal, indeed the property includes more than 5,000 square metres of retail space. Furthermore, among the advisors, Chiomenti assisted Kering, Barclays acted as financial advisor for Blackstone and Lazard for Kering.

This operation is the latest series of purchases by luxury fashion houses seeking to lock down flagship locations. Since, in january the luxury group had announced a purchase of 963 millions dollars in New York (fifth avenue).

Kering

Kering, a prominent player in the luxury industry, surprised observers by announcing a profit warning. They anticipate a significant drop in sales at Gucci, their flagship brand, mainly due to a downturn in demand in China, a crucial market for them. Despite this setback, Kering remains financially robust, boasting €2 billion in free cash flow from operations last year. Additionally, the company sees acquiring strategic real estate assets as integral to its long-range plans.

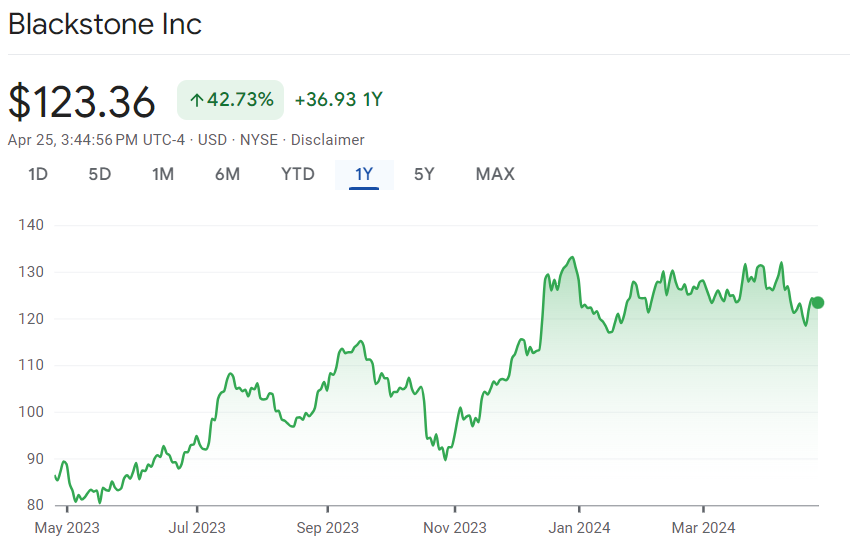

Blackstone

Blackstone Inc. is an American alternative investment management company. Blackstone’s private equity business has been one of the largest investors in leveraged buyouts in the last three decades, while its real estate business has actively acquired commercial real estate. Blackstone is also active in credit, infrastructure, hedge funds, insurance, securities, and growth equity. As of June 2023, the company’s total assets under management were approximately US$1 trillion, making it the largest alternative investment firm globally.

Blackstone bought the Milan property as part of its 2021 acquisition of Reale Compagnia Italiana, a private Italian firm that also owned offices, hotels and residential properties in the city.

They paid about €1.1bn for the whole portfolio. It has managed the property with its partner Kryalos, an Italian real estate firm. James Seppala, head of European real estate at Blackstone, said the deal “demonstrates exceptional investor demand for high-quality real estate in the strongest markets”.

Blackstone has also recently moved to add to its own luxury retail holdings. It is in talks to buy a £230mn property on London’s New Bond Street.

Via Monte Napoleone

Via Monte Napoleone is a street in the center of Milan, considered one of the most luxurious areas of the city and one of the major centers of ready-to-wear shopping. Via Monte Napoleone in 2019 was the third most expensive street in Europe and the fifth in the world, while in 2022, according to Forbes, it was the most expensive in Europe and the third in the world.

The Milan deal is the largest single property sale in Europe since March 2022, said MSCI. Via Monte Napoleone commands the second-highest rent of any shopping street in the world, after Fifth Avenue in New York, according to advisers Cushman & Wakefield.

Overview of fashion industry market

Fashion companies are anticipating economic challenges, technological shifts, and changes in competition for the year 2024. Despite these hurdles, evolving consumer preferences offer avenues for growth. In 2022, the fashion industry displayed resilience, nearly matching its record economic profit from the previous year. Particularly, the luxury sector thrived, offsetting weaknesses in other segments. However, 2023 witnessed persistent challenges, with slow growth in Europe and the United States, and fading performance in China’s luxury market. Looking ahead, uncertainty prevails among industry leaders due to subdued economic growth, inflation, and weakened consumer confidence. McKinsey forecasts a 2 to 4 percent global industry growth in 2024, with the luxury segment expected to lead despite facing economic pressures. Beyond luxury, modest growth is predicted across regions, with challenges such as slumping consumer confidence affecting spending patterns. There are ten emerging themes for 2024, including economic uncertainties, climate urgency, shifting consumer behaviours, and technological advancements. Despite these challenges, leading fashion companies are expected to focus on cost management, growth strategies, and sustainability initiatives to navigate the complexities of the year ahead and emerge resilient.

Authors: Iva Jelisavčić & Maelyn Frydman