“We never had an objective to sell a low-cost phone. Our primary objective is to sell a great phone and provide a great experience, and we figured out a way to do it at a lower cost.”

Tim Cook, Apple’s CEO

INTRODUCTION

Apple Inc. is an American multinational corporation and technological company based in Cupertino, California. Given its extraordinary performances it’s considered as one of the Big Tech companies, as well as being in prestigious positions such as the world’s largest company by market capitalisation from 2011 to 2024 (now the position is held by Microsoft), and the largest technology company by revenues in 2022 with $394.3B. Apple is listed on the NASDAQ under the ticker AAPL, as of April 26th the stock price is $169.30 with a $-0.59 change and volume of 44.8M. Currently EBITDA is $43,221,000 and EBITDA margin is 32.33%.

APPLE’S STRATEGY AND MARKET OVERVIEW

Nowadays Apple strategy is to increase market demand for its products through differentiation, by providing customers with unique and attractive designs, brand loyalty, a huge variety of products and many other features for which people are willing to pay more, thus the company is enabled to maintain a premium pricing at the cost of unit volume. For these reasons Apple created an artificial entry barrier to competitors.

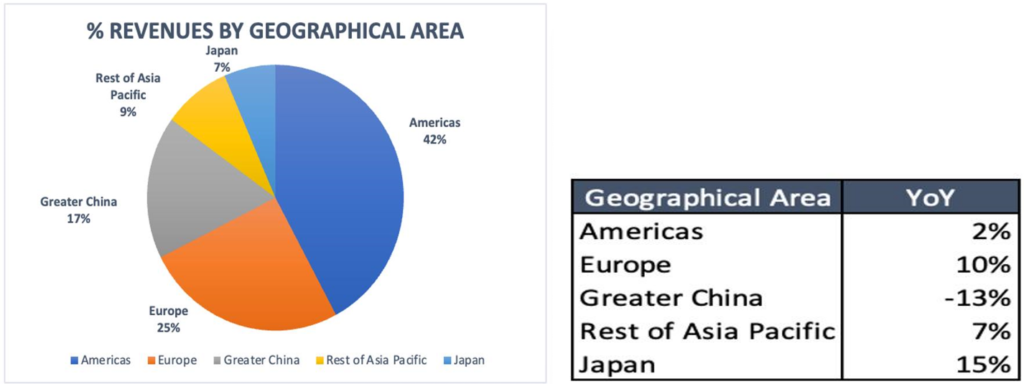

Despite this method seemed to work well in the past years, recently we witnessed a change in trend with a decrease in sales. There are a few reasons for this, but we will draw our attention to the increasing competition within the Chinese market. Indeed, in the Chinese market, Apple finds a great struggle as the prices charged are much higher than what the population can afford as well as the fact that competitors are offering products that better satisfy local customers’ needs. The first two months of the year were disastrous for Apple in China. According to the research firm Counterpoint, in fact, iPhone sales in the Asian country fell by 24% compared to the previous year in the first six weeks of 2024. A major crash, driven by growing competition from local rivals, Huawei over all the others, in fact, while the iPhone producing company is struggling, Huawei has seen a 64% increase in unit sales in the same period. Figures that feed fears of a slowdown in demand for the giant of Cupertino, with revenue forecasts for the current quarter that are 6 billion dollars lower than Wall Street expectations. (See Chart 1)

Stocks of the Californian firm lost over 1.5% after the publication of Counterpoint. A negative sign that embraces a long enough trend. Since the beginning of the year, Apple has lost about 10% on Wall Street, and left the title of company with the largest market capitalization in the hands of Microsoft, the gap between the two companies is over 300 billion dollars. Apple’s latest market cap in Q1, 2024 was $2,976,556.73B.

Apple’s market share in the Chinese smartphone market fell to 15.7%, placing it in fourth place, compared to the second place of the previous period, when the latter was 19%. While Huawei rose to second place thanks to the increase in its market share to 16.5% from 9.4% of the previous year. The overall smartphone market in China has contracted by 7%.s

Senior Research Analyst at Counterpoint, Ivan Lam, talked about Apple’s situation in China: “Apple’s sales were contained during the quarter as Huawei’s return to the premium segment had a direct impact on Apple. In addition, the iPhone update rate was slightly lower than in previous years. In the second quarter, it is possible that the launch of new colors along with aggressive commercial initiatives bring the brand back into positive territory; and, of course, we are waiting to see what they will say on the theme of AI during the WWDC in June. This has the potential to shift the balance needle significantly over the long run”

Apple «faced fierce competition in the high end from a resurgent Huawei, while it was crushed in the middle by aggressive prices from OPPO, Vivo and Xiaomi», said Mengmeng Zhang, senior analyst at Counterpoint. Last week Apple began discounting some iPhone models up to 1,300 yuan (180.68 dollars) through flagship stores on Tmall, Alibaba’s main market platform. But the road, for now, seems full of obstacles. The iPhone “status symbol” that raged in China until some time ago, must find again its charisma.

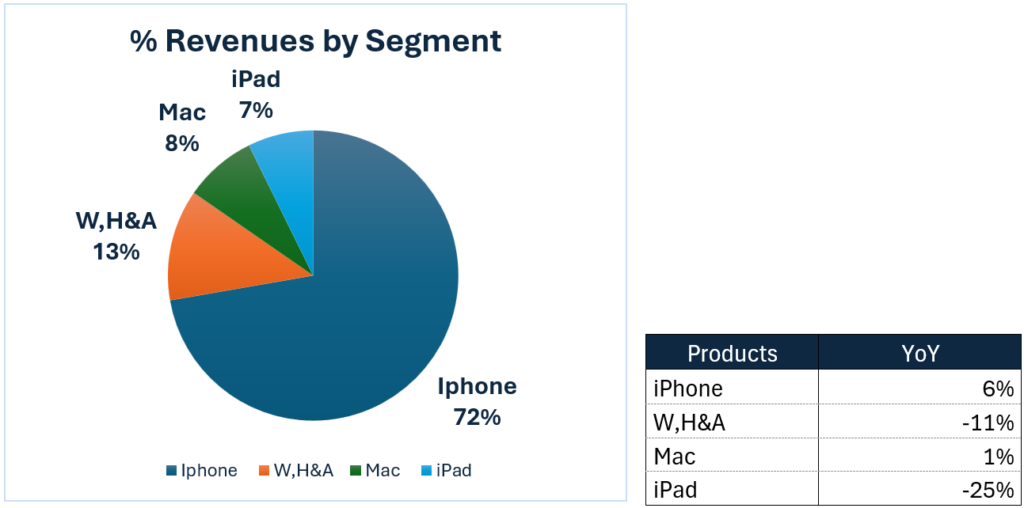

Products’ total revenues for Q1, 2024 totaled $96,458,000M. In chart 2 we see revenues breakdown by product.

APPLE MUST RECLAIM ITS SOFTWARE ROOTS

Apple needs a cutting-edge new technology to go back to its glory days and the answer may lie in the AI. For this big development many resources are needed and seeing its liquidity figures (free cash flow for Q1, 2024 is $37.5B) they will most likely be able to implement it. Apple is aiming at building its own LLM (Large Language Models); this project is very ambitious as it requires a lot of R&D as well as huge changes in the current hardware and software due to the large memory need of LLM, for instance the only iPhone potentially capable of embracing this technology is the iPhone 15 Pro and Pro Max, meaning that all the other models wouldn’t be able to access this breakthrough technology. Same holds for the Macs which will become almost obsolete. This innovation process might be a double-edged weapon as a revolution of this magnitude will surely bring many benefits however Apple might once again fall in the trap of too high prices and hence a reduction of demand.

Authors: Giorgia Mentasti & Alessandro Ceccherini