INTRODUCTION TO LBO

Leveraged Buyouts represent one of the numerous investment techniques adopted within Private equity firms. Throughout this article we will analyze the fundamental pillars of this method.

The acronym LBO stands for “Leveraged Buyout”. As the name suggests, this type of financial transactions are related to the leverage. Indeed, it consists in purchasing a target company by a small group of investors using a high level of debt and moderate equity investment. On average it is estimated that the equity contribution is around 40%, while the debt is 60%.

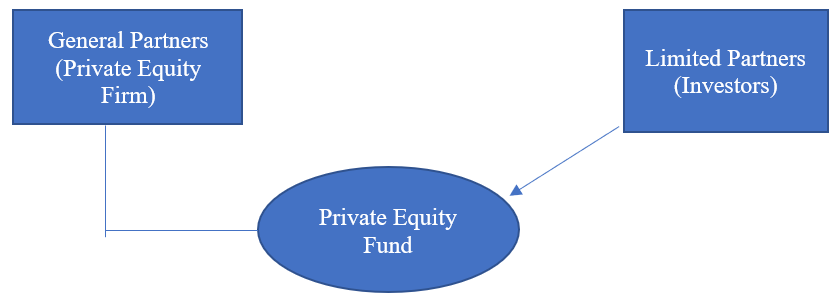

Since an LBO is a sophisticated operation, it’s usually promoted by buyout firms. These transactions are generally financed by investors known as Limited Partners (LP) and managed by private equity firms known as General Partner (GP). Limited Partners tend to be institutional investors such as pension funds, endowments, sovereign wealth funds and family offices. This group of investors don’t have the expertise and the competence to do this type of complex operations, so they rely on private equity firms.

LBO DYNAMIC

Most of the capital invested in the funds is provided by Limited Partners, but there are scenarios where General Partners decide to invest less than 5% of their own wealth.

Once they have raised money from investors, the private equity firm must find a target company to purchase. Buyout funds seek for a public or private company that has the following features: firms with predictable revenues, cash generating capacity and assets that can be sold.

These are the main characteristics, but the process of assessing if a company is a good investment is extremely complex. To properly determine it, firms go through an in-depth 1 due diligence process on many companies’ aspects, such as: exits options (this means understanding if the company will be sellable up front 2), management, legal, industry analysis and macroeconomic environment, growth and strategic opportunities and financial due diligence.

FINANCING COMBINATION (EQUITY AND DEBT)

Once a target company has been identified by a GP, debt capital is raised to help finance the takeover, with the acquired company’s assets usually serving as collateral. This debt, as highlighted, can significantly leverage the targeted company.

It’s crucial that the firm determines an appropriate level of debt level that the target company can realistically handle. Excessive leverage may lead to covenant breaches and jeopardize the success of the operation.

DEBT PAYBACK

After the acquisitions, the GP has the goal to run the company and maximize shareholders value trying to improve the company’s performances, resulting in a profitable exit. In this stage the GP tries to enhance the cash flow of the company to repay the debt.

In the management of debt repayment, GPs have the flexibility to adopt various strategies, including utilizing all the company’s cash flow or just a designated portion of it. This is a management decision that will impact the value of a future exit, thus private equity firms must make all the right valuations to secure and maximize LPs and GP returns.

To improve their cash flows they may try to do two operations: selling no-core business assets or reducing their net working capital. These are the most important and the easiest ways to increase free cash flow in a short period of time. In addition to these two, there is a wide range of operations that firms can engage in (Ex. Consolidation…).

EXITS STRATEGIES

An important aspect of this kind of operation is that LPs cannot liquidate their investments 3. This means that LPs must wait till the company’s exit to receive their money back with interests. On average an LBO operation should be concluded in 4-5 years, but as we are seeing recently it could take more years. Therefore, these investments are highly illiquid, as a consequence investors expect and ask to receive a premium return compared to the stock market yield.

Studies indicate that the most employed exit strategy in LBO operations involves selling to a strategic buyer, often a corporate investor seeking to expand its market share or product portfolio. However, other exit strategies are also viable, including resorting to an IPO, selling to the management, or offloading to another private equity fund, among others.

GPs receive a management fee, that is usually equal to 1.5-2.5%, and a carried interest provision which gives GPs a fraction of fund profits. The management fee is a fixed annual payment. While the carried interest is a payment that GPs receive once they sell the target company. Typically, they receive around 20% of the profits, contingent upon the fund surpassing a predetermined hurdle rate, usually set at 8%. Consequently, General Partners (GPs) are strongly motivated to strive for optimal performance to ensure that this threshold is exceeded.

- Usually firms outsource part of the due diligence process to consulting firms such as: KPMG, Bain, McKinsey… ↩︎

- Ex: A company in the business of selling car components has a huge inventory containing millions of individual items. However, they lack a proper accounting system that tracks their stock levels. With these structural problems, assessing the value of the company becomes both highly challenging and expensive. ↩︎

- The global financial crisis of 2008 marked the beginning of a sustained and growing trend in secondary market activity for Limited Partner (LP) investments. This development allowed an alternative mechanism for exiting LP’s holdings, bypassing traditional exit processes. ↩︎

Authors: Giuseppe Caccamo & Gian Carlo Sari