INTRODUCTION

Boeing is one of the major companies that operate in the aviation industry (commercial airplanes, defense, space, and security). The main competitor in the production of bigger widebody and narrowbody aircrafts is Airbus, while for defense, space, and security segments the major ones are Lockheed, Northrop and General Dynamics.

WHAT HAPPENED?

In the first quarter of 2024 Boeing lost $355 million on falling revenue. This is a clear sign of crisis for the company that must also deal with increasing scrutiny over safety concerns after several whistleblowers reported various manufacturing problems concerning Boeing 737 and 787.

CEO David Calhoun assured the public that Boeing is focusing on fixing the manufacturing issues and that’s why they are not working on the financial results.

The most recent incident happened in January when a door plug blew out of a Boeing 737 Max during an Alaska Airlines flight. However, few years ago this kind of aircraft was involved in two accidents. In 2018 and 2019 two Boeing 737 Max of Ethiopian Airlines and Lion Air crashed killing 346 people. The Alaska Airlines incident stopped the slow recovering progress and put safety concerns and manufacturing problems on the spotlight once again. The Federal Aviation Administration has given Boeing time until May to produce a plan to fix manufacturing problems in 737 Max.

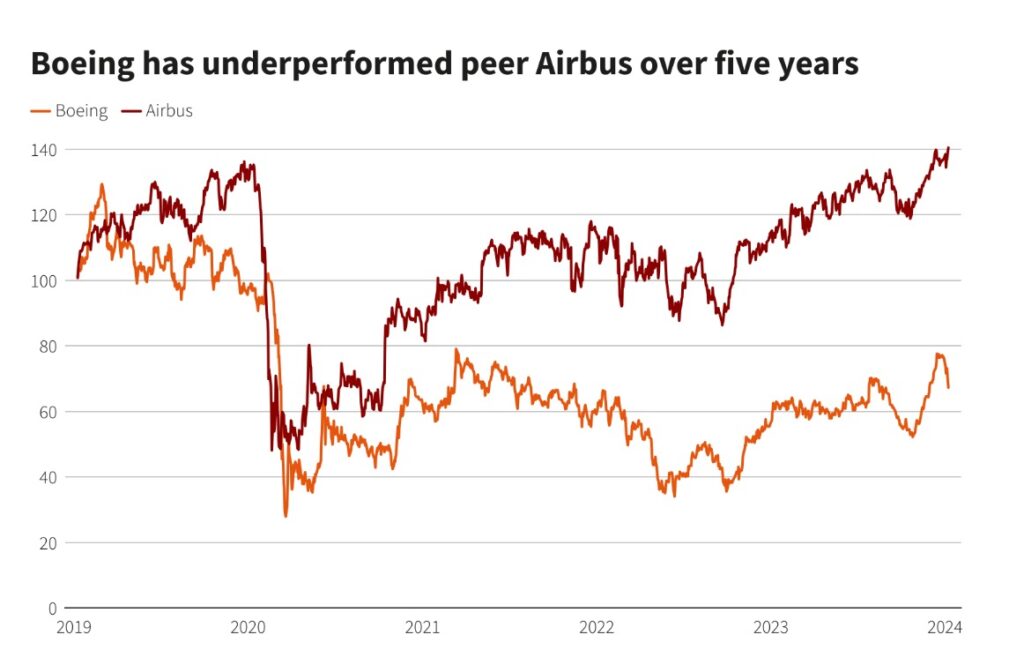

As a consequence of this string of events, Boeing stock has plunged by one-third (they have dropped 34% since the Alaska blowout) and delivery delays worsened. Over the past two years, the gap between Boeing and Airbus’ performances has begun to grow. Boeing delivered 528 aircraft in 2023, while Airbus completed 735 deliveries.

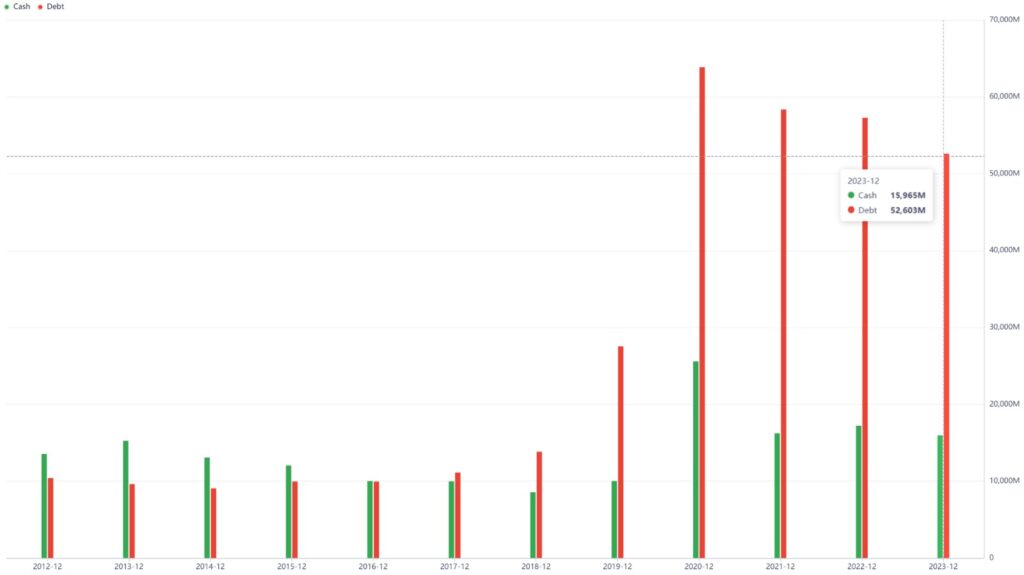

Moreover, the massive losses have resulted in the company’s debt level skyrocketing, from $13 billion at the end of 2018 to $48 billion now. Moody’s downgraded Boeing to Baa3, the lowest investment-grade rating, because of the weak performance of the commercial-airplanes business. In this scenario, even with improved financial performance, Boeing’s cash flow will not be enough to cover $4.3 billion of debt due in 2025 and $8 billion due in 2026.

MARKET OVERVIEW

Despite massive losses ($24 billion in the last five years) and the 7.5% revenue fall, the company is not at risk of failing.

Usually, a company cannot keep losing money and stay in the market. However, the commercial aircraft manufacturing industry doesn’t follow traditional rules of competitive markets. If a client wants to purchase bigger narrowbody and widebody aircrafts, there are only two options: European consortium Airbus and American manufacturer Boeing.

Boeing and Airbus maintain a duopoly that has near complete control of the market. As a result, Boeing has lost $32 billion in the last five years but still maintains an impressive backlog and continues to sell and deliver jets even if they slowed their pace.

The underlying reason is that the barriers to entry are incredibly high, so much that even large-scale industrial nations like China and Russia couldn’t leverage their engineering capabilities to compete in the market. There are some other manufacturers, like Embraer and Bombardier, but they operate on the regional jet market.

THE GF SCORE: WHAT IS BOEING Co GF SCORE?

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with lower GF Scores. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

GF Score takes following five key aspects into consideration:

1. Financial Strength : 3/10

2. Profitability Rank : 5/10

3. Growth Rank : 6/10

4. GF Value Rank : 9/10

5. Momentum Rank : 5/10

Based on research and backtesting results, GuruFocus believes Boeing Co is Likely to have average performance.

Authors: Marco Epis & Sofia Olivia Pedemonte