Considering that the next few years will be crucial for the spread and development of electric vehicles, we have witnessed a great shift as of 2023 alone.

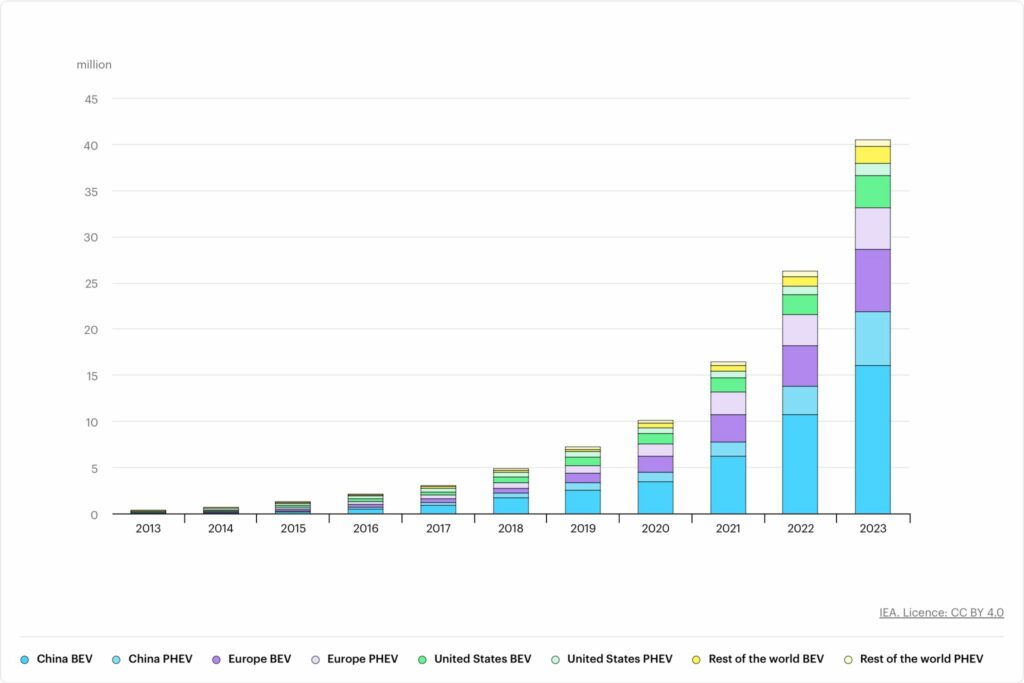

At the end of last year, we counted a total of 25,6 million vehicles, whereas 14 million of those sold within the year, registering a 35% year-on-year increase from 2022. Furthermore, forecasts from the 2023 edition of the Global EV Outlook (GEVO-2023) predict a total of 381 million EV vehicles by 2032. As far as sales are concerned, they tend to remain concentrated in specific areas: nearly 95% of the total were registered in China (57%), Europe (22%) and in the USA (13%).

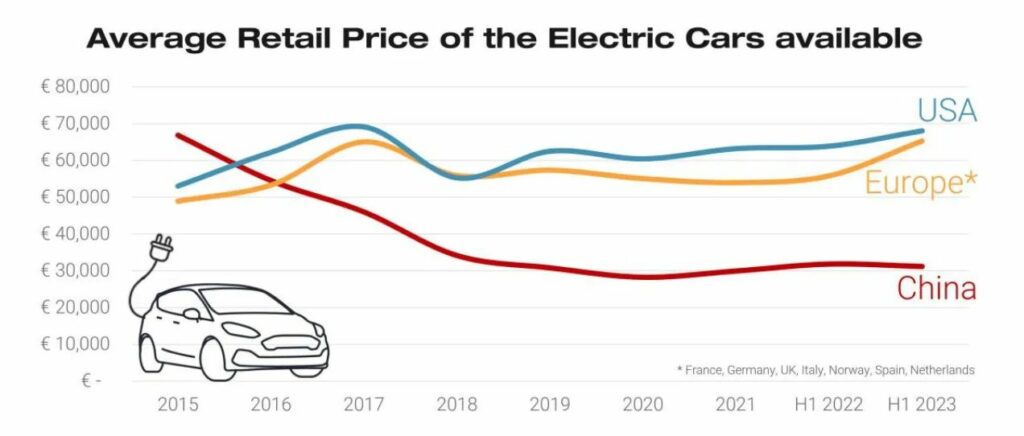

While the rest of the world is still catching up, in order to increase global sales, the most effective strategy would be to cut prices on EV. Therefore, China comes into play, with its affordable products, ready to sweep the competition.

Xiaomi formally launched its much-anticipated electric car: the new Speed Ultra 7 (SU7) sedan and it’s the company’s first electric vehicle, that would sell for 215,900 yuan ($29,874) to 299,900 yuan ($41,497) in the country. However, the starting price is about $4,000 cheaper than Tesla’s new Model 3 sedan, which starts at 245,900 yuan in China. A price war erupted last year as companies tried to boost sales in the face of weaker consumer demand. Meanwhile, as a result, Tesla and other major companies have registered a decrease in market shares (-33% since the beginning of 2024) due to several reasons, but a downturn in sales in China being top of the list.

In China, electric car prices have dropped significantly since 2018, with approximately 55% of the electric cars sold in the country in 2022 being cheaper than their average ICE (Internal Combustion Engine) equivalent. This trend, reported in detail in GEVO-2023, highlights China’s exceptional position in offering affordable electric models. Although, as reported by Jato Dynamics, Chinese prices in 2023 were over half the price of its competitors, and we shall wonder the reasons behind this market trend.

This tendency can be attributed to various factors, including customer preferences, market trends, special local circumstances, and underlying macroeconomic factors. Nevertheless, we should consider two main elements: battery production and the large government subsidies made to develop a greener economy.

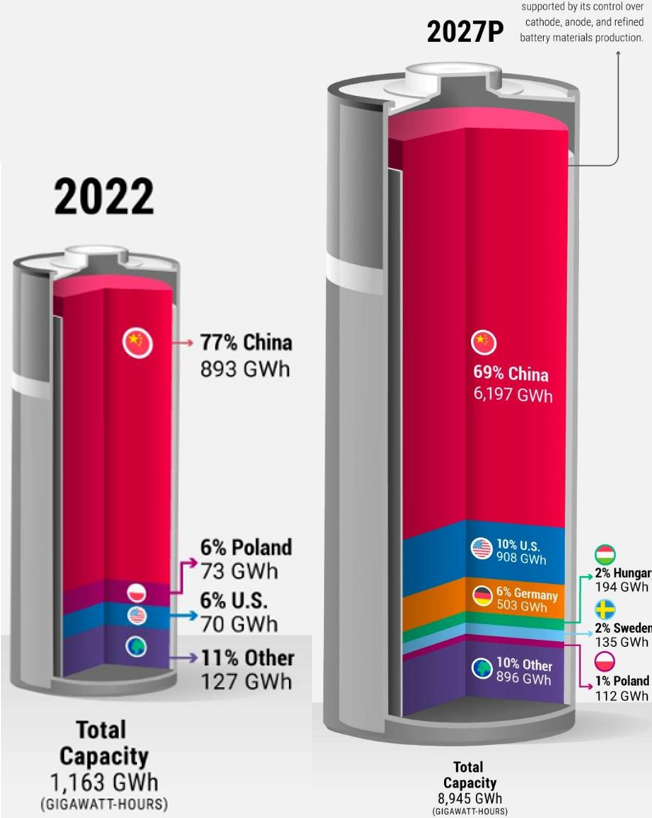

In exploring the electric automotive industry, the spotlight often falls on companies such as Tesla, BYD or Geely. However, there is another crucial player to take into account: the battery makers. Among them, China has proven to be a powerhouse, emerging as a global leader in the battery production, and thus having a monopolistic grip.

As a matter of fact, in 2022 China had more battery production capacity than the rest of the world, accounting up to 77% of the global production, followed by the US and Hungary at 6% each, and then the rest of the world.

By 2027, China is still expected to dominate 70% of the industry, while the US and Germany are also anticipated to grow their presence in the market.

Nevertheless, China’s overwhelming influence sparks significant worries. As we transition to electric vehicles, leaning heavily on Chinese battery may pose risks in terms of geopolitical manipulation, sudden price variations and shortages.

Efforts to counter the Chinese control in the industry can be made through different approaches, such as:

• utilizing regulatory authority to broaden the sources of batteries;

• committing to domestic battery manufacturing, such as India’s initiative in exploring lithium reserves in Argentina.

However, these approaches are not easy to implement, and experts estimate at least decade before achieving significant results.

In the USA, the Biden administration is set to announce new tariffs on Chinese electric vehicles, increasing them from 25% to 27%, all in effort to protect America’s interests and jump-start domestic manufacturing in the energy sector to counter a surge of imports.

While Biden aims to pressure China and demonstrate his commitment to protect American manufacturing, China has begun ramping up the production of electric vehicles, lithium batteries and solar panels, in which the Biden administration has invested billions of dollars to initiate production within the US.

The competition within the battery industry reflects a bigger quest for energy independence and geopolitical leverage. As countries navigate this issue, there will be increasing efforts to secure alternative power sources and reduce dependence on China. These efforts will significantly shape the future of electric mobility and global energy dynamics.

Authors: Liliana Prina & Madonna Veronica De Torres