Introduction

International Business Machines (NYSE: IBM) is set to acquire HashiCorp Inc. (NASDAQ: HCP), as the definitive agreement was made public on April 24th, 2024. IBM´s all-cash offer of $35 per share is valuing HashiCorp Inc, a key player in the multi-cloud software infrastructure industry, for $6,4 billion. The announcement underscores IBM’s strategic focus and commitment to expanding its hybrid cloud services and AI capabilities.

Industry description

The software infrastructure industry consists of the foundational elements and technologies that enable the development, operation, and management of software applications and systems. This includes software frameworks, middleware, databases, networking components, and cloud infrastructure. The industry’s key focus is on providing scalable, reliable, and efficient solutions to support the growing demand for digital services and applications across various. As organizations increasingly rely on technology to drive their operations and deliver value to customers, the software infrastructure industry continues to evolve with innovations in areas like containerization, microservices architectures, serverless computing, and edge computing.

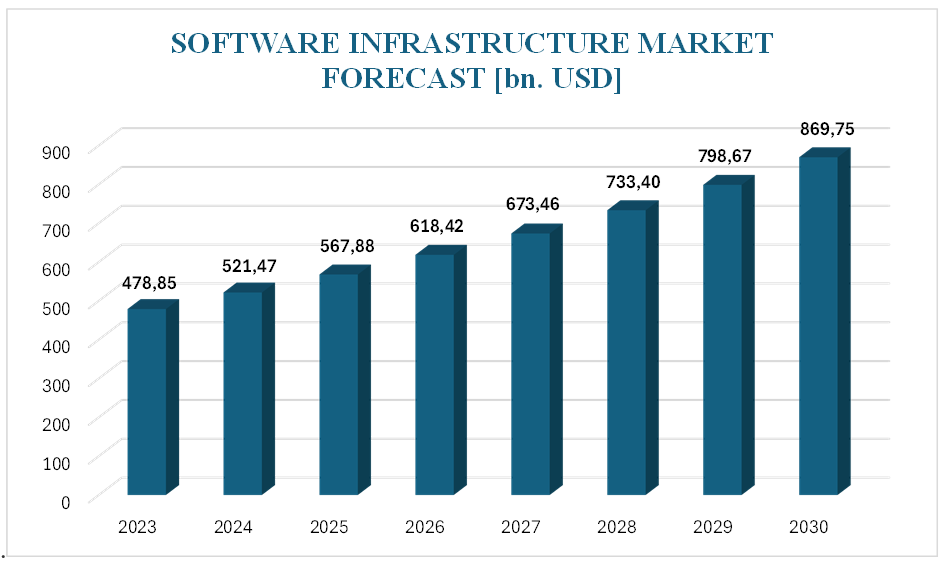

This fast-paced industry, with over 600 active businesses worldwide, represents a cumulative value of $478,85 billion based on FY23 data, an increase of 14,13% on a Year-over-Year basis. The software infrastructure industry is projected to experience a Compound Annual Growth Rate (CAGR) of 8.9% by 2030. This growth reflects ongoing demand for software solutions that support digital operations across various sectors.

Company description

IBM – The acquirer

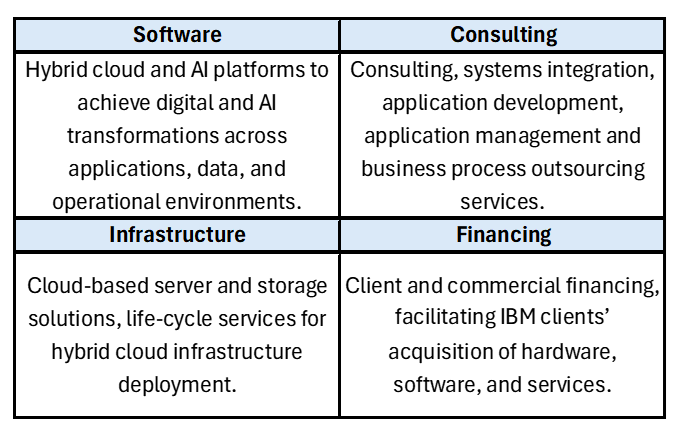

International Business Machines is US based company, established in the State of New York on June 16, 1911. IBM’s focus lies on the intersection between business insight and technology breakthroughs. With nearly 300 thousand employees, and operations in over 175 world countries, IBM is one of the key players in the technology sector. The specific focus of the firm is dedicated to 4 sub-industries – Software, Consulting, Infrastructure, and Financing.

In FY23 (ending 31st December 2023) IBM generated revenues of $61,9 billion, a slight, 2,15% increase from the previous fiscal year. Revenues generated by the Software division accounted for the largest slice of the firm´s revenues, totaling $26,3 billion, with the rest of core activities (Consulting, Infrastructure, and Financing) representing $19,9; $14,6, and $0,7 billion respectively. Net earnings of the firm rose substantially, disclosed at $7,5 billion, representing the highest earnings since 2020. The firm´s stock price increased in price by 15,9%, however, underperforming its benchmark index S&P 500 Information Technology (SPLRCT), which rose by 56,4% in the same time frame.

HashiCorp, Inc. – Target

HashiCorp Inc. is an American software company, based in San Francisco, California. Fairly young company, established in 2012, focuses on providing automatization solutions in multi-cloud and hybrid environments for clients, to accelerate their time to market, reduce their cost of operations, and improve their security and governance of complex infrastructure deployments. With the firm´s employee count exceeding 2200, HashiCorp is providing services to over 4400 clients across more than 60 countries. Core commercial products of the firms are Terraform, Vault, Consul, and Nomad, which can be adopted by clients separately or interconnected, to solve larger, more complex challenges in the digital transformation.

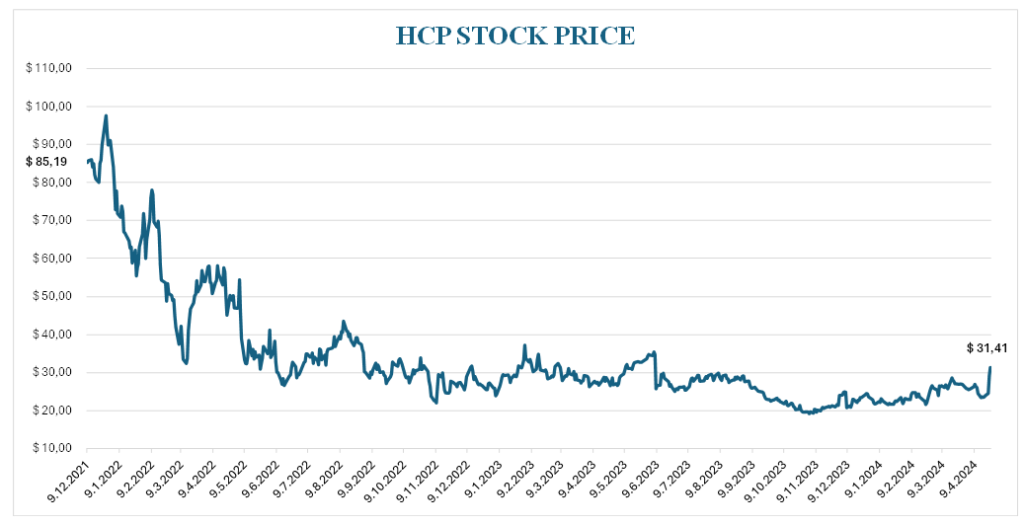

In FY24 (ending 31st January 2024) HashiCorp Inc. business activities generated $583,14 million in revenue, representing a CAGR of 48.13% in revenues since FY20. The largest share of revenue generated in FY24 is attributable to subscription revenue, totaling $564,646 million. On the other hand, the firm recorded a net loss of $190,668 million, mostly due to R&D and Sales and Marketing expenses, connected to investments in market opportunities. Management expects to incur more losses due to this reason in the foreseeable future, as stated in the annual report. HashiCorp Inc. went public at the end of 2021, with an offering price of $80, it recorded an underpricing of $5,19 per share. Since then, stock performance has been rather poor, after over 2 years, standing at just below 40% of its IPO price.

Deal details and market reaction

After the market close on Wednesday, 24th April 2024, IBM together with their earnings report for the 1st quarter of FY24, announced an intention of acquiring HashiCorp Inc. In the earnings call, IBM missed its expected revenue by 0,35%, however beat EPS forecasts by 6,33%. IBM’s offer on the table is $35 per HashiCorp´s share in cash, representing a premium of 36% of the pre-announcement price. Total acquisition cost for IBM is around $6,4 billion. Prior to acquisition rumors hit the market, HashiCorp was traded at 7,81 EV/Revenue multiple compared to the peer’s average of 9,03.

“To strengthen our position in today’s hybrid cloud and AI – driven technology landscape, we also announced our intent to acquire HashiCorp. IBM’s and HashiCorp’s combined portfolios will help clients manage growing application and infrastructure complexity and create a comprehensive hybrid cloud platform designed for the AI era.” – Arvind Krishna, IBM Chairman and CEO.

Acquisition drivers:

- Strong Strategic Fit – By merging the portfolios and expertise of both companies, IBM will be able to deliver comprehensive application, infrastructure, and security lifecycle management solutions, such as an end-to-end hybrid cloud platform designed to manage AI-driven complexities. By integrating HashiCorp’s solutions with IBM and Red Hat, clients will gain a platform that automates the deployment and orchestration of workloads across diverse infrastructures, including hyperscale cloud service providers, private clouds, and on-premises environments. This will strengthen IBM´s ability to expand its market reach.

- Growth Acceleration in Key Areas – HashiCorp´s acquisition is expected to deliver substantial synergies, mostly for strategic growth areas like Red Hat, watsonx, data security, IT automation, and Consulting.

- Clientele – Acquiring HashiCorp will unlock access to more than 4,400 clients for IBM, including clients such as Bloomberg, Comcast, Deutsche Bank, GitHub, J.P Morgan Chase, Starbucks, and Vodafone. HashiCorp´s products and solutions are used by 85% of Fortune 500 companies.

- Financial Opportunities – Operating efficiencies, together with already mentioned growth acceleration are expected to increase the firm´s margin over time. Transaction will be accretive to Adjusted EBITDA within the first full year, post-close, and free cash flow in year two.

After the announcement, HashiCorp’s share price soared by 22%, while IBM’s market cap was reduced by 9%. Boards of directors of both, the acquirer and target, have already endorsed the transaction, however, it still needs the approval of HashiCorp´s shareholders, regulatory approvals, and other customary closing conditions. On the 12th of August 2024, HashiCorp´s shareholders will vote on the matter, while it has been made public that the firm´s largest shareholders, collectively holding around 43% of the target´s common shares, have agreed with IBM to vote in favor of the acquisition, and against, in case of a new bid. As of May 2024, analysts estimate a probability of 77,27% for the deal going through. Assuming all proceeds smoothly, the transaction is anticipated to be finalized by the end of 2024.

Author: Martin Rumanovský