Deal overview

Alphabet, through its subsidiary Google, is in negotiations to acquire cybersecurity start-up Wiz for approximately $23 billion, potentially marking the largest acquisition in Alphabet’s history. This deal could face significant antitrust scrutiny, as regulators under U.S. President Joe Biden’s administration have shown resistance to large tech acquisitions, especially involving Google. Alphabet’s last major acquisition was Motorola Mobility for $12.5 billion over a decade ago. The acquisition of Wiz, valued at $12 billion, would significantly bolster Alphabet’s cybersecurity capabilities following its $5.4 billion acquisition of Mandiant two years ago.

Wiz, headquartered in New York and led by Israeli founder and former Microsoft executive Assaf Rappaport, has raised about $2 billion from investors, including Sequoia, Thrive, and Blackstone. Wiz assists companies like Salesforce, Mars, and BMW in securing cloud programs and has reached approximately $350 million in annual recurring revenue (a metric often used by software start-ups, which consists in the following algebraic sum: Total Revenue of Yearly Subscriptions + Total Expansion Revenue – Total Contraction Revenue). During the Fortune Brainstorm Tech conference, Rappaport refrained from commenting on the talks but emphasized the need for consolidation in the fragmented cybersecurity sector; he only gave an outlook on the cyber-security sector and stated that “It’s too fragmented, so we’ll see a consolidation through acquisitions” and also remarked the importance of cloud security in our economy, saying “If you don’t have the right platform or it’s not stable enough you get less value”. Also Google didn’t release any statement.

The primary aim of this acquisition for Alphabet is to strengthen its cloud services market share, challenging major players like Amazon and Microsoft. However, on July 23, the deal fell through as Wiz’s management rejected the $23 billion offer. Rappaport expressed confidence in remaining independent, targeting $1 billion in annual recurring revenue and an eventual IPO. Regulatory approval concerns also played a role in the decision. The Wall Street Journal first reported the rejection, highlighting Wiz’s potential as a public company valued at $12 billion with ambitious revenue goals.

Wiz

Founded in 2020 by a team of former Microsoft Azure Security executives, Wiz has quickly emerged as a leader in the cloud security sector. Wiz’s innovative platform offers comprehensive visibility into cloud infrastructures, helping organizations identify misconfigurations, vulnerabilities, and potential risks in real-time. By utilizing artificial intelligence and automation, Wiz analyzes large volumes of data to identify complex threats, improving the speed and effectiveness of incident response. Its platform easily integrates with major cloud service providers such as AWS, Azure, and Google Cloud, offering a unified solution for multi-cloud security.

Wiz fosters collaboration between security and development teams, enabling more effective vulnerability management and greater agility in problem resolution. This innovative approach has attracted significant funding from high-profile investors, with a Series C round in 2021 raising $250 million, bringing the company’s valuation to over $6 billion. The company has quickly acquired a diverse customer base that includes large enterprises across various sectors, demonstrating the effectiveness and robustness of its solutions.

Wiz is recognized for its innovative approach to cloud security, earning awards and accolades in the cybersecurity sector. Sources such as TechCrunch, Forbes, and ZDNet have praised the company for its funding achievements and key technologies.

Cyber-Security Sector

In recent years, the cybersecurity sector has experienced exponential growth, driven by the increase in cyber threats and the global digitalization of businesses and public administrations. Threats range from simple viruses to sophisticated attack campaigns, such as ransomware and advanced phishing, highlighting the need to protect networks, computers, and sensitive data. Leading companies like Palo Alto Networks, Cisco Systems, Symantec, Check Point Software Technologies, and Fortinet are investing in innovative technologies like artificial intelligence and machine learning to improve the ability to detect and respond to attacks.

However, the sector faces a significant challenge: a shortage of qualified professionals, with demand far exceeding supply. With a continuously expanding market and growing awareness of cybersecurity, the future of the field looks promising despite the complexities and increasingly sophisticated threats.

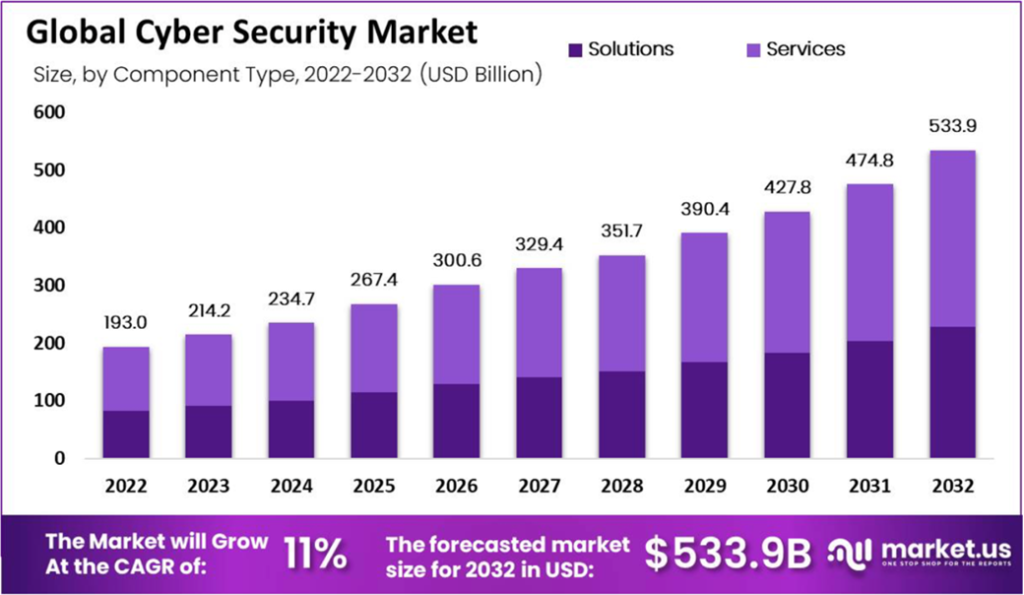

The cybersecurity market has rapidly developed over the past few decades, with exponential growth reflecting the increase in cyber threats and the growing need for digital protection. According to a report by Cybersecurity Ventures, global spending on cybersecurity is expected to reach $248 billion by 2026, up from $137 billion in 2017. In 2023, the Italian cybersecurity market reached a record of €2.15 billion, a 16% increase compared to 2022.

A Shipwrecked Deal

Speculations ended on July 23 when Wiz’s management rejected Alphabet’s $23 billion offer. CEO Assaf Rappaport communicated this decision in a memo to employees, citing confidence in the company’s team and future prospects, including achieving $1 billion in annual recurring revenue and pursuing an IPO. Concerns about a lengthy regulatory approval process also influenced the decision to remain independent. Despite declining to comment on antitrust issues, representatives from both Wiz and Google have not provided further insights. The Wall Street Journal’s report on the rejection has sparked significant interest among industry experts regarding Wiz’s future IPO potential.

Authors: Giuseppe Caccamo & Riccardo Coti Zelati