MARKETS

The Financial Markets Division is responsible for monitoring and analyzing key financial market developments and trends. The primary function of the Financial Markets Division is to publish weekly reports on major economic events, such as interest rate changes, stock market performance, and currency movements. These reports are essential tools for members who need to stay informed and up-to-date on the latest market developments. They provide valuable insights and commentary on the impact of these events on the global financial market, as well as potential opportunities and risks for investors. The reports are produced using a range of analytical tools and techniques, including statistical analysis, technical analysis, and fundamental analysis. By utilizing these tools, the Financial Markets Division is able to provide a comprehensive and nuanced view of the market that takes into account a range of factors, including economic data, geopolitical events, and investor sentiment.

Our Publications:

-

Unicredit’s Bold Ambition: TAKING THE LEAD IN EUROPEAN BANKING

Unicredit’s Bold Ambition: TAKING THE LEAD IN EUROPEAN BANKING On September 11th, UniCredit acquired a 4.5% stake in Commerzbank after the German government sold 531.1 million shares, roughly 4.49% of its shareholding in Commerzbank, for about $750 million. The lender doubled its holding in Commerzbank and reached 9% of the shares. On September 23rd, Unicredit […]

-

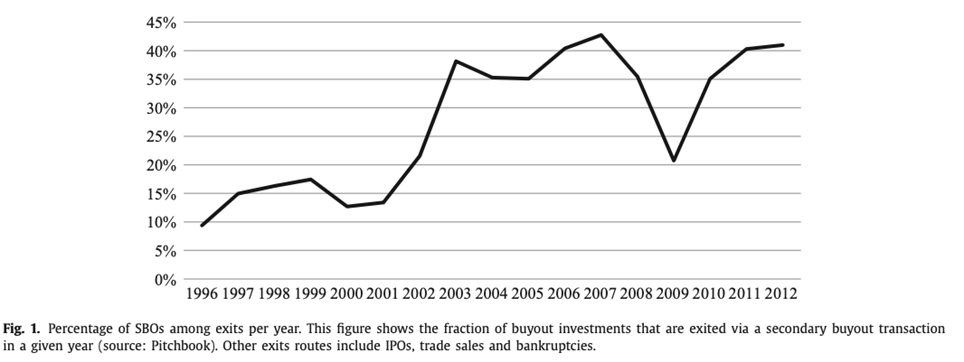

Secondary Buyouts

Secondary Buyouts It is worth analyzing one of the most common and controversial way in which a PE firm is able to exit from an investment that has been made during the life cycle of one of its Private Equity fund. Secondary buyout, also known as SBO, is a strategy that is increasingly used starting […]

-

Navigating Capital Markets: Key Investment Instruments Explained

Navigating Capital Markets: Key Investment Instruments Explained In capital markets, various types of instruments can be bought, providing different ways to invest our money. These instruments offer opportunities to grow our savings, protect them from inflation, or simply generate additional income. Investing in the right mix of these instruments can help build a robust financial […]

-

Evergrande: when bricks crack

Evergrande is a Chinese real estate company. It has become well known around the world for the huge level of debt (more than 260 billion dollars). Such a high debt could lead to a global financial crisis. This enormous debt comes from a dangerous scheme that Evergrande used to take advantage of the exponentially growing […]

-

IPO (Initial Public Offering)

In the life of a company, just as it occurs in a person’s life, there are significant instances that mark a deep shift from the previous life. One amongst them is the IPO, which is an acronym that stands for Initial Public Offerings. An IPO is a procedure through which a private company offers its […]

-

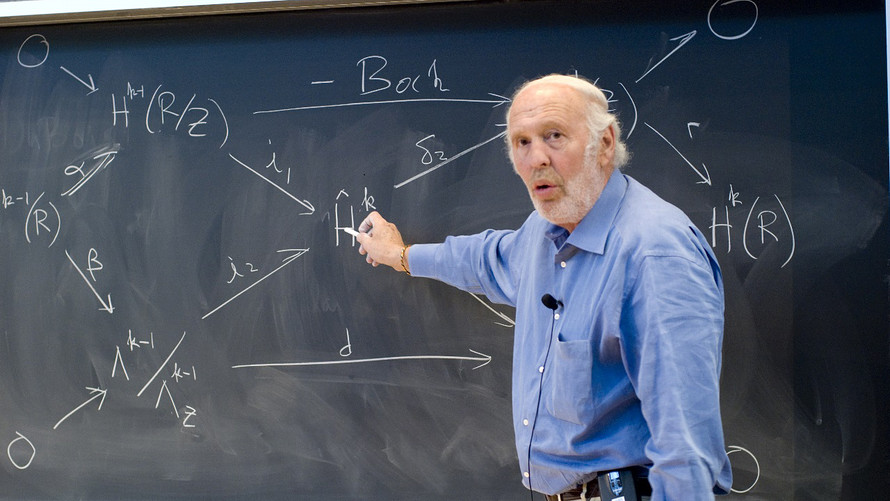

WHO WAS JIM SIMONS?

James Harris Simons, the famed mathematician and hedge fund manager, has died at the age of 86, according to a statement from his family foundation. He was widely known among investors for leveraging quantitative analysis and mathematics to create complex algorithms, taking advantage of the market inefficiencies. Jim Simons was born in Massachusetts in 1938 […]

-

Exploring the Implications of BBVA-Sabadell Merger

Banco Bilbao Vizcaya Argentaria (BBVA) recently made a strategic move in the banking sector, unveiling its proposal to acquire all outstanding shares of Banco Sabadell. This proposition, presented at a premium of 30% over the closing price recorded on April 29th, amounts to a substantial figure of approximately $12 billion. The motive behind BBVA’s ambitious […]

-

Power Shift: China’s Dominance in Automotive and Battery Markets Reshaping Global Dynamics

Considering that the next few years will be crucial for the spread and development of electric vehicles, we have witnessed a great shift as of 2023 alone. At the end of last year, we counted a total of 25,6 million vehicles, whereas 14 million of those sold within the year, registering a 35% year-on-year increase […]

-

BUY DOLLARS, WEAR DIAMONDS

Is the old saying “Buy dollars, wear diamonds” truer now than before? This saying suggests that by investing in dollars and bonds, one can accumulate enough wealth to afford luxury items like diamonds. However, in the current economic and political landscape, it is increasingly difficult to predict with reasonable certainty when the Federal Reserve will […]

-

How Boeing has experienced major turbulence in recent years

INTRODUCTION Boeing is one of the major companies that operate in the aviation industry (commercial airplanes, defense, space, and security). The main competitor in the production of bigger widebody and narrowbody aircrafts is Airbus, while for defense, space, and security segments the major ones are Lockheed, Northrop and General Dynamics. WHAT HAPPENED? In the first […]

-

Junk bonds: are they really “trash”?

In the broad and intricate universe of bonds, junk bonds are one category among many. Junk bonds, also referred to as high-yield bonds or speculative bonds, represent one of the numerous categories of corporate debt securities: these are typically issued by companies or firms burdened with heavy debt or those carrying a speculative level rating […]

-

Wall street opened 24/7: an opportunity or a threat?

A highly debated topic today concerns the possibility of keeping the New York Stock Exchange (NYSE) open 24 hours a day, 365 days a year. As of today, only a consultation has been launched with the aim of making this idea legal and effective. Many investors hope that this is just the beginning of a […]

-

Investments in AI

Ever since the discovery of OpenAI’s ChatGPT, the attention towards Artificial Intelligence has now touched an all time high. With a burgeoning market valued at an estimated USD$200bn, many companies are pivoting towards the sector. Amongst the many firms investing in the market, the most important worth mentioning is Microsoft. Its strategic investments in AI […]

-

Inflationary pressures easing faster in the Eurozone and implications of policy rate cuts

Inflationary pressures easing faster in the Eurozone Inflation in the Eurozone is approaching the 2% target, reaching 2.4% in March, exceeding US forecasts. This has led investors to speculate that the ECB could cut interest rates before the FED does. Central bank policy rates are shown in figure 1. Conversely, US inflation surpassed forecasts, rising […]

-

The Future of Banks

Banking profits are rising thanks to the increase of the interest rates settled by the central banks, even if this positive result come from a particular economic environment due to the necessity to decrease inflation. Despite the positive year, recently, banks have faced period of negative tax of interest, liquidity woes and failure of banks […]

-

The Real Estate Landscape: the market and its evolution

The commercial real estate market is regarded as a vital indicator for economic well-being, boosting the interconnection of factors including local economies, population growth, interest rates, and government regulations. Through this article, we will try to understand the complexities of the real estate industry, recalling the trends of the past year and looking forward to […]

-

The challenge of Tod’s: The new PTO

Tod’s is attempting to re-enter the market with a second public tender offer (PTO) after the failure of the first attempt in 2022, with a price per share of €40.00, not reaching the threshold set at 90%, forcing the group to withdraw the offer. The Della Valle brothers, Diego and Andrea, try again, supported by […]

-

Fashion industry and the impact of sustainability

The fashion Industry has always represented one of the world’s biggest manufacturing branches. In 2021 it generated more than USD 2.5 trillion of global annual revenues, employing more than 300 million people along its value chain, as illustrated in the graph below. Apparel enterprises have always been a reference point in the process of underlining […]

-

Global Outlook 2024

Throughout 2023, the global economy has demonstrated greater resilience than expected, despite significant monetary tightening and persistent global political uncertainty. While economic growth has generally exceeded expectations, this apparent robustness hides short-term risks and structural vulnerabilities. Against a backdrop of high debt levels, rising financing costs, low levels of investment, weak global trade and growing […]

-

Economic Growth in India

Since the 2014 election of Narendra Damodardas Modi as the new Prime Minister, India witnessed a significant growth, and it doesn’t plan on stopping. Today worldly renowned as one amongst the fastest growing countries, India has been able to position herself in the top five biggest economies since 2019. As of last year alone, the […]

-

How a man bent two central banks in one day

Throughout the course of history, only a few men have been able to unsettle entire governments through their actions: George Soros stands as one of them. George Soros was born on August 12, 1930, in Budapest, to a family of Jewish origin. During the Nazi occupation of Hungary, Soros and his family managed to survive […]

-

Decoding Economic Trends in 2024: A first look

As the global stage ushers in 2024, the economic landscape navigates through a nuanced tapestry of challenges, including inflationary pressures, geopolitical intricacies, and persistent market volatility. This article aims to not only dissect but delve deeper into the significant trends shaping the financial terrain, offering heightened insights to guide investors with prudence as their compass. […]

-

SANTA CLAUS RALLY

Beyond the Joyeuse Christmas celebrations, the holiday season casts a notable influence on financial markets and trends. In this article we shall delve into the intricate relationship between holidays and financial dynamics. The Santa Claus Rally is the tendency of the stock market to increase during the Christmas season. Hypotheses include increased holiday shopping and […]

-

The automotive market and the shift towards Electric Vehicles

The automotive industry, a business sector involving the design, production, marketing, and sale of automobiles; has been an important contributor to the European economy in terms of economic growth, innovation, and prosperity for decades. It accounts for almost 7 percent of the region’s GDP and is both directly and indirectly responsible for employing almost 14 […]

-

The Impact of AI on the Global and Financial Markets

Humans have been fascinated by the possibility of creating machines capable of simulating the human brain. The term “artificial intelligence” was coined in 1955 by John McCarthy, who, along with other scientists, organised the ‘Dartmouth Summer Research Project on Artificial Intelligence’ in 1956. This event led to the creation of machine learning, deep learning, predictive […]

-

The new millennium’s crises: 2001 vs 2009

The increase in interest rates, inflation and the consequent stagnation of the economy are all current issues, which, especially in this period of economic slowdown, causes concern. It is not the first time that the world economy has experienced a period of recession: there are numerous cases in economic history. This article will focus on […]