Unicredit’s Bold Ambition: TAKING THE LEAD IN EUROPEAN BANKING

On September 11th, UniCredit acquired a 4.5% stake in Commerzbank after the German government sold 531.1 million shares, roughly 4.49% of its shareholding in Commerzbank, for about $750 million. The lender doubled its holding in Commerzbank and reached 9% of the shares.

On September 23rd, Unicredit asked for approval to increase its stake in Commerzbank to 29.9%, as for the ECB it constitutes as a qualifying holding. Meanwhile, it entered into financial derivative contracts, specifically zero collar derivatives, covering about 11.5% of Commerzbank’s shares. Settlement of these derivatives, which would transfer actual shares to Unicredit, is conditional to obtaning the necessary regulatory approvals.

Therefore, Unicredit’s current direct ownership stands at 9%, with the potential of incresing the stake up to 20.5% upon settlement of the derivative contracts. This might be a strategic decision for UniCredit, since a stake below the 30% threshold avoids triggering the mandatory takeover bid required under German law.

UniCredit’s acquisition brings potential benefits but also challenges:

– Benefits:

- crossborder synergies: the combination of UniCredit’s operations with Commerzbank’s can lead to higher competitiveness in the global scenario. This aligns with the ECB’s support for cross-border mergers to enhance competitiveness.

- advancing the banking union: the UniCredit–Commerzbank pole would further integration, addressing the fragmented European banking scenario and boosting competitiveness against U.S. and Chinese giants.

- access to a new client base: increasing the stake of Commerzbank might allow UniCredit to tap into a stable and profitable client segment since Commerzbank has a strong presence among Mittelstands (SMEs).

- potential cost efficiencies: since both banks operate in Europe, there is the possibility for significant cost saving, for instance through IT integration, reduction of branches where overlapping, reduction of administrative figures.

– Disadvantages:

- potential backlash: there is particularly resistance from the German Government; stakeholders, who are concerned about national interests and employment; labor unions, especially the Verdi union, which has called on the German government to stop the takeover.

- cultural and operational challenges: the differences in corporate culture between Italian and German banking institutions can make integration difficult, potentially hindering operational efficiency

- risk of losing SME focus: Commerzbank is highly centered on SME clients’ personalized services, which may be at risk if it becomes part of a larger multinational structure

- execution risk: successfully integrating two large banking institutions is not an easy task, failure to do so can lead to financial and reputational damages.

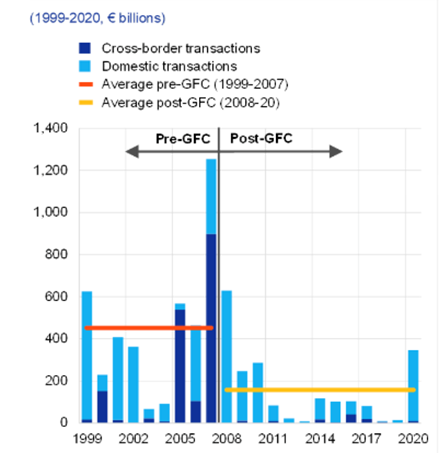

This event is noteworthy as it has the potential to mark a turning point in the European banking market. Part of the Financial Stability Review, published by the ECB in November 2021, shows that bank M&A activity has remained muted since 2008 in terms of both deals’ values and numbers, with the share of failed deals increasing. Moreover, most acquisitions have been made by large institutions that have targeted smaller ones with the aim of complementing their existing business models rather than consolidating the balance sheets. This evidence is shown empirically by the chart.

In addition, Bank M&A activities have been concentrated in the domestic market, with roughly 80% of all completed deals taking place nationally. Cross border transactions remain rare due to regulatory fragmentation and political resistance.

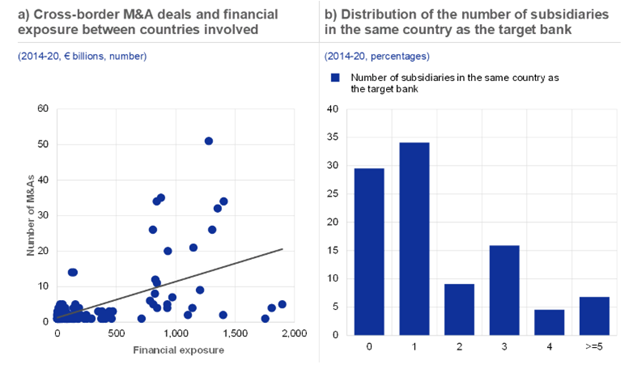

Ultimately, the Financial Stability Review shows that cross-border M&As are more likely when there are existing financial linkages between two countries. As a matter of fact, UniCredit has a significant presence in the German market through its subsidiary HVB (HypoVereinsbank), and an acquisition would increase its market share to 10-11% in the domestic market, making it one of the leading banks in German, behind Deutsche Bank and DZ Bank.

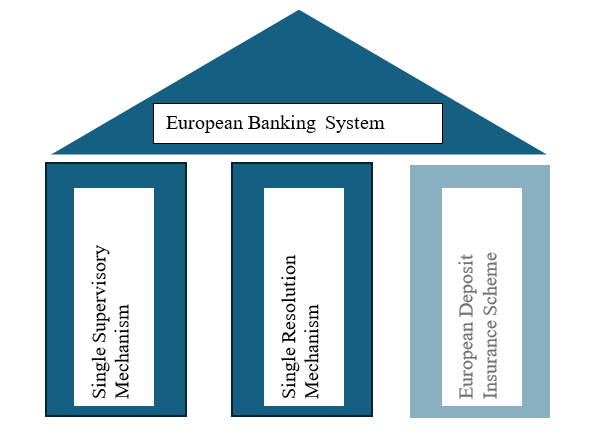

The successfulness of the UniCredit-Commerzbank deal may address key systemic challenges in Europe’s banking sector, such as fragmentation, regulatory consistency, and competitiveness. This acquisition might serve as an example for cross-border acquisitions, encouraging other banks to explore similar opportunities. Therefore, pressure other banks to consolidate and break the status quo of domestic only M&A activity. Furtherly, this could help reduce fragmentation in the European banking market, still recovering from the Great Financial Crisis, while demonstrating that the SSM (the Single Supervisory Mechanism, which is a mechanism that allows the ECB authority to monitor significant banks within the Eurozone, ensuring consistent supervisory standards) and SRM (the Single Resolution Mechanism, which provides a framework for the resolution of failing banks, minimizing the impact on the economy and the need for taxpayer-funded bailouts, by setting up a common fund pitched by banks), can handle complex, multinational entities. It may also speed up the process for the EDIS (the European Deposit Insurance Scheme, which is intended to protect depositors across the EU uniformly, enhancing confidence in the banking system), since its implementation has been delayed due to political disagreements, mostly about risk-sharing and potential financial liabilities. The lack of this pillar has significant implications: without a common deposit insurance scheme, national banking systems remain isolated, hindering full financial integration; and the incomplete EBU makes cross–border banking merger more difficult, as evidenced by the resistance in the analyzed case.

Lastly, a successful deal may strengthen confidence in the ECB’s supervisory role and promote greater alignment between national and EU-level regulatory frameworks, making future deals smoother.

Despite this, Olaf Scholz, the current German Chancellor, has slammed UniCredit’s move on Commerzbank and described as “hostile” because it would result in job losses and stated that: “hostile takeovers are not a good thing for banks”, making it more difficult for UniCredit to proceed with his plans. For all that Andrea Orcel stated that they will evaluate many options, including a significant capital gain in case of rejection.

As stated before, the outcome of this deal may help address systemic challenges in the European banking system. However, the ultimate outcome is still uncertain, given the significant resistance from Germany.

While the deal holds a promise to set a precedent for this kind of opportunities in Europe, its success will depend on UniCredit’s ability to overcome all the challenges that this operation may lead to. As the situation evolves, this case will serve as a critical test for the resilience of the European Banking Union and the willingness of member states to prioritize financial integration over national interest.

Authors: Veronica M. De Torres & Luca Laurita