An option, in finance, is a contract between two parties that gives the buyer the possibility, but not the obligation, to buy or sell an underlying asset at a specific price on a future date.

The underlying asset can be of different types, some examples are:

- Equity

- Forex

- Commodities

- Bond

- Index

The specific price at which the buyer has the right to buy or sell the underlying asset is called “strike price.” (K).

There are two main types of options:

1. Call Option: A call option gives the buyer the possibility to buy the underlying asset at the strike price at a future date. This type of option is preferred if you have upward expectations of the underlying security.

2. Put Option: A put option gives the buyer the possibility to sell the underlying asset at the strike price on a future date. This type of option is preferred if you have downward expectations of the underlying security.

There are two main styles of options:

- European option: Where you need to wait the expiration to decide whether to exercise it.

- American Option: You can exercise the option early; this makes it more expensive than the European option for the same features.

Nothing excludes to cope with styles, these are named “Exotic Options” (Asian, Lookback…) which will be covered in subsequent articles.

The price, or premium, can be defined by various methods of calculation, the most common derived from the differential equation of Black-Sholes and Merton.

At any given time, options can be:

– In-the-money (ITM): A call option is “in-the-money” if the market price of the underlying asset is higher than the strike price.

This implies that if it is exercisable, we will get a gain from it since S > K.

– Out-of-the-money (OTM): An option is “out-of-the-money” if the market price of the underlying asset is not favorable to the buyer (S < K).

– At-the-money (ATM): An option is “at-the-money” if the market price of the underlying asset is very close to the strike price (S = K)

The purposes of these are many, mainly they can be used for speculative purposes, hedging or arbitrage transactions.

Options are affected by several factors that determine their value:

– Price of the underlying asset: which is, the price to date (spot) of the asset on which the option is written

– Strike or Exercise Price: As mentioned earlier, the strike price is the price at which the buyer of the option has the right to buy (call option) or sell (put option) the underlying asset.

– Expiration date: The expiration date is when the option ceases to be valid.

– Market volatility: Volatility measures the price variability of the underlying asset. The greater the volatility, the greater the value of the option.

– Interest rates: Interest rates are necessary in order to discount flows and play a key role in pricing an option.

– Dividends: If the underlying asset is a dividend-paying stock.

– Option style: The behavior of the option may vary depending on its style, which may be European, American, or other.

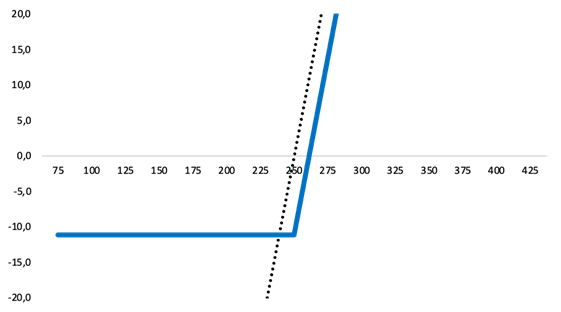

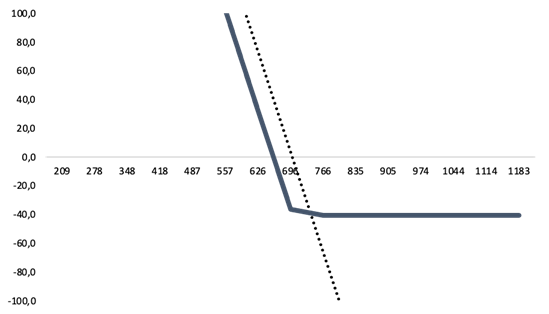

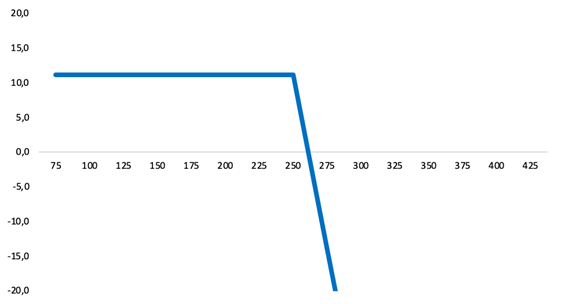

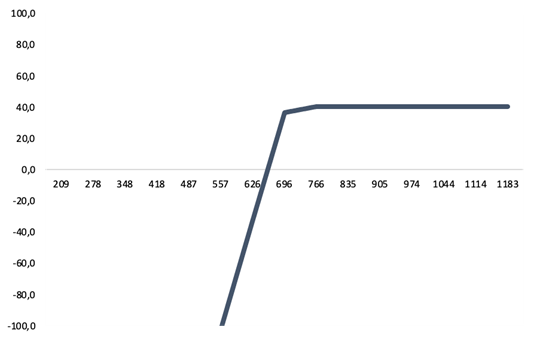

Here 4 different payoffs obtained by the following type of options:

Buy a Call (+C)

Buy a Put (+P)

Sell a Call (-C)

Sell a Put (-P)

Author: Gianluigi Pezone