The automotive industry, a business sector involving the design, production, marketing, and sale of automobiles; has been an important contributor to the European economy in terms of economic growth, innovation, and prosperity for decades. It accounts for almost 7 percent of the region’s GDP and is both directly and indirectly responsible for employing almost 14 million people.

However, this status quo has recently been challenged as the industry is experiencing profound innovations such as the advent of electric vehicles (EVs), smart technologies, and globalized supply chains. In fact, from a market initially characterized by traditional manufacturing practices and internal combustion engine dominance, the industry has witnessed a paradigm shift towards innovation, sustainability, and advanced technologies.

This dynamic has opened the doors for new competitors both in Europe and internationally. Notably, China has swiftly emerged as the world’s largest automotive industry, disrupting the established order and winning market share. Indeed, in early 2009 China’s automobile sales surpassed those of the United States for the first time, making it the largest car market in the world, a status which it retains to this day.

China has created an environment conducive to robust car sales, by leveraging factors including their expanding middle class, government policies, and initiatives to promote the shift towards electric vehicles. This made the country the leading global market for automotive sales and the first to surpass the significant milestone of 20 million units sold annually. It maintains its impressive 14-year run as the leading country in global car sales, with a total of 26.86 million vehicles sold last year. This accounts for 38.3% of total car sales globally. The most popular models that dominated the Chinese market in 2022 are BYD Song PLUS, with 459,424 units sold, Nissan Sylphy – 446,492 units, and WulingHongguang MINI EV which saw sales of 443,384 units.

In addition to being the largest automotive market, China also produces more cars than any other country. The world’s second and third-largest car markets are respectively the United States and India, as Japan has fallen to fourth place for the first time in 2022. In the European market, it is worth noting that in 2022 China surpassed Germany in the export of light vehicles for the first time, exporting approximately 3.0 million vehicles compared to Germany’s 2.6 million.

However, significant R&D investments have helped European carmakers to implement new technologies, and despite other markets experiencing faster growth at the moment, 5 out of 10 most valuable car brands worldwide are still European. The brand value of the ten largest automotive companies combined is conservatively estimated to be 200 billion euros. Therefore, the real challenge for European car manufacturers is going to be adapting to the huge changes affecting the whole industry in a proper, efficient way.

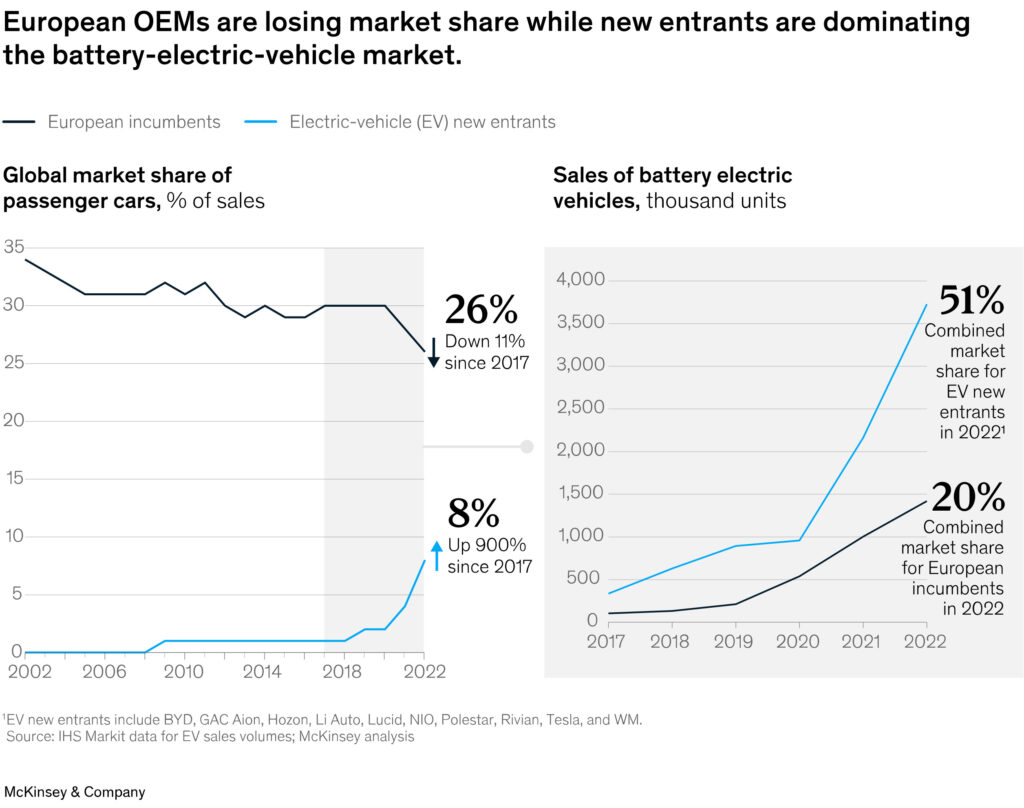

The transition from internal-combustion-engines (ICEs) to zero-emission vehicles is rapidly accelerating with a measure of 80% per year of global sales of Electric Vehicle since 2020, and recent analysis suggests that many global mobility markets will reach near-total EV penetration by the mid-2030s. This substantial change in the market trends represents a threat for the European OEMs (Original Equipment Manufacturers) that in recent years have been losing shares of the market in favor of new entrants. The companies that join the market have more development flexibility and can exploit easily this sudden market shift from ICEs to EVs.

In addition, in 2022 these newcomers represented 18% of the global population, compared to 72% of the European incumbents. This becomes even more visible in the context of total market share, in fact (as shown in the graph below) since 2017 the European brands have lost market share, meanwhile, the new competitors are experiencing a massive increase.

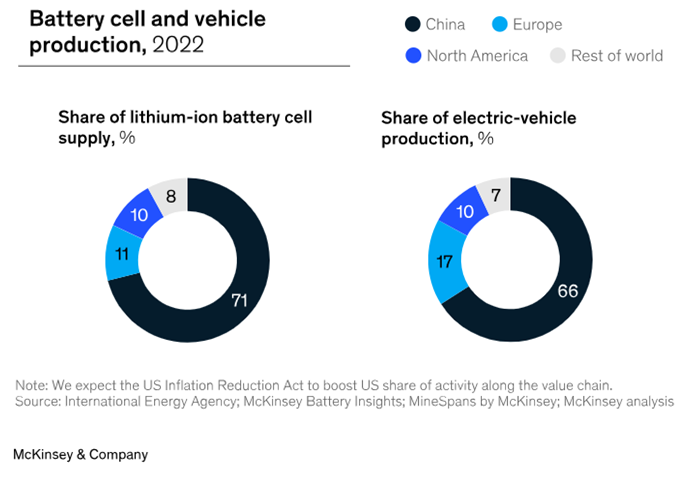

Additionally, the industry is being enticed to prioritize software performance more than hardware, with consumers developing a preference for brands that offer better vehicle technology such as advanced driver assistance systems, comfort-enhancing features, and connectivity services. This holds, especially in the case of EVs. Soon, the customer choice will probably be based more on these technological / software aspects of car design, and less on the physical aspect, which means that the comparative advantage will be based heavily on “computer” components of future automobiles. This phenomenon is giving increasingly more relevance to industries such as semiconductor and battery production, shifting the focus of the supply chain from traditional suppliers to “high-tech commodity” companies that produce these materials. Overall, this creates a threat to the European system considering that the current battery value chain is largely controlled by Chinese companies.

In summary, in the last decades, the global automotive market has faced a proper transformation, moving the focus of the consumers and, as a consequence, changing the main subjects involved in this sector. The advent of new technologies especially of EV, is shifting the demand of the sector to different OEMs such as batteries and semiconductors that are creating an advantage for countries with supply chains already developed in their production. Although markets like the European and North American are still relevant, these recent modifications are affecting their market shares, and to adapt to these new conditions, a strong change in the supply chain will be needed.

Authors: Alessandro Verga & Mateusz Tuszyński