The increase in interest rates, inflation and the consequent stagnation of the economy are all current issues, which, especially in this period of economic slowdown, causes concern.

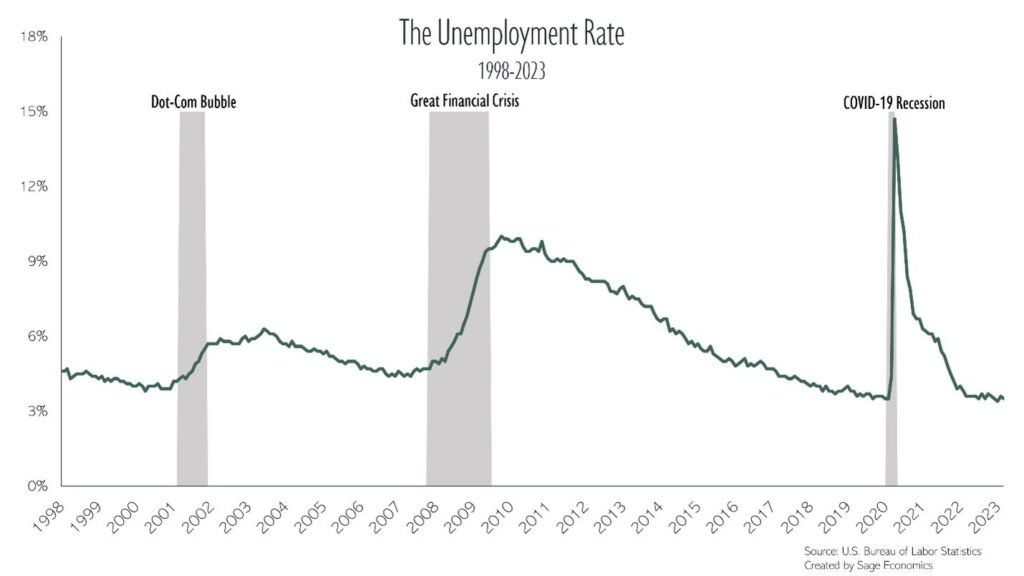

It is not the first time that the world economy has experienced a period of recession: there are numerous cases in economic history. This article will focus on the two crises of the new millennium: the 2001 and 2008 crises, also known as the Dot-Com bubble burst recession and the Great Recession.

The former, the Dot-Com bubble crisis, is a stock market phenomenon that took place in the late 90s, was fueled by the rise of internet-based businesses identifiable by their “.com” domain addresses.

The start of the New Economy began when Netscape, a company that introduced the first commercial web browsers, went public in 1994. This marked the beginning of a big change in how the economy worked, replacing the old and traditional way of doing things, known as the Old Economy.

It was in this context that institutional investors, retail investors and venture capitalists engaged in speculative fervor around tech companies, seeking rapid and substantial profits. The prevailing low interest rates increased mortgage demand, allowing banks to make lots of money. These banks in return supported initial public offerings of tech companies. This period witnessed “herding behavior”, where many investors followed market trends.

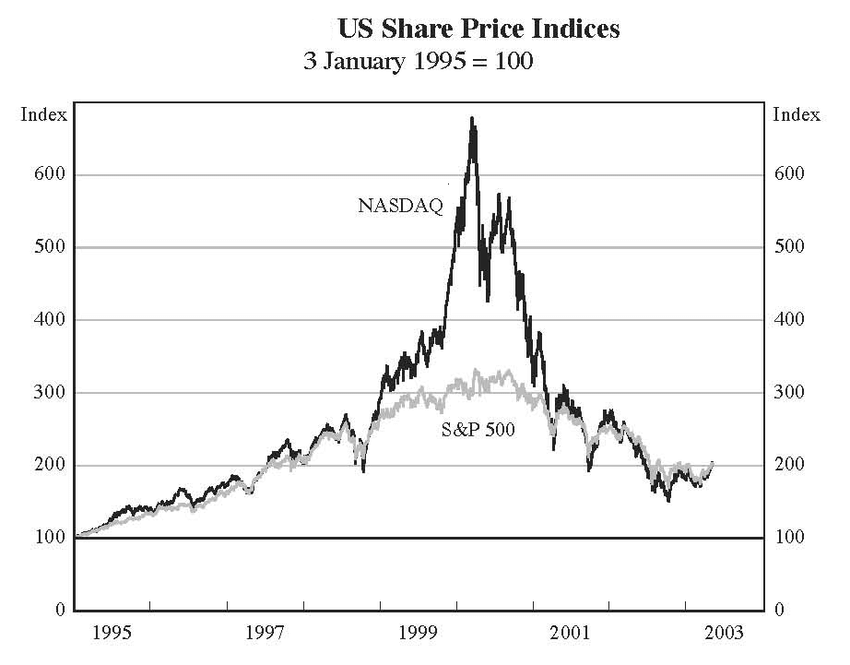

As a matter of fact, during this speculative turmoil, the NASDAQ composite index skyrocketed from 751.49 points in January 1995 to 5,132.52 points in March 2000, reflecting a remarkable increase of 582%.

This quick rise reflected an overestimation of tech stocks, and many investors were overly optimistic. This paved the way for a later realization that things might have not been as good as they seemed: as a matter of fact, many of the companies issuing stock were not financially sound, and their valuations were often based on future growth expectations rather than present earnings.

In March 2000, the financial landscape witnessed a downturn as companies’ balance sheets not only showed negative results, but these were even below expectations, giving evidence that investments had not indeed turned out to be profitable.

In 2001, the euphoria gave way to a sharp reality, generating a wave of panic selling as investors feared substantial losses. The NASDAQ composite index experienced a steep decline of 75% from March 2000 to October 2002, marking the definitive bursting of the Dot.com bubble.

The aftermath of such a burst led to the insolvency of several companies with a weak financial foundation, such as Pets.com, Webvan to Boo.com. On the flip side, companies such as Apple, Amazon and eBay emerged stronger thanks to the more solid business models. Some of these represent few of the biggest and most influential companies worldwide.

7 years later, in Wall Street, the United States of America experienced the worst crisis it had ever seen.

For explanation purposes we must take a step back, starting from the 2006 spread of derivative instruments in America, precisely mortgages and instruments linked to subprime mortgages. In fact, it became standard practice to negotiate bonds that had mortgage loans as underlying assets, so that banks could easily securitize these loans, thus quickly obtaining resources from the market, subordinating return and capital to the solvency of borrowers. All the big investment banks relied on the fact that these mortgages were safe to package as highly rated products and thus making them particularly attractive. These mortgages were however often granted without negligible requirements: there was no adequate assessment of the creditworthiness of borrowers, so when families and businesses were no longer able to repay these mortgages, they quickly lost value, causing the collapse of the portfolio of Lehman Brothers, fourth largest US bank, amongst many others.

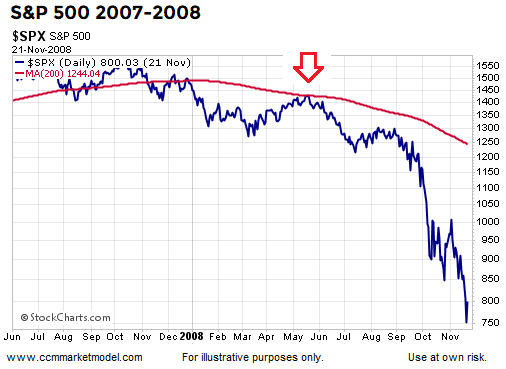

In that occasion the FED decided not to guarantee for the purchase by Bank of America and Barclays, Lehman Brothers took advantage of Chapter 11 and declared bankruptcy. As soon as the declaration took place, a global crisis ensued: the US GDP, after years of growth, recorded a sudden collapse, then followed by a phase of stagnation and an increase in the unemployment rate. On Wall Street the S&P index recorded a collapse of 40%, which had historically been only surpassed by the great depression of the 1930s.

The default of Lehman Brothers generated a new phase of tension and uncertainty in the markets, aggravated the decision of the government authorities to let a bank of this size fail, which brought even greater concern on issues such as counterparty risk, chain effects and systematic risks of so-called “too big to fail” banks.

Someone may wonder if there could ever be a new crisis like the one that took place in 2008. What can be noticed is that, starting from this event, very strict liquidity and capital requirements have been imposed for banks, as well as the presence of the deposit insurance scheme and of the State as lender of last resort. These make us believe that, as in the case of the Credit Suisse collapse of March 2023, the extent of such an event can be managed without creating a global systemic crisis.

By comparing these two events that marked economic history, we could first focus on the macroeconomic scheme that characterized these events. Both crisis were characterized by the same five stages of a bubble.The initial period of prosperity which gives rise to the bubble induced by low interest rates, known as displacement. Secondly, the boom stage, where prices climb and attract new investors. The third stage is euphoria where everyone expect that someone will be willing to buy notwithstanding the steady increase in prices. The fourth is profit-taking where predictions that the bubble will burst start to rise. The fifth and last stage is panic in which prices sharply decline and investors rush to sell.

In both crises the rise in investors’ demand translated into lack of caution from banks. US GDP during the Great Depression slowed down about 4.3% while in the Dot.com bubble 0.3%. The unemployment rate reached in 2009 reached 9.5%, and in 2001 5.5%.

Both in 2001 and 2008, respectively, the adoption of the internet and the surge in demand for housing, had an immediate positive impact, initially boosting economic well-being until the bubble burst and caused long lasting repercussions on the world’ economy.

Authors: Sabrina Ramdohur & Luca Laurita