As the global stage ushers in 2024, the economic landscape navigates through a nuanced tapestry of challenges, including inflationary pressures, geopolitical intricacies, and persistent market volatility. This article aims to not only dissect but delve deeper into the significant trends shaping the financial terrain, offering heightened insights to guide investors with prudence as their compass.

Evolving Monetary Landscape and Inflation Dynamics

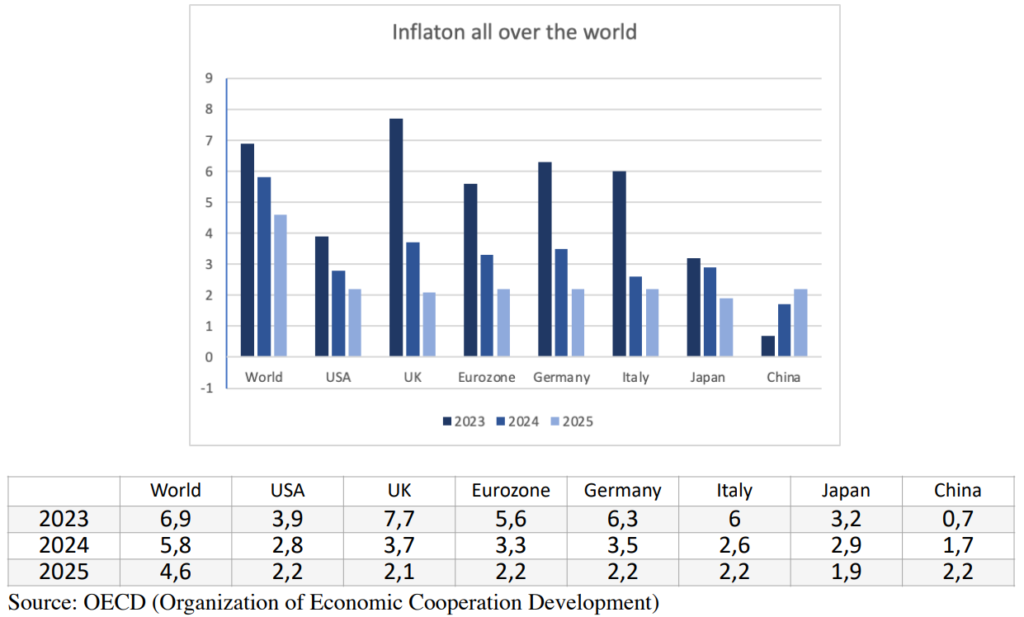

The forthcoming year is poised to signal a pivotal departure from the restrictive monetary policies of major developed nations. Analysts anticipate a strategic shift toward interest rate adjustments, marking the inception of a potential “soft landing” after a prolonged period of rate hikes. The market sentiment reflects skepticism towards the “higher-for-longer” theory, with bets against central banks maintaining borrowing costs at restrictive levels. Both the US Federal Reserve and the European Central Bank are expected to cut interest rates multiple times in 2024, signaling a departure from the current high-rate environment. This shift aligns with the conviction that inflation is heading towards target levels, labor markets are cooling, and growth is settling into more subdued levels.

In the eurozone, the remarkable fall in inflation, closer to the European Central Bank’s 2% target, has prompted a shift in monetary policy. ECB board member Isabel Schnabel stated in early December that further interest rate hikes were off the table due to this notable decline in inflation.

This shift in monetary policies, accompanied by the market’s anticipation of interest rate cuts, is expected to have a profound impact on inflation dynamics. The adjustments in interest rates aim to navigate economies toward a softer landing, carefully balancing growth and inflation targets. Diversification in investment portfolios becomes paramount as these changes unfold, ensuring resilience in the face of evolving monetary policies and their cascading effects on inflation.

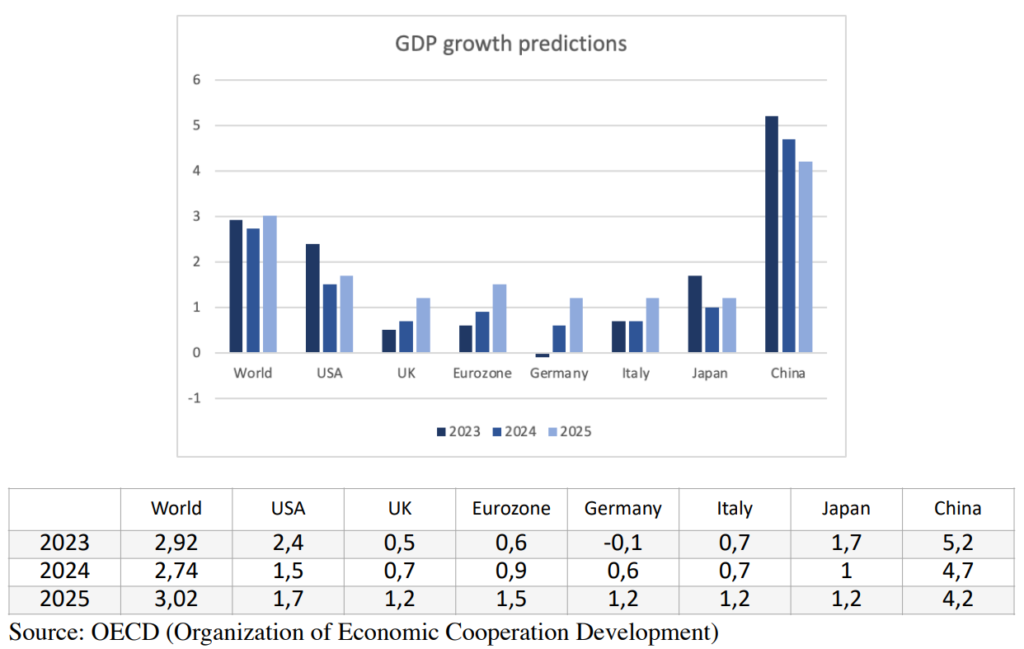

Predicting GDP Growth

Geopolitical tensions emerge as a prime concern, exerting influence on financial markets and potentially disrupting the disinflation trend. A cautious outlook prevails regarding global growth, prompting an even deeper macroeconomic approach to 2024’s investment landscape. Considerations extend to potential interventions and adjustments, further introducing the possibility of yield volatility and intricate interplays between economic indicators. In this context, the evolving landscape of global trade dynamics and the resurgence of multilateralism play pivotal roles in shaping economic trajectories.

Analyzing Interest Rate Trends

Late 2023 and early 2024 have witnessed a discernible deterioration in the global economic outlook, leading analysts to consider more significant downward revisions in earnings forecasts for the upcoming year. The article scrutinizes the potential shift in global interest rate trends, an event that may only partially counteract the negative impacts of economic slowdown but also presents opportunities for astute investors. An in-depth exploration of the implications of technological disruptions and innovations on financial markets, including the rise of decentralized finance (DeFi), adds layers to this comprehensive analysis.

Strategic Investment Approaches

Against this challenging situation, it is suggested a neutral stance on global equities, underlining not only the need of maintaining maximum diversification both geographically and sectorally but also the need for a more refined and systematic plan of action. Banca Generali recommendations for investors are to actively engage with the expectations of future market volatility, looking at it as an iter for more profitable opportunities across both bond and equity markets within a well-diversified portfolio. Furthermore, this section explores the impact of changing demographics and societal trends on investment preferences and strategies.

Lastly, this article strongly aims to point out a cautious yet opportunistic approach facing the prevailing economic uncertainties. The proposed framework aligns with approaches implemented in the past, permitting market returns while maintaining the conviction that a global recession was not the main scenario, thereby positively affecting financial market courses. As we dive in the complications of 2024, this comprehensive guide was aimed to give insights for investors poised to clutch new opportunities in an ever evolving financial landscape, comprehending a closer look at potential geopolitical developments and advancements in sustainable finance.

Author: Vittorio Matalone