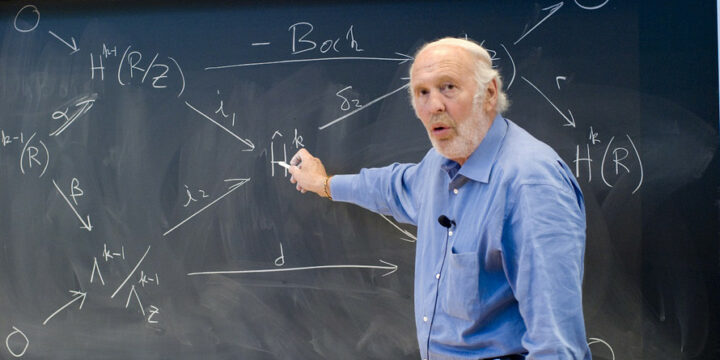

WHO WAS JIM SIMONS?

James Harris Simons, the famed mathematician and hedge fund manager, has died at the age of 86, according to a statement from his family foundation. He was widely known among investors for leveraging quantitative analysis and mathematics to create complex algorithms, taking advantage of the market inefficiencies. Jim Simons was born in Massachusetts in 1938 and he has liked mathematics from a very young age. He graduated from the MIT with an undergraduate degree in mathematics and earned a doctorate in the same subject at the age of 23. He soon began working in the academic world where he contributed to the development of knowledge in string theory, quantum field theory and condensed matter physics in the 1970s. Thanks to his talent, in 1964, he started working for the National…