PORTFOLIO MANAGEMENT

The Portfolio Management Division focuses on educating its members and readers about the world of trading and investments through a diverse stock portfolio. There are two goals that the members of this division will try to achieve. The first one will be to publish a short daily summary regarding both the general stock market, and the movements which occurred during trading hours that directly affected our portfolio value. Secondly, we will also focus on maximising portfolio growth, in order to then donate all profits to a charity designated by the Investment Club as a whole, fostering a collective commitment to social impact. To maximize our portfolio’s growth, we will combine both comparative and fundamental analysis. These analytical and logical tools will allow members of the division to envision both broader stock market trends and the financial health of the companies held within our portfolio.

Daily Articles:

-

Pro Medicus: A High-Growth Opportunity in Medical Imaging

Pro Medicus: A High-Growth Opportunity in Medical Imaging Pro Medicus Limited (ASX: PME) has emerged as one of the most dynamic players in the medical imaging software sector, delivering substantial growth and capturing increasing market share, particularly in the United States. Over the past year, the stock has surged by more than 185%, pushing its […]

-

PORTFOLIO HOLDING UPDATE: ALPHABET

PORTFOLIO HOLDING UPDATE: ALPHABET Read the Full Article Author: Filippo Ferrero

-

Analysis of the Global Automotive Industry and Market

Analysis of the Global Automotive Industry and Market INTRODUCTION The global automotive industry is undergoing significant transformations driven by technological advancements, shifting consumer preferences, and evolving regulatory landscapes. In 2024, the sector faces both challenges and opportunities as it navigates these changes. INDUSTRY OVERVIEW Global vehicle sales are projected to reach approximately 94.7 million units […]

-

TRUMP’S RETURN TO PRESIDENCY: IMPACTS ON THE STOCK MARKET AND ECONOMIC OUTLOOK

TRUMP’S RETURN TO PRESIDENCY: impacts on the stock market and economic outlook Donald Trump’s return to presidency is a highly debated topic, with the markets reflecting both hope and apprehension. His presidency promises to bring drastic changes in economic policy, with key discussions around tax reforms, deregulation, and trade policy. All these factors are already […]

-

ELI LILLY FACES RATING DOWNGRADE DUE TOSALES ISSUES, WHILST MOODY’S STOCKREACHES ITS ALL TIME HIGH

ELI LILLY FACES RATING DOWNGRADE DUE TO SALES ISSUES, WHILST MOODY’S STOCK REACHES ITS ALL TIME HIGH Erste Group, one of the main European banking groups based in Austria, recently modified its rating of portfolio holding Eli Lilly (LLY) (0.2 units purchased @582.99). Its recommendation changed from Buy to Hold and the main factors that […]

-

Market Volatility Amid Earnings Season and Policy Shifts: NVIDIA, Oklo, and Eli Lilly in Focus

Market Volatility Amid Earnings Season and Policy Shifts: NVIDIA, Oklo, and Eli Lilly in Focus During the last two weeks, the stock market has fluctuated greatly, partly due to the election of the new US president, Donald Trump, and partly because we’re right in the middle of earnings season, when many companies report their earnings […]

-

Swiftonomics: The Economic Impact of Taylor Swift

Swiftonomics, a term coined to describe the economic influence of Taylor Swift, encapsulates the intersection of pop culture and economics. As one of the world’s most influential artists, Swift’s activities generate significant economic ripples, affecting various industries and market behaviors. Concert Tours and Local Economies Taylor Swift’s concert tours are a prime example of Swiftonomics […]

-

The Rising Significance of Copper

The value of Copper, often referred to as “Dr. Copper” for its role as an economic indicator, is experiencing a significant rally in its market value. Prices have surpassed $10,000 per ton for the first time since April 2022, reaching around $10,220 per ton, driven by soaring global demand and tight supplies, rising 29% from […]

-

European companies started to cut their targets for renewable energy.

Many of the most important power companies have started to either change or review their targets to develop renewable energy because of high costs in development and low costs of electricity. This comes as a sign of the general difficulties that present in transitioning away from fossil fuels. The continent’s largest renewable energy producer, Starkraft, […]

-

OpenAI and Apple Partnership Signals AI Evolution Amid Market Uncertainties

May 16th, 2024 – ChatGPT maker OpenAI held its “Spring Update” event on Monday, where it announced a new desktop app, a web UI refresh, and the launch of its most advanced model, GPT-4o. The demo showcased how edge devices, starting with Macs and iPhones, can benefit from AI. By integrating voice, text, and images, […]

-

AFTER DISAPPOINTING RESULTS, SHOPIFY AND UBER FACE HUGE DROPS IN THEIR STOCK PRICES

May 8th, 2024 – Today, Shopify (SHOP) (-19.3% at 10:35 AM EDT), a notorious Canadian e-commerce firm operating in multiple countries, disclosed its expectations about quarterly revenue growth and the forecasted values are the worst in the last two years. Among the several factors that led to this poor result are the decreasing consumers’ spending […]

-

Market trends under a macro lens.

May 1st, 2024 – In the current year, 2024, market trends have 3 main characteristics: medium growth, high inflation and elevated geopolitical risks. Such factors hinder investment strategies and opportunities across most asset sectors. Said geopolitical uncertainties influence the equity market, as it can be deduced from growth expectations of 2-3% in the S&P 500. […]

-

META AND ALPHABET: REACQUIRED CONFIDENCE FOR DIGITAL GIANTS

April 28th, 2024 – After the challenges of the year 2022 as a whole, digital ad companies finally succeeded in not only recovering but mostly exceeding the expectations analysts had for the first months of 2024, reporting strong achievements and wonderful results for their investors this week, publishing their first-quarter results. Companies have gone through […]

-

Portfolio holding rises on earnings.

24 April 2024- One of our portfolio holdings, Boeing (BA) (Purchased 0.15 units @ $248.79) announced its first fiscal quarterly results better than expected. The analysts were expecting the adjusted loss per share to be $1.76 compared to $1.13 declared. The company also shared its revenue which is slightly above the expectations. $16.57 billion compared […]

-

EARNINGS REPORTS AND MERGER TALKS

April 19th, 2024 – Netflix reported better-than-expected revenue and earnings for the first quarter of 2024 thanks to subscribers growth of 16% YoY. The streaming company posted an EPS of $5.28 and a 14% revenue growth to $9.37 billion, and they both have beaten analysts’ expectations. The company struggled in premarket because of a poor […]

-

Portfolio Holding delivers killer earnings

April 17th, 2024- One of our portfolio holdings, purchased recently, United Airlines (UAL) (1 unit @$41.78) announced its quarterly result after markets closed on Tuesday. United Airlines reported first-quarter revenue of $12.5 billion, compared to the consensus estimate of $12.4 billion. And an adjusted quarterly loss of 15 cents per share, outperforming analyst estimates of […]

-

BoA DISCLOSES DISAPPOINTING Q1 PROFITS WHILE GOLDMAN SACHS BETS ON A PROMISING COMPANY

April 16th, 2024 – Today, Bank of America (BAC) released an important statement in which it disclosed its disappointing Q1 2024 profits, which marked a decrease of around 18% compared to their 2023 Q1. The factor that determined this very poor performance was the huge difference between the deposits’ costs and the combination of assets’ […]

-

GOLDMAN SACHS QUARTERLY RESULTS BEAT EXPECTATIONS: REDISCOVERING THE CORE BUSINESS

April 15th, 2024 – In the first quarter, Goldman Sachs witnessed a 28% increase in profits, well beyond what analysts expected, as a result of their strong performances in these months. Bloomberg’s compiled analyst forecasts were nearly $1 bln short for the bank’s reported net income for the first three months of the year, which […]

-

Wholesale inflation report pushes markets forward

April 11th, 2024 – Tech giants led a stock rally on Thursday as investors weighed encouraging wholesale inflation data against yesterday’s harrowing price report. The Nasdaq surged 1.7%, while the S&P 500 gained 0.7% and the Dow Jones ended the day flat. Nike (NKE) have been under fire in the past months, with shares plummeting […]

-

GOLD: A “SAFE HAVEN” OR A FRAGILE ILLUSION?

April 8th, 2024 – It is thought by many that good times for always increasing gold prices may have come to an end and the price of the commodity could experience a downturn shortly. The spot yellow metal price has hit a fresh record of $2,375.5 per ounce on Monday confirming the positive trend of […]

-

Unlocking Opportunity: The small-cap health-care stocks suggested by Jim Cramer.

6th April, 2024 – The financial guru from CNBC, Jim Cramer, had brought into the notice the rosy prospect of microcap stocks, particularly in healthcare as one of the best investment options for the year 2024. Stating that the most notable effect is the revival of the smaller companies, Cramer indicated five companies that though […]

-

Major Indices fall in anticipation for March’s job report

April 4th, 2024 – Stocks tumbled on Thursday in a session of volatile trading ahead of the March jobs report. The Dow Jones lost 530.16 points, 1.35%, to close at 38,596.98, suffering its worst session since March 2023. The S&P 500 dropped 1.23% to end at 5,147.21 and Nasdaq dipped 1.40% to close at 16,049.08. […]

-

Oil prices continue rising as JPow outlines his signals for possible rate cuts

03 April 2024- At a conference held by Stanford University in California, Jerome Powell commented on the current stance of the US economy and he answered some questions. Recently, the data on job gains and inflation came higher than expected, when commenting on this data, Jerome Powell said that it doesn’t change the big picture […]

-

GENERAL ELECTRIC’S BREAK-UP FINALLY COMES TO AN END, WHILST RIVIAN EXCEEDS MARKETS’ FORECASTS

April 2nd, 2024 – General Electric (GE) recently terminated its break up process through which 3 different companies were created (GE Healthcare, GE Aerospace and GE Vernova that came to life at the beginning of 2023). This huge operation was announced in late 2021, after GE saw its dimension increasing hugely thanks to an important […]

-

THE AI BOOM: AN ENERGY ISSUE

April 1st, 2024 – The upsurge in demand for energy to power data centers, therefore the amount of the latter required to fuel the ongoing AI revolution could lead to a “golden era” for natural gas, according to executives. Managers’ belief, strongly supported by data, is that renewable energy sources and batteries won’t be enough […]

-

Tesla’s disappointing Q1: hits and misses

30th March, 2024 – In the rocky start of 2024, Tesla, the electric car giant, had a big drop. Its stock fell almost 30%, making it the worst in the S&P 500 index. This was very different from the larger market’s good rise, with the S&P 500 going up by 10.2%, its best in a […]

-

A DEEP DIVE INTO HUAWEI AFTER STRONG 2023 EARNINGS

29th March, 2024 – As we announced recently in our article on the 26th of March, Apple (AAPL) (Purchased 0.6 units @ $183.96) is struggling to keep its position in the Chinese market because of changes in the national macro environment and strong competition from Huawei. The Chinese networking and electronics company reported stellar results […]

-

New IPO falls following meteoric rise

28th March, 2024 – The S&P 500 rose on Thursday registering its best first-quarter performance in five years, closing at 5,254.35 with a growth of 0.11%. The Dow Jones added 0.12% and finished at 39,807.37, while Nasdaq slipped 0.12% to end at 16,379.46. Reddit (RDDT) shares are plummeting after experiencing a rally stemming from the […]

-

Better than expected report propels clothing retail giant into new territory

27 March, 2024 – H&M shares surged over 15% on Wednesday after the company reported better-than-expected first-quarter results. The reason for this impressive increase is a significant profit increase and a raised operating margin target. H&M’s operating profit was announced at 2.08 billion Swedish Krona (~$196 million), higher than analyst predictions of 1.43 billion Swedish […]

-

APPLE AIMS TO PROTECT ITS MARKET SHARE IN CHINA, WHILE A NEW PLAYER THREATENS NOVO NORDISK AND ELI LILLY LEADERSHIP

March 26th, 2024 – Portfolio holding Apple (AAPL) (0.6 units purchased @183.96) is facing a series of difficulties in China due to changes in the national macro environment and the fierce competition by Huawei, factors that caused a 24% drop in iPhone sales in the first six weeks of 2024. The Cupertino based company is […]

-

REDDIT’S IPO TRIUMPH: SPARKING TECH MARKET REVIVAL

March 26th, 2024 – Reddit, the beloved social media platform, made headlines with a staggering 30% jump in its shares following its recent IPO; Debuting at $34, the stock closed at an impressive $59.80 on Monday, reflecting investors’ fervent interest. Together with existing investors, Reddit raised around $750 million in the offering, marking a significant […]

-

Tech IPO Resurgence: Reddit and Astra expanded Morgan Stanley.

23rd March, 2024 – This week saw an unprecedented rise in the IPO tech market, bringing to end a prolonged period of drought triggered by the public offering of Reddit and Astera Labs. The two companies, which patrolled the same world within the tech-investment space, represented the first known venture-backed tech flotation in the U.S. […]

-

A CHANGE OF SEAT IN LVMH OFFSETS THE COMPANY

22nd March, 2024 – Despite beating revenue and profit analysts’ expectations, Nike stock fell nearly 7% after giving a soft outlook for the full year and announcing slowing sales in China. Going through the numbers, revenue rose by 0.3% to $12.43 billion, beating the estimated revenue of $12.28 billion, while EPS came in at 77 […]

-

Apple accused of monopoly by the DOJ

March 21, 2024 – Thursday was a pretty good day for Wall Street, the Dow Jones closed in on the 40,000 threshold for the first time in its 128 years as markets rallied to new highs closing in at 39,781.5. Also the other two major indexes reached new highs with the S&P 500 increasing 0.3% […]

-

Fed rates remain unchanged, however with dovish undertone.

20th March 2024 – Today, the Federal Open Market Committee announced they kept interest rates between 5.25%-5.5%, aligned with investors expectations. Even though they kept the rates at the same level, the signal of three possible rate cuts fueled investors’ risk appetite. Additionally, the Fed’s announcements were approached positively because since the recent data was […]

-

SHELL’S ABOUT TO INTRODUCE IMPORTANT ”GREEN” CHANGES, WHILE BOEING STRUGGLES BECAUSE OF DELIVERY ISSUES

19th March, 2024 – An important announcement regarding its competitive strategy in the near future has been released by the oil giant Shell (SHEL). The company is about to shift its focus from the traditional retail businesses to EV charging sites, with the London based company that opted for expanding the number of charging stations […]

-

Two tech giants rise on news of possible partnership

18th March, 2024 – Portfolio holdings Google (GOOG) (Purchased 0.8 units @ $133.93) and Apple (AAPL) (Purchased 0.6 units @ $183.96) had a positive run on Monday, rising 4.60% and 0.64% respectively. This came following a Bloomberg article outlining the possibility of a partnership between Google’s Gemini AI and Apple’s iPhone’s. Both tech firms have […]

-

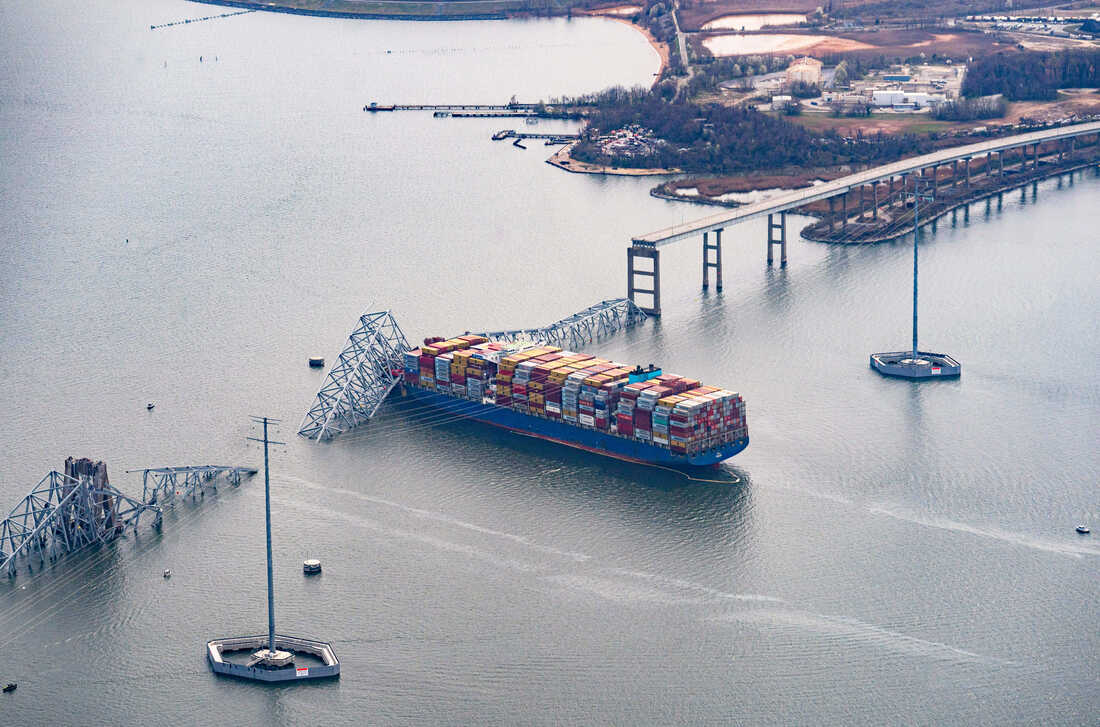

How ocean carriers are affected by crises in the Red Sea

In a recent Interview, Rolf Habben Jansen, CEO of Hapag-Lloyd, illustrated his views for the rest of the year on global trading. As we all know the Houthi attacks in the Red Sea and Panama Canal drought have driven up ocean freight with rates on key routes up 75% to 150% year-to-date. Despite these problems […]

-

BITCOIN STRUGGLES BUT CRYPTO STOCKS SEEM TO BE HOLDING UP

14th March, 2024 – After reaching its all time high on Wednesday, Bitcoin’s rally ended on Thursday. On Friday the most famous cryptocurrency continued to struggle, losing more than 4% at the time that this article was written (8:30 p.m. CET). The fact that Bitcoin did reach an all time high before its halving, was […]

-

Scorching hot PPI sends yields skyrocketing in rough Thursday session

Hotter than expected inflation report Thursday afternoon caused yields to increase, given that the Federal bank might not be cutting rates as soon as markets previously expected. This general negative trend has rendered investor sentiment from positive to mildly negative, as major indices fell. Meta Platform’s recent performance (up 39.8% ytd), can also be linked […]

-

Downgrades cripple Tesla stocks, as portfolio holding can’t catch a break

13th March, 2024 – The Dow Jones Industrial Average increased by 0.1% on Wednesday, while the S&P 500 and Nasdaq fell by 0.19% and 0.54%, respectively Tesla’s (TSLA) stock price dropped by 5% after Wells Fargo downgraded its rating to underweight from equal weight. They also lowered its price target to 125$ from 200$. Colin […]

-

JAMIE DIMON DISCLOSES HIS VIEW ABOUT FED INTERVENTIONS ON INTEREST RATES WHILST BOEING ISSUES ARE NEGATIVELY AFFECTING SOUTHWEST’S OPERATIONS

12th March, 2024 – A very important suggestion about how the FED should deal with interest rates’ cuts in the US has been presented by JP Morgan CEO, Jamie Dimon, during an Australian Financial Review business meeting. At this moment, the majority of investors think the US’ central bank will not introduce changes in March […]

-

CRYPTO BOOM: BITCOIN AND ETHEREUM SURGE ON INSTITUTIONAL INTEREST

Mar 12th, 2024 – Bitcoin’s meteoric rise continues to dominate headlines as it reaches yet another milestone, surging to a record high of $72,022.16: this latest jump represents a 3% increase from previous levels and underscores the cryptocurrency’s enduring appeal to investors. Driving this surge are the substantial inflows into U.S. spot Bitcoin ETFs, which […]

-

NVIDIA’S RALLY COMES TO AN END, WHILE THE FDA POSTPONED THE APPROVAL OF DONANEMAB AND COSTCO REPORTED MIXED RESULTS

On Friday, Eli Lilly and Company (LLY) (Purchased 0.2 units @ $582.99) announced that the US Food and Drug Administration (FDA) has postponed approving its Anti-Alzheimer’s drug “Donanemab” to further evaluate the safety and efficacy of the drug. The date of the advisory committee meeting has yet to be set by the FDA, and the […]

-

Stocks rise on thursday, as Novo delivers an astounding quarter

US stocks rose on Thursday as the S&P 500 hit a new record high closing at $ 5,157.36 with an increase of 1.03%. On the other side techs took the lead with the NASDAQ gaining as much as 1.5% and the Dow Jones gained about 1.3%. Shares of portfolio holding Novo Nordisk (NVO) surged over […]

-

Jerome Powell makes dovish statements, however advises precaution.

At the meeting held by the Federal Reserve on Wednesday, FED Chair Jerome Powell stated that he is expecting the rate cuts to happen this year, unsure of when it will start. Jerome Powell said he wants to see a little bit more data to start cutting rates and expressed concerns that starting cutting rates […]

-

APPLE AND TESLA UNDER DIFFICULTY AFTER FACING NEGATIVE MARKET TRENDS IN CHINA

Portfolio holding Apple (AAPL) (0.6 units purchased @183.96) continues to struggle as new data regarding iPhone’s sales in China have been disclosed by the research firm Counterpoint. Taking into account the first six weeks of 2024, there was a significant worsening in the sales trend of the main product of the Cupertino company (–24% year […]

-

EU FINES APPLE €1.8 BILLION FOR ANTITRUST BREACH IN MUSIC STREAMING

In a significant blow to Apple, the European Union has imposed a hefty €1.8 billion fine for the tech giant’s antitrust violations in the music streaming market; this marks a crucial moment in Apple’s history as it is the first time the giant has faced such penalties for breaching EU competition laws. Following the announcement […]

-

WTO Moratorium on E-commerce Prolonged Despite the Obstacles of Negotiations.

2nd March, 2024 – The World Trade Organization (WTO) concluded its 13th biennial ministerial meeting in Abu Dhabi with a significant breakthrough: another two years extension of the moratorium on e-commerce tariffs lasting until 2026. Indeed, the negotiations failed to reach consensus on sticking points like the treatment of agriculture and fisheries subsidies. WTO Director-General […]

-

NVIDIA, AMD AND DELL ARE FLYING WHILE GS REMOVES A GIANT TECH COMPANY FROM ITS CONVICTION LIST

Nvidia (NVDA) (Purchased 0.24 units @ $471.73) was up on Friday by almost 4% but was outshined by AMD, that saw a +5% performance thanks to AI server demand from Dell Technologies, that posted better-than-expected quarterly earnings and registered a +30% performance on Friday. The fourth quarter revenue was $22.3 billion, above analysts’ expectations even […]